Economists united on RBA decision: "Not this time!"

For the first time this year, economists are in complete agreement on what the Reserve Bank will do next - and it spells a short reprieve for homeowners.

According to Finder's latest RBA Cash Rate Survey™, all 32 experts polled believe the central bank will hold the cash rate steady at 3.60 per cent in September. It's the first unanimous call of 2025, following months of divided opinion on how the RBA would navigate stubborn inflation and slowing growth.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.

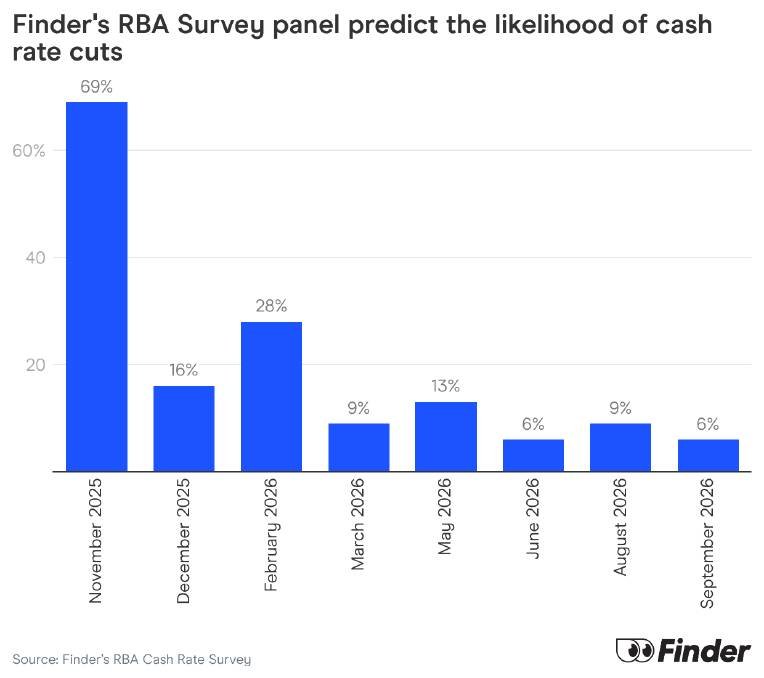

But while September's decision looks like a sure thing, economists say relief could be on the way as soon as November, with almost seven in ten panellists (69 per cent) predicting the RBA will cut rates at its Cup Day meeting.

Graham Cooke, Finder's head of consumer research, said the consensus reflected the unique balancing act facing the central bank.

"Mixed economic signals have kept the RBA in a holding pattern," Cooke said. "While spending remains strong, rising inflation and increasing unemployment add complexity to the decision-making process. Despite full consensus of a pause, the majority of economists predict a further rate cut by November as inflationary pressures ease and the economy continues its slow recovery."

Still, Cooke warned that inflation's recent uptick could cause a delay. "September's increase in monthly inflation from 2.8 per cent to 3 per cent may keep the RBA's scissors in the sheath on Cup Day if the quarterly data follows suit," he said.

View.com.au Economics expert, Cameron Kusher said:" There may still be a case for a reduction later this year but it will very much be dependent on data flow and the data since the last meeting has pointed to less of a need to reduce interest rates further."

University of Melbourne economist Tomasz Wozniak said September was "not the time" for the RBA to move, but stressed that the direction of travel was clear. "No doubt the RBA is on a slide down with the cash rate. However, the several promised cuts will be spread over quite some time, and we should not expect a cut at every single meeting," he said.

AMP chief economist Shane Oliver agreed, noting that the RBA has signalled a slow and measured approach to easing. "Since the August meeting nothing has happened to change this," Oliver said. "Underlying inflation is around target and economic growth is recovering gradually... the RBA is likely to hold."

For now, borrowers face another two months of waiting - but the growing consensus suggests the first spring cut may arrive in time for summer.

Originally published as Economists united on RBA decision: "Not this time!"