THE ECONOMIST: Trump clashes with Fed again as disputed sacking of Lisa Cook adds to fears for US institutions

THE ECONOMIST: Legal challenges loom as Donald Trump’s attempt to fire the Fed’s Lisa Cook leaves credibility under a cloud.

Donald Trump has not been shy: he wants interest rates down, fast. For months, the president has berated the Federal Reserve for dithering and cutting rates too slowly. In July he flirted with firing Jerome Powell, the Fed’s chair, but backed off.

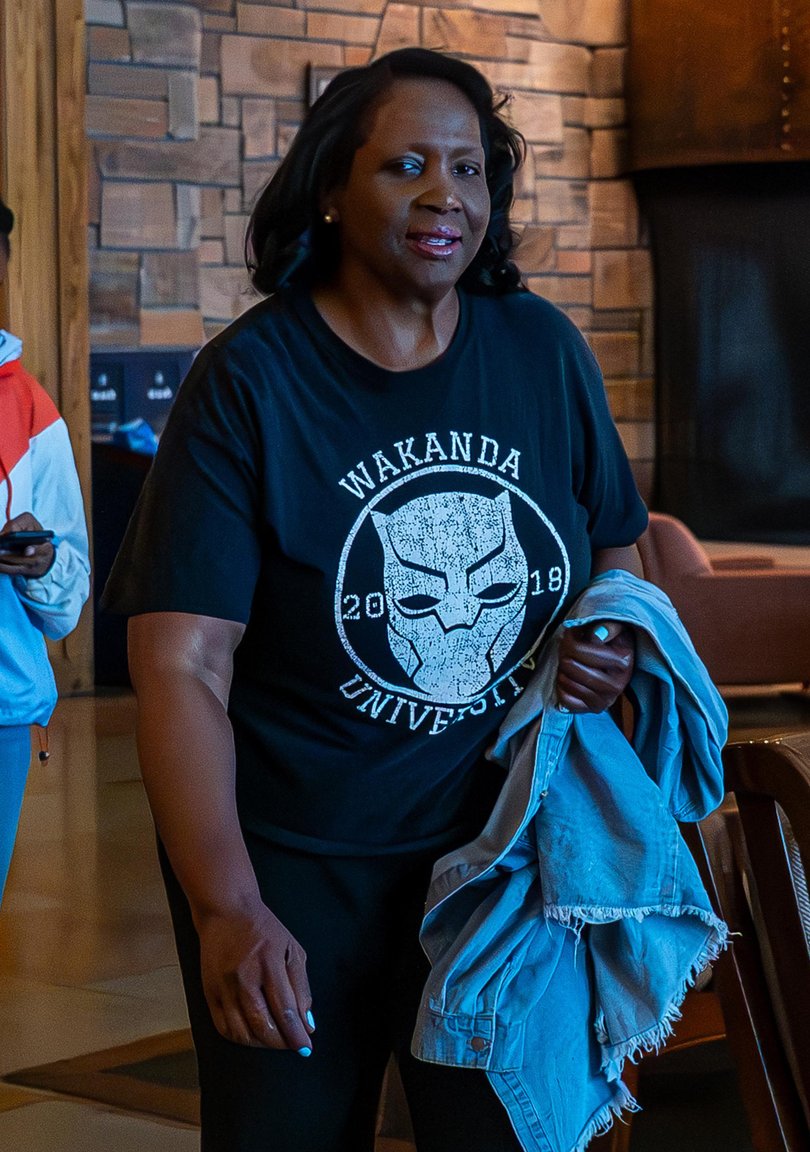

Another angle of attack opened up when Bill Pulte, the head of the Federal Housing Finance Agency, claimed that Lisa Cook, a governor on the central bank’s board, had lied on her mortgage applications.

This time, the president has pounced. In a letter on August 25 posted to Truth Social, his social-media platform, he announced that he was sacking Ms Cook “effective immediately”. She, in turn, issued a statement saying Mr Trump has no authority to fire her and refused to resign.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The legality of the president’s move is highly uncertain. A Supreme Court judgement in May all but confirmed that Fed governors can only be sacked “for cause”, and Ms Cook has not been indicted, let alone convicted, of any crime.

The allegations, which the Department of Justice is investigating, relate to paperwork submitted before Ms Cook took her post. There is little precedent: no Fed governor has been fired for cause before.

The move marks a dramatic escalation in Mr Trump’s battle with the Fed — the agency of the American government that is best insulated from political meddling, in order to allow for monetary policy to be set independently. In normal circumstances Fed governors have long tenures and, by design, are hard to dislodge.

Ms Cook’s term is set to run until 2038. But what has so far been a war of words is now all but certain to be fought in the courts. Should Mr Trump eventually be granted a relatively free hand to sack Fed governors, central-bank independence in America would start to look fragile indeed.

Markets have reacted nervously. The dollar fell by 0.3 per cent in the hours after the announcement. The S&P 500 index of large American stocks fell by nearly 0.5 per cent in futures trading, and ten-year Treasury yields rose by 0.04 percentage points. That is an uncomfortable combination, reflecting American assets cheapening across the board.

But so far, the declines have not been enormous. Investors are treating the news as merely unwelcome, perhaps waiting to see exactly how things will turn out.

Earlier this month Mr Trump also used Truth Social to fire Erika McEntarfer, the head of the Bureau of Labour Statistics (BLS), after revisions to employment data showed that jobs growth had sharply weakened. He has proposed replacing her with EJ Antoni, a Trump-aligned economist.

Although politically motivated data-fiddling and rate cuts are still some way off, each is easier to imagine today than at the start of the year. Mr Trump would have to flip several more seats at the Fed before having any hope of persuading a majority of rate-setters to vote for more than a handful of cuts.

And the thousands of civil servants involved in compiling America’s economic data would surely sound the alarm if Mr Antoni tried to manipulate the jobs or inflation figures.

All the same, previously non-partisan parts of America’s policymaking machine have been dragged into the political fray, and may well stay there.

Moreover, Mr Trump’s actions will almost certainly prove self-defeating, by making his ultimate goal — lower borrowing costs for the federal government and ordinary Americans — much harder to achieve.

The Fed controls only short-term interest rates; longer-term rates are set by the bond market. Between blow-out deficits and the threat that political interference might keep inflation high, investors are getting skittish.

The yield on 30-year Treasuries is nearly 5 per cent and has stayed elevated over the past few months, even as the economy has slowed.

If Mr Trump found high interest rates unwelcome when growth was strong, combining them with weak growth would be more unpleasant still.