"Starting to come up out of the curve": why it's time to buy in premium regional hotspots

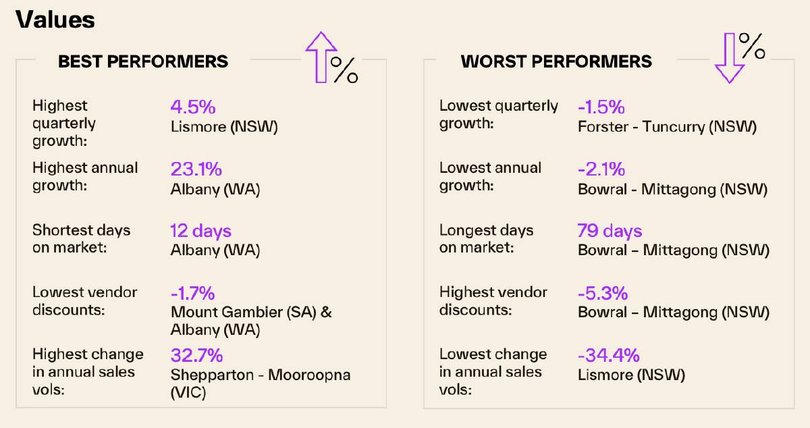

The latest regional data from Cotality showed that a blue-chip regional NSW area is experiencing the largest drop in annual home values, with vendors offering the highest discounts to lock in a sale.

Cotality's August 2025 Regional Market Update revealed that, surprisingly, the Southern Highlands Bowral-Mittagong region has been the poorest performing market over the last year.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy."The Bowral - Mittagong region in NSW's Southern Highlands was at the other end of the scale, recording not only the largest annual decline in values (-2.1 per cent) but also the weakest selling conditions," the report said.

Over the year to July, properties across the region took approximately 79 days to sell, while vendors offered a median discount of 5.3 per cent in order to secure a sale.

Two other regions - one in Victoria and another in NSW - also saw a yearly decline, albeit less pronounced.

"Just two other markets, the Warragul-Drouin (-1.5 per cent) region in Victoria, and the Forster-Tuncurry (-1.4 per cent) region in NSW, saw values fall over the year," the report said.

In Warragul-Drouin, homes took approximately 51 days to sell over the year to July, and vendors offered on average a 3.5 per cent discount to get their property sold.

Southern Highlands sensitivity

"Right now, the market feels a little more measured and price-sensitive than in previous years," said Ray White Bowral Agent Erica Chapman.

"Days on market reflect buyers being more considered in their decisions. We're seeing fewer impulsive purchases compared to the height of the regional property boom."

Ms Chapman said there are multiple factors at play, which are causing the current sentiment in the Highlands.

"Higher interest rates (slowly easing) reduced borrowing power, lifestyle buyers are far more cautious, and we've also had more stock available than in the peak pandemic years.

"For vendors, this means pricing has to be sharper and negotiations more flexible."

Buyers can benefit, but not for long

For buyers, this could be the perfect time to enter the market in these well-regarded areas.

"The current conditions certainly lean towards a buyer's market," Ms Chapman said.

"With values dipping 2.1 per cent over the year and properties taking longer to move, buyers have more time to do their due diligence and negotiate.

"However, the Southern Highlands remain a premium destination, so while there's more choice and softer pricing right now, the long-term fundamentals are strong. Supply is higher, but it's not oversupply. Quality homes in good positions are still holding interest," she said.

"For buyers, this is a great window of opportunity; they can secure a home in a prestigious regional area without the pressure of competing against dozens of buyers.

"In short, buyers currently have the upper hand, but the region's enduring appeal means this balance will not last forever."

Mild gains in Geelong and Launceston

The other regions that increased in annual values, but didn't show much oomph in the numbers, were Geelong in Victoria and Tasmania's Launceston.

"Geelong (0.9 per cent) in Victoria and Launceston (0.9 per cent) in Tasmania saw the mildest increases," the report noted.

This kind of measured and mild growth could signal an opportunity to snap up a good buy at a precise moment - one that is trending upwards but yet to accelerate.

Director of McGrath Geelong Jim Cross believes that yes, it is a great time to buy in the region.

"Now is a really good time to be buying. I've been in this industry for 25 years, and I've been through five of these cycles so far, and we tend to follow the Melbourne market out of the lull," he said.

"We genuinely feel like we're through the bottom of the market, and we're starting to come up out of that curve.

"As Melbourne starts to see increased clearance rates at auctions and increased prices, our market will follow into the upturn. We are genuinely expecting an upside over the next three to six months."

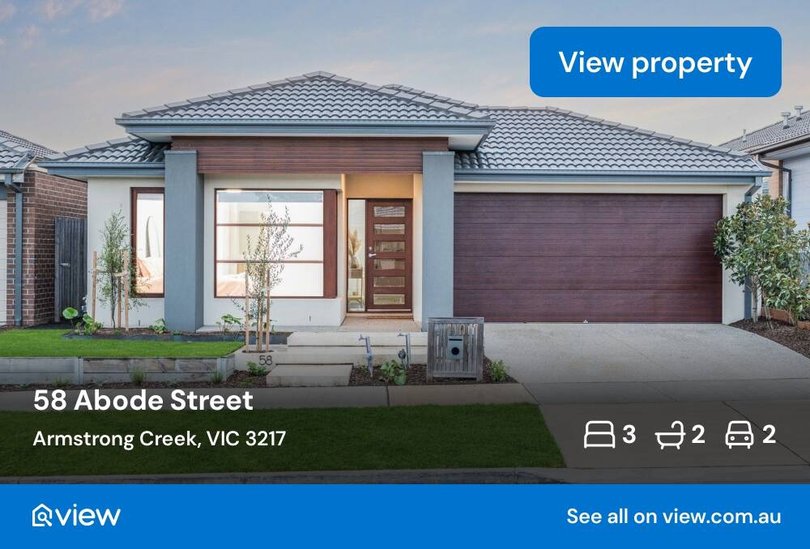

Mr Cross said that the Armstrong Creek growth corridor is already experiencing an upswing in buyer activity in the McGrath Armstrong Creek office, pointing to investors and first-home buyers snapping up affordable new family homes.

"Off the back of those three recent interest rate reductions we've had, you start to notice the increase in buyer activity in different markets," he said.

"We're seeing that the affordable housing market is showing really good activity. And properties are selling in one to three weeks again."

Originally published as "Starting to come up out of the curve": why it's time to buy in premium regional hotspots