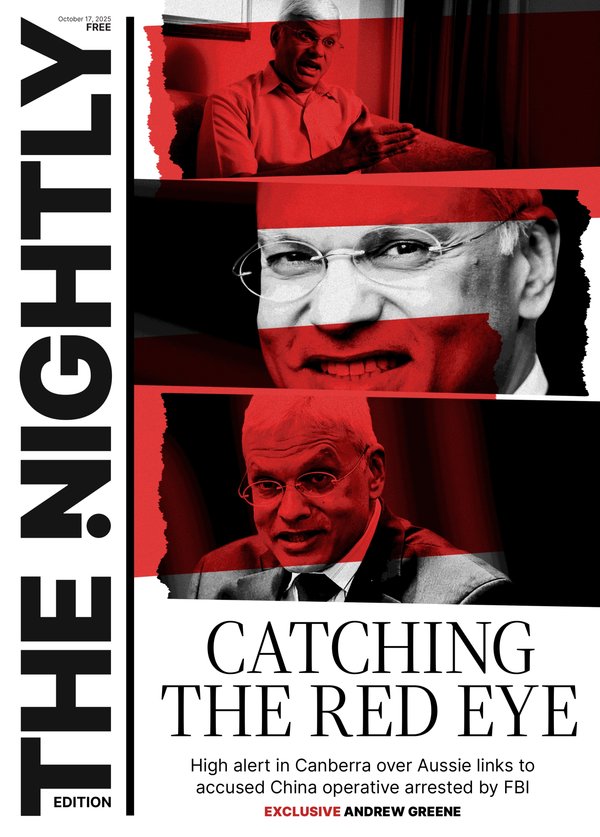

Australia's Home Guarantee Scheme: Pros and cons

The housing market is already heating up on the back of recent reductions to the cash rate and improving consumer sentiment.

With the federal government recently announcing that the Home Guarantee Scheme will commence in October 2025 instead of in January 2026 and have no income caps and higher price caps, I expect that this stimulus is likely to pour even more fuel on an already unaffordable housing market.

What is the Home Guarantee Scheme?

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.From 1 October 2025, all Australian first home buyers will have the chance to purchase a home if they have a deposit of 5 percent of the purchase price.

First home buyers can already purchase with a 5 percent deposit however; they will typically have to pay lenders mortgage insurance (LMI) which is either an upfront cost or capitalised into the mortgage over the term.

LMI is paid by the borrower to insure the lender against potential loss from the mortgage (crazy right, you're paying to insure the lender) while at the same time, lower equity borrowers are usually also paid higher interest rates.

From October 1, the federal government will cover the expense of LMI for first home buyers if they have a deposit of at least 5 percent.

The Home Guarantee Scheme also has several other features, namely:

- There are no limits on places, any would-be first home buyer with at least a 5 percent deposit can access the scheme.

- There are no income caps to access the scheme.

- The property price caps to access the scheme have been increased.

- This replaces the current Regional First Home Buyer Guarantee.

What are the pros and cons of this scheme?

Pros of Home Guarantee Scheme

1. The deposit gap is one of the biggest challenges to overcome when purchasing a home and then on top of that if you can't save a 20 percent deposit you are slugged with LMI. This scheme will mean that potential first home buyers can purchase sooner with a smaller deposit. The most recent data from Cotality found that it took 10.6 years for a median income household to save a 20 percent deposit (in order to avoid LMI). With the Home Guarantee Scheme, it will only take the median income household 2.7 years to save a big enough deposit to avoid LMI.

2. The scheme is likely to be attractive and the fact that it enables first home buyers to purchase sooner and without the impost of LMI, it could result in a lift in home ownership rates. I note that all of the first home buyer assistance over the past 25 years hasn't stopped a decline in homeownership rates.

3. If the scheme is successful and it sees a strong uptake then it may help to alleviate some of the rental market pressures.

4. Although this stimulus is available on both new and established homes, this scheme may assist in getting more new housing built.

Cons of Home Guarantee Scheme

1. For many years the federal government has provided assistance to first home buyers in the form of cash grants. While those grants may be considered as a waste of taxpayer money, this scheme sees government (taxpayer) money directly underwriting property purchases. The government now has more of an interest in housing and has exposure to losses which incentivises the government to encourage even higher housing prices.

2. The assistance here is not well targeted. There are now no income caps so essentially, we may have people that don't need assistance entering the market that can now do so without having to pay LMI. An example could be some that have a 10 percent or 15 percent deposit and were thinking about buying that can now put down a 5 percent deposit instead, not pay LMI and borrow more because of the equity they are contributing.

3. Like the first home buyer grants we've seen for the past 25 years, there is more demand side stimulus at a time when there is insufficient housing supply. It's also occurring at a time in which prices are rising (with increases now accelerating), sentiment is improving and interest rates are falling. These incentives are likely to push housing prices even higher.

4. Because this is more demand-side stimulus it is expected to lead to even higher home prices in the future. We've seen this play out before, it is likely to result in governments having to come up with more significant purchasing support for future cohorts of first home buyers. That looks as if it will be even more taxpayer support in the future, more shared equity buying and potentially lower equity purchases.

5. This stimulus is targeted to all properties, not the much-needed new housing supply. This may be a bit of a debatable con, but with a need for more new housing and the developer and home building sector challenged, it could have made sense to only make the Home Guarantee Scheme available to new builds.

What do I expect the impact of the Home Guarantee Scheme to be?

The start of the Home Guarantee Scheme is now a month away; it is commencing on pretty short notice. Because it helps first home buyers enter the market sooner and without the impost of LMI, I anticipate that it will be popular. This will mean more first home buyers sooner.

First home buyers are a relatively small part of the overall market however; more demand from them then allows existing home owners to upgrade into more expensive homes while lower interest rates are expected to stimulate an increase in investor activity in the market.

We've seen this play out before in 2008-09 and again in 2020, when there is a significant increase to the incentives for first home buyers that eventually feeds through to more demand across the market pushing housing prices higher.

This stimulus is coming into effect at a time when interest rates are already falling and home prices are already rising.

Cotality is reporting that since the first interest rate cut in February 2025, national home values are already 3.4 percent higher and with this stimulus coming into effect, expectations of further rate cuts and improving sentiment, it seems likely prices will continue to rise with growth potentially accelerating.

What I think will be most interesting will be how owners of properties that are expected to sell for less than the price caps for the Home Guarantee Scheme react.

There is not much point in trying to sell those properties before the Scheme goes live because you are likely to get a better price once it commences. Equally, there could be some value in holding off listing those properties for some time because there may be a bit of an initial rush to buy and sell limiting supply of properties down-the-track.

As I have highlighted, there are both pros and cons to the Home Guarantee Scheme. I believe that the cons outweigh the cons but equally, I am not a first home buyer struggling to enter the market. For those that are, I expect the Home Guarantee Scheme will be very popular.

In my view the biggest negative is that I can't see how this kind of support will ever be removed and how the support doesn't creep to being larger over time as we've seen with first home buyer grants which started as $7,000 grants in 2000 to offset GST.

That grant has now evolved into a scheme such as this and the soon to commence Help to Buy Scheme which is a shared equity investment scheme for first home buyers commencing in 2026.

Originally published as Australia's Home Guarantee Scheme: Pros and cons