Many Taylor Swift fans expected her engagement. Some bet on it.

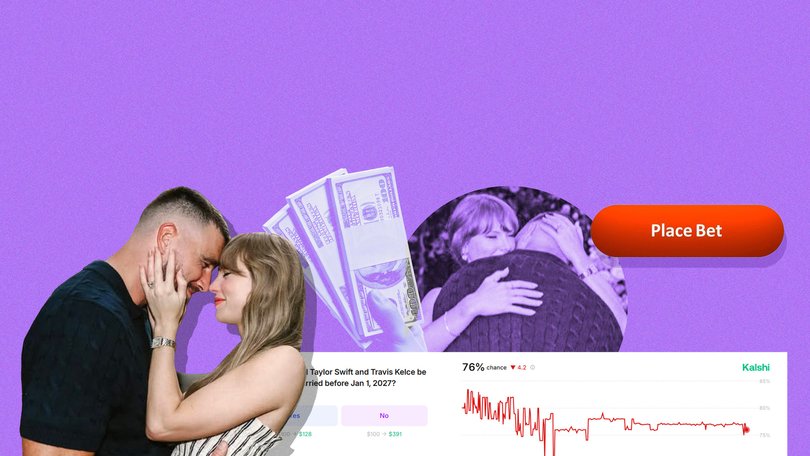

Kalshi and Polymarket, platforms that are popular with political news obsessives, also drew bets from Swift fans.

When Taylor Swift announced her next album during an appearance on a podcast co-hosted by her boyfriend and his brother, casual fan Blake Law had a “hunch” that the pop star might have some other big news on the horizon.

Mr Law isn’t an obsessive Swiftie. The 23-year-old Atlanta resident spends his days making wagers on Kalshi, an online prediction market where people buy and trade stakes in certain future outcomes - similar to stocks or bonds. Bets can be placed on elections, sports, hurricanes and cultural events such as a music megastar’s change in relationship status.

This month he made a modest bet that Swift and Kansas City Chiefs tight end Travis Kelce would get engaged by the end of year. On Tuesday, he made about $US1,000 off that wager.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Leading up to the 2024 US elections, prediction markets such as Kalshi and Polymarket drew billions of dollars in wagers on the outcomes of state and national races, drawing attention and controversy. Critics of the platforms have fretted that flush supporters could sway the markets with large bets - or that the spectre of a large payout could incentivize attempts to manipulate an election. In November 2024, prediction markets were some of the first information sources indicating Donald Trump was favoured to win.

Compared with politics, Tuesday’s bets on Swift and Kelce appeared to be more low-stakes and lighthearted. The Kalshi market on their engagement drew around $US257,000, while political trades over the 2024 campaign ultimately paid out nearly $US900 million, Kalshi’s CEO told The Washington Post in November.

Since Tuesday’s announcement, Kalshi has seen more than $US100,000 in activity relating to Swift and Kelce’s nuptials, the company said, with the market favouring a spring 2026 wedding.

A Kalshi spokesperson said Wednesday, local time, that the platform’s culture markets “have grown immensely this year.” Polymarket didn’t immediately respond to a request for comment Tuesday.

The Swift bets also highlight her mass-market appeal: She’s a billionaire and cultural icon whose every move is watched and dissected by the media, fans and traders.

Nate Meininger, a 22-year-old in Phoenix, trades mostly on politics and economics, topics he understands, or where he feels he has an “edge.” Swift and Kelce’s relationship didn’t seem like an area where he had any relevant data, he said in a phone interview Tuesday.

But then a Kalshi market popped up where users could wager on the amount of views Swift’s episode on the New Heights podcast might fetch on YouTube. Seeing lots of bets for 50 million to 80 million views, Mr Meininger thought the market was “massively inflated,” adding that “it’s just vibes for some people.”

Seeing that Donald Trump’s appearance on The Joe Rogan Experience got around 40 million views within three days, Mr Meininger placed bets that Swift’s high-profile podcast appearance would net around 20 million views. He made about $US1,500 on those trades.

Some bettors flocked back to prediction markets on Tuesday after shunning them due to election-related losses. Ted Gonzalez, a 22-year-old who splits his time between Southern California and Mexico, estimated that he lost about $US1,000 betting that Vice President Kamala Harris would win the 2024 presidential election. Shortly afterward, he deleted the app where he’d placed those wagers.

On Tuesday, when he saw the news about Swift and Kelce’s engagement, he was back on Kalshi, wagering on the likelihood that the couple would tie the knot this year. He got in and out quickly, netting about $US73.

Gonzalez wasn’t among those scouring Swift’s every Instagram post for clues about an engagement. “I always thought they were going to break up because she’s had a lot of boyfriends,” Mr Gonzalez said in a phone interview Tuesday. Before this week, “I would’ve bet that they would’ve broken up, not get engaged.”

Wagering on elections and other events is gaining popularity as Americans double down on sports betting in the wake of dozens of states legalizing the pastime. In 2024, the sports betting industry had more than $13.7 billion in revenue, a 25 percent increase from around $11 billion in 2023, according to the American Gaming Association.

Prediction markets have won particular prominence in tech, finance and cryptocurrency circles - and some observers pointed out that those circles include Swifties, too.

Amal Moritz works for the portfolio support team at Dragonfly, a venture capital firm that has invested in Polymarket. While the 26-year-old New Yorker admits that the average trader might not be Swift-obsessed, the pop star’s fan community is “so global and widespread,” Mr Moritz said, that “it also simultaneously captures engineers and gamblers.”

Mr Moritz mused that the engagement opens the door to a multitude of potential markets, such as the style of Swift’s wedding dress, what Swift song might play as she walks down the aisle - and the wedding date. (Mr Moritz thinks 13, Taylor’s lucky number, might figure.)

After successfully betting that the couple would get engaged this year, Mr Law made another Swift wager on Tuesday. In the market asking “Will Taylor Swift and Travis Kelce be married this year?,” Mr Law somewhat counterintuitively bet on “no.”

His rationale is that people would see the engagement news and “want to react in some way,” he said, without thinking about how long it takes to plan a wedding.

Mr Law thinks it’s going to be next year. After all, ’26 is a multiple of 13.

© 2025 , The Washington Post