Australian Taxation Office: Hilarious responses to ATO’s online plea for Aussies to ‘report all extra income’

It’s that time of year when tax accountants are at their busiest, and income earners their most inconvenienced.

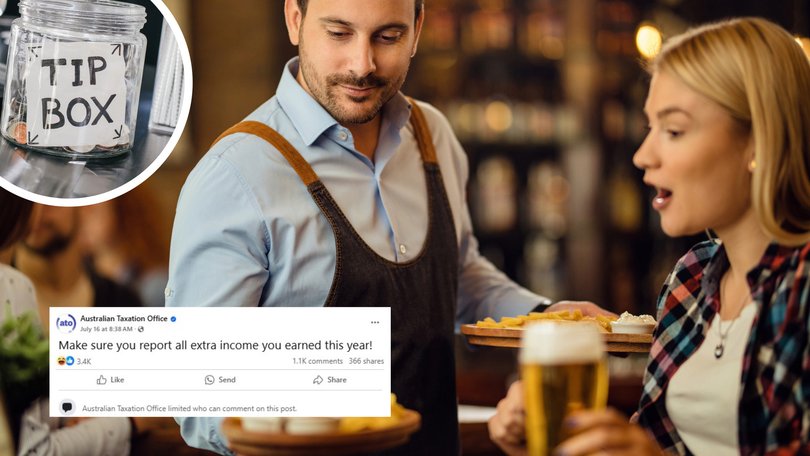

As Aussies slowly get around to lodging their tax returns, the Australian Taxation Office’s Facebook account — yes, they’re on social media — has attempted to remind Aussies that they’re legally required to lodge every last dollar raked in from the previous financial year.

But unsurprisingly, it hasn’t gone down so well with the working man.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“Make sure you report all extra income you earned this year!” a post from the ATO on Tuesday read, which has since disabled further comments.

Here are some of the funniest responses:

“What about my daughter’s lemonade stall?” one person asked.

Another said, “What’s the point of cash in hand, if we just gonna tell you about it”.

“Every smart**** here is getting audited,” one person wrote.

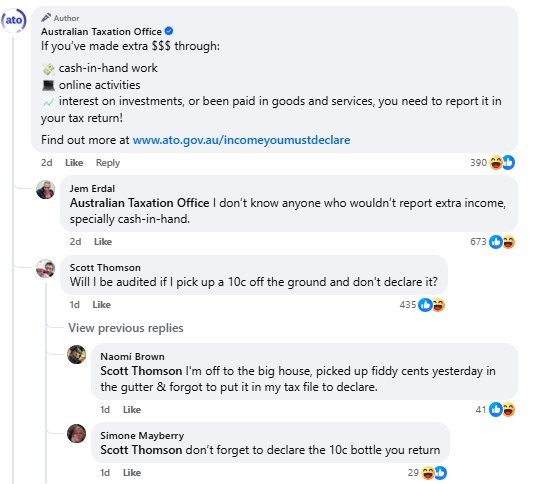

The account sought to define exactly what “extra $$$” referred to.

Cash-in-hand work, online activities, and interest on investments were among the key income-earning streams that Aussies “need to report in your tax return!”

“Love how OnlyFans is described as ‘online activities’ haha,” one person said in response.

“Construction workers, barbers laughing, contractors laughing at this joke,” another chimed in.

“Why?? My marketplace selling is just a hobby!!!” one added.

“Will I be audited if I pick up a 10c off the ground and don’t declare it?,” asked another.

What about pokie winnings?

The page confirmed, “You don’t need to declare your gambling winnings as income. You’ll only need to declare your gambling winnings or losses as income if you’re a professional gambler carrying out a business of betting or gambling.”

Tips earned through hospitality? Unfortunately...

“Yes, cash tips that you receive, regardless of whether from your employer or direct from customers, must be declared,” the ATO stated.

While many of the account’s 327k followers said they’d been waiting up to two weeks to receive their refunds, others suggested the ATO should spend less time monitoring the little guy.

“Your main focus should be on big businesses, those who don’t pay a single penny,” one person wrote.

Another inquisitive income earner, tongue-in-cheek of course, asked the ATO exactly how it would go about proving someone didn’t declare all of their additional earnings.

“How do you plan on proving that I didn’t? Hypothetically”, they asked.

For more tips on lodging your tax return, head to ato.gov.au.

For more laughs, head here.