Almost half of this capital city's dwellings sold at a 47 per cent loss

If you've held a property for 10 years, the traditional rule of thumb is that you'd expect its value to double.

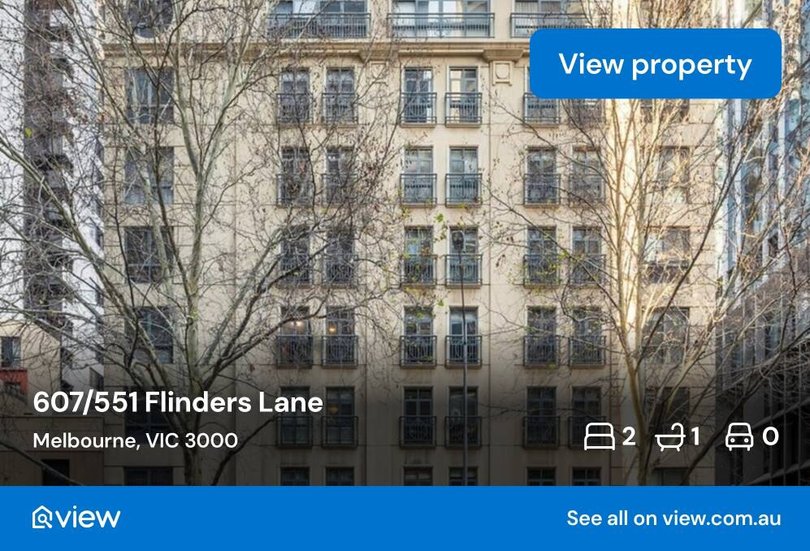

But if that property happens to be a unit in Melbourne's City Council area, chances are you're staring down a loss instead.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.According to Cotality's latest Pain and Gain Report, Melbourne continues to post the highest proportion of capital city loss-making sales in the country.

Almost half of all dwelling resales in the June quarter sold at a loss (47 per cent), with more than half of units reselling for less than their purchase price.

And the pain runs deep. Properties held for an average of 10 years in the Melbourne LGA sold for close to a $65,000 loss.

Where the losses are stacking up

It's not just the CBD. Stonnington and Moonee Valley council regions also recorded sharp increases in loss-making sales.

On the flip side, sellers in Yarra, Whittlesea, the Mornington Peninsula and Moreland saw a notable decline in losses, offering some balance to the Victorian market.

Nationally, the proportion of loss-making sales rose to 5.2 per cent in the June quarter, up from 5 per cent in March.

Nearly 60 per cent of that increase came from resales of Sydney and Melbourne units, about 2,500 transactions in total.

Gains still dominate nationally

Despite the recent losses, most sellers are still coming out ahead.

Nationally, 92.3 per cent of resellers made a profit in the June quarter. The median gain hit a record $315,000, while the median loss shrank to $42,000.

And some markets are still flying.

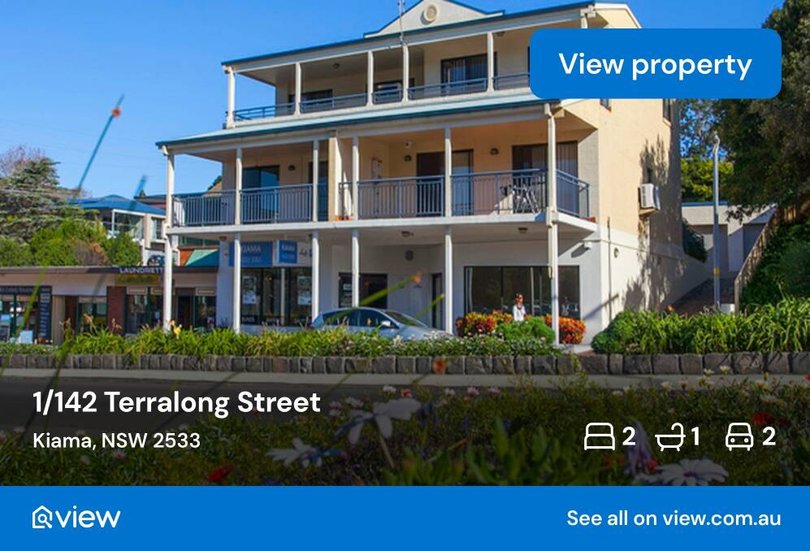

Kiama, on the NSW south coast, delivered the highest median resale profit at $758,000, while Brisbane was the standout capital for the third consecutive quarter, 99.7 per cent of sellers walked away with a profit, and the median gain hit $400,000.

Short-term holds under pressure

Short-term resales remain a major theme, with 15.3 per cent of transactions occurring within just two to four years of purchase.

For many sellers, that meant buying between April 2021 and June 2023, near the peak of the market.

Unsurprisingly, these quick flips came with pain: 7.7 per cent of resales in this window sold at a loss, compared with the national average of 5.2 per cent.

CoreLogic's Head of Research, Eliza Owen, said the rise in loss-making activity is linked to markets that haven't recovered to their peaks.

"The top 10 markets for loss-making resales accounted for a third of all losses in the quarter, compared to one quarter over the decade average," Ms Owen said.

"Some owners may also be cutting their losses as conditions improve, choosing to sell after holding for long periods."

Signs of a shift?

There are early signs the tide may be turning. Between June and August, national home values rose 1.3 per cent, and fewer suburbs recorded quarterly price declines.

Still, Victoria remains behind. Home values are 3.1 per cent below their March 2022 peak, and in the Melbourne City Council area specifically, values remain 12.5 per cent below their June 2017 peak, with another 1 per cent decline recorded in the June quarter.

Nationally, houses continue to outperform units where 97.2 per cent of houses sold for a profit compared with 89.8per cent of units and regional Australia remains slightly more profitable than the capitals.

But in Melbourne's CBD and surrounding LGAs, units remain a risky play.

For many owners, the dream of doubling your money in 10 years has instead ended in disappointment.

Originally published as Almost half of this capital city's dwellings sold at a 47 per cent loss