Why Bitcoin is ending 2025 with losses, and whether it can rebound in the new year

Bitcoin boomed earlier this year but its seemingly magical momentum didn’t last. In the last quarter, the token surrendered its gains, placing the flagship cryptocurrency on track to finish 2025 in the red.

Bitcoin boomed earlier this year, but its seemingly magical momentum didn’t last. In the last quarter, the token surrendered its gains, placing the flagship cryptocurrency on track to finish 2025 in the red.

But while the token’s disappointing reversal has left investors on tenterhooks, some experts say bitcoin can still stage a comeback in 2026.

The world’s oldest cryptocurrency was last trading at $US88,242, down about 6 per cent on the year, or about 30 per cent off its record high of around $US126,000 hit in early October.

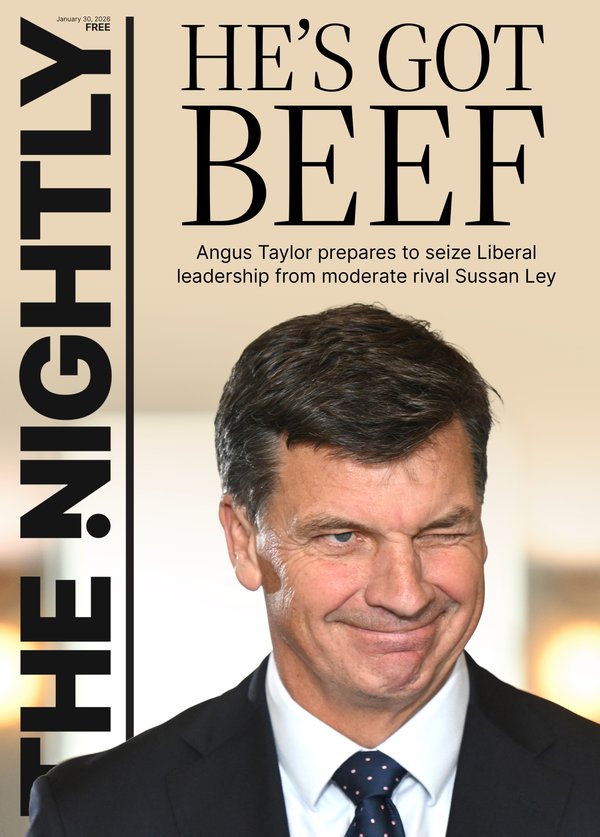

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Bitcoin’s weak year-to-date performance comes after cascading liquidations of highly leveraged digital asset positions battered investors’ confidence in the crypto market this fall. The rotation out of the volatile assets was hastened by mounting economic uncertainty, including President Donald Trump’s on-and-off tariff threats against China and other major US trading partners.

Crypto catalysts in 2026

There are several near-term catalysts that could lead bitcoin to rally in 2026, including a growing crop of crypto exchange-traded funds that are poised to increase investors’ access to bitcoin, as well as growing regulatory and policy support for the crypto industry at large, according to Citi Research.

“Our forecasts, in particular for Bitcoin, rest on an assumption that investor adoption continues, with flows into ETFs of $US15 billion boosting token prices,” Citi Research analyst Alex Saunders said in a note to clients dated Dec. 18.

Citi has a base-case target of $US143,000 on bitcoin over the next 12 months. Its bull-case price target is $US189,000, while its most bearish target is $US78,000 for the same period.

Bitcoin is also likely to get a boost from US lawmakers’ expected passing of a market structure bill for the crypto industry in 2026, the analyst noted.

“The regulatory backdrop remains positive with a market structure bill expected to be passed in the US next year and regulatory activity across the globe,” Saunders wrote.

Separately, investors can look at the enterprise-value-to-bitcoin-holdings ratio of Strategy, the largest corporate holder of bitcoin, as another potential indicator of the cryptocurrency’s future price action.

“If this ratio stays above 1.0 and MicroStrategy can eventually avoid selling bitcoins, markets will likely be reassured and the worst for bitcoin prices will likely be behind us,” allowing the flagship crypto to bounce back next year, JPMorgan strategist Nikolaos Panigirtzoglou wrote in a note to clients dated December 3.

“At the moment, we find it encouraging that MicroStrategy’s enterprise value to bitcoin holdings ratio is holding up, staying safely above 1.0,” he noted. “We also find encouraging MicroStrategy’s creation of a $US1.4 billion reserve fund for future dividend and interest payments, which could cover up to two years of payments, thus making it even less likely that the company will be forced to sell bitcoins in the foreseeable future.”

Death of the four-year cycle?

But while analysts are betting on bitcoin’s rebound, some long-time holders are bracing for more crypto carnage. That’s because bitcoin’s traditional four-year cycle suggests the token could tumble further in 2026.

The four-year cycle is a historical price pattern tied to “the halving,” an event that reduces the incentives for bitcoin miners by half every four years. Based on that pattern, bitcoin is set to plunge further into the red in its post-halving period, with the token typically seeing drawdowns of about 80% or more.

The last halving took place in 2024.

However, ReserveOne CEO Jaime Leverton told CNBC’s Squawk Box on Tuesday that bitcoin’s four-year cycle is on the way out, particularly as the crypto industry is poised to gain historical regulatory and political support in the U.S. in 2026.

“I actually think we’ll see a new bitcoin all-time high next year, which would really be the final nail in the coffin for the historical cycle,” Leverton said.

CNBC

Originally published on CNBC