What Melbourne's "affordable" housing market can teach the rest of Australia

While many eyes remain locked on Sydney's red-hot housing market, new Cotality analysis shows Melbourne is quietly offering something different and that difference might just hold a lesson for Australia's broader housing future.

Nowhere is the contrast more apparent than in value growth.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

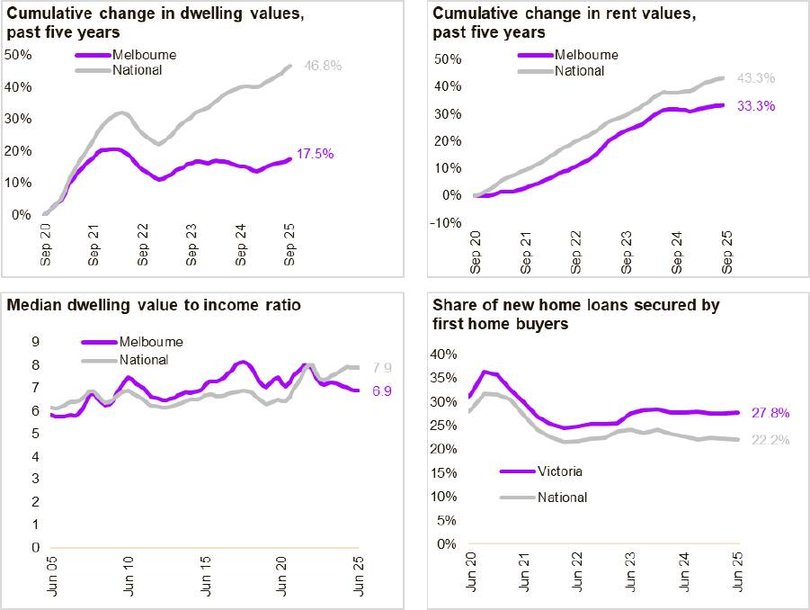

By continuing you agree to our Terms and Privacy Policy.Nationally, home values have surged 46.8 per cent in the past five years, pushing the median dwelling value from roughly 6.4 times median household income to nearly eight times.

In the rental market, median rents now sit around $672 per week, up 43.8 per cent over the same period.

By comparison, Melbourne has taken a more measured path: dwelling values across the city are up by just 17.5 per cent in the past five years.

The median house value of $953,000 remains below the million-dollar mark, a milestone recently reached in Canberra and Brisbane and long since passed in Sydney.

The dwelling-value-to-income ratio in Melbourne is about 6.9, down from a peak of 8.2 in 2017 and now at its lowest since December 2014.

Rents in Melbourne have risen by around 33.3 per cent in five years, which, while significant, remains among the lowest of Australia's capital cities.

As Eliza Owen, Head of Research at Cotality, notes: "Melbourne's relative under-performance has delivered a degree of affordability. The city's slower growth has opened breathing room for first-home buyers."

And the numbers back that up, ABS housing-finance data show that Victoria leads Australia in the share of new housing loans going to first home buyers.

How has Melbourne kept it's cool?

There is no single explanation, but several consistent themes emerge.

A tougher investment environment has played a major role. Victoria introduced significant tax reforms in the May 2023 Budget, including lowering the land-tax threshold from $300,000 to $50,000, adding a flat annual surcharge of up to $975, and increasing the absentee-owner surcharge.

For a tenanted property with a land value of $650,000, this equates to around $1,300 in extra tax each year. Combined with higher interest rates, maintenance, and compliance costs, many investors have reconsidered whether holding property in Victoria still stacks up.

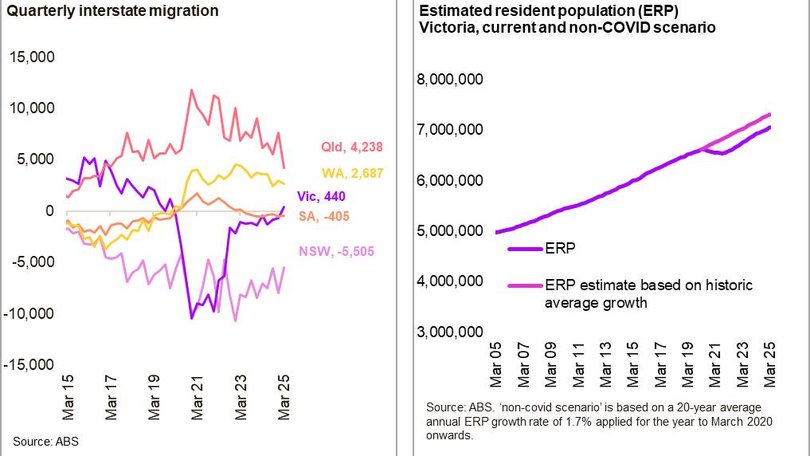

At the same time, weaker economic and demographic trends have helped cool demand. Victoria's population fell by over 1.1 per cent between March 2020 and September 2021, compared with a national rise of just 0.3 per cent.

Melbourne also endured one of the world's longest lockdowns, 262 days, leaving the economy struggling to recover.

Economists have pointed to structural headwinds such as a higher concentration of lower-productivity industries, a relative decline in household incomes, and high government debt levels compared to the size of the state's economy.

Another factor has been supply. Over the past 15 years Victoria has delivered roughly 885,000 new dwellings, 21.5 per cent more than NSW despite its smaller population.

That additional stock has helped keep a lid on price growth. However, the construction pipeline is now weakening.

New dwelling approvals are averaging about 4,600 a month, 12 per cent below the decade average and total property listings are 15 per cent lower than a year ago, suggesting fewer homes coming to market.

What it means for affordability

At this moment, Melbourne holds what Cotality describes as an "affordability advantage."

The city's more modest growth, coupled with strong first-home-buyer activity and greater tenant opportunity, suggests it may be offering a rare corrective to the runaway markets seen elsewhere.

But that advantage may not last. Home values in Melbourne have already risen 3.0 per cent this year, compared with 4.7 per cent across the combined capitals.

If supply continues to tighten and population growth returns, affordability could quickly erode and we'll all be bidding in the same unaffordable housing market.

Originally published as What Melbourne's "affordable" housing market can teach the rest of Australia