Luxury Thredbo chalet sells for record $9 million and bucks trend of softening mountain market

Record high prices are being paid for the top properties in Australian ski resorts Thredbo and Mt Buller.

But older resort stock is being discounted and in nearby service towns the cost of housing has come off by up to 30 per cent, according to alpine agents.

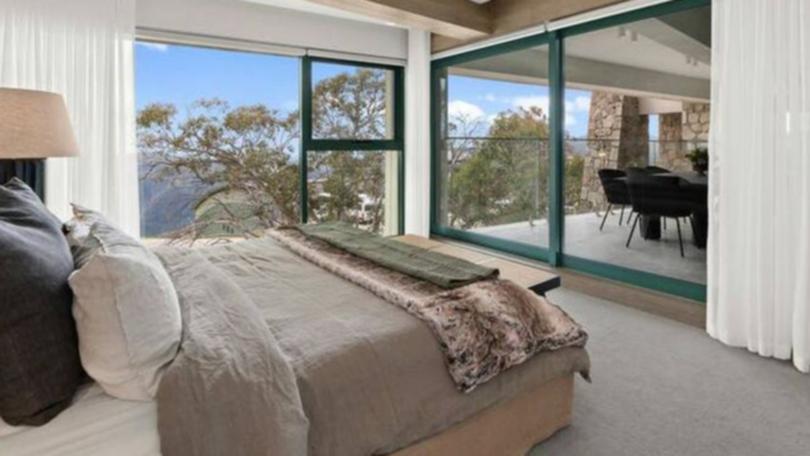

Leading the high-end charge is Thredbo in the NSW ski fields, where the five-bedroom Sastrugi Lodge was recently sold for close to $9 million by agent Michelle Stynes from Forbes Stynes

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“It’s a property that can’t be replaced in a position that can’t be replaced,” says Ms Stynes. “It’s unique, a one-off.”

She says the previous highest Thredbo price was $4.5 million for Tussock, a luxury chalet on Crackenback Ridge, which sold in 2020, “and prices have doubled since then”.

Thredbo is now a two-tier market according to Ms Stynes.

Newer, higher-quality properties above $1 million are holding value, she said.

A two-bedroom apartment in Thredbo that Ms Stynes is also selling is currently attracting interest.

It has a price guide of $2.99 million and features a light-filled living space with a stone-fronted fireplace.

However she says older apartments in larger complexes are down 10 to 15 per cent - from above $800,000 to under $700,000.

Luxury leads

At Mt Buller in Victoria, veteran agent John Castran says that the strongest demand is for new luxury products such as Whitehorse Village, Kooroora and Timbuktu, all developed since 2020.

“Buller four weeks ago recorded the second-highest price in alpine Australia - over $8 million, that’s pretty prodigious,” says Mr Castran.

He says middle-of-the-road Mt Buller product - around $2.5 million - is still selling and that prices overall have come off by up to 10 per cent.

“We have about 40 per cent more property on the market than we this time last year and we’re still transacting,” he says.

“We do have difficulty matching vendor expectations with purchaser expectations.”

Such property in that price range is a three-bedroom luxury apartment, pictured below, in a ski-in, ski-out position in Mount Buller village.

It has a price guide of $2.795 million and is selling through Zach Adams of Adams Real Estate.

This three-bedroom luxury apartment in Mount Buller has a price guide of $2.795 million. Pic: Supplied

He is also selling this Scandinavian and Japanese-inspired apartment, below, which has accommodation for at least eight people and a luxury kitchen also in Mount Buller which has a price guide of $2.5 million.

Elsewhere in the Victorian Alps, Mr Castran says: “Hotham is pretty stable, Falls Creek has fallen - it’s hit the wall - and I reckon Dinner Plain is pretty stable as well.

“The sub-alpine areas of Harrietville, Mansfield, Bright, Omeo, Tawonga and Mt Beauty have, definitely, definitely slowed down.”

There’s a similar trend in NSW alpine service towns Jindabyne, Berridale and Cooma, which like their Victorian counterparts boomed post-COVID.

“We went through a real rollercoaster when it came to the price of real estate,” says Michael Henley from Henley Property.

“For some reason our marketplace went completely berserk after COVID.”

Mr Henley says the market peaked in 2022 and has since adjusted.

“We’ve dropped anywhere between 10 per cent to 25 or 30 per cent.”

The most expensive properties have been discounted the most.

“One of our top-end properties which fetched $2.95 million in 2021 sold just before Christmas last year for $2.4 million.”

Still on a high

According to property data provider CoreLogic, the Snowy Mountains NSW and the Wodonga Alpine region in Victoria residential markets may have fallen from recent highs but are still worth about 50 per cent more than in March 2020.

Eliza Owen, Head of Australian Research at CoreLogic, says headwinds for these markets are largely tied to weaker economic conditions and curbed household spending, which may impact the tourism sector.

“At the moment there seems to be a more solid growth trend in the low-priced markets of larger regional centres of NSW and Victoria, that have more amenities and are less ‘touristy’ - such as the Upper Murray region outside of Albury, the Murray River - Swan Hill region and East Gippsland.”

This article was originally published at view.com.au.

Originally published as Luxury alpine properties sell for record prices in softening mountain market