Where it's now cheaper to build a new house than buy an established home

After years of soaring construction costs, the tide is turning.

During the pandemic, construction costs soared. Builders who had locked in pricing went bust.

Homeowners excited for their perfect new home felt the crushing squeeze as their bill spiked.

But new data from Ray White shows this pattern is course correcting nationally, and has even flipped in some markets.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy."The momentum is clearly shifting. For the first time in years, we're moving in the right direction for housing supply," said Chief Economist at Ray White, Nerida Conisbee.

She reported in December 2023 that construction costs had dramatically outpaced house price growth, making it cheaper to buy an established home than build new.

"At that time, nationally, capital city house prices had risen by just 11 per cent while construction costs had soared 27 per cent over the previous two years," Ms Conisbee said.

"Fast forward to mid-2025, and while it remains cheaper to buy than build in most markets, the gap is finally narrowing.

"Some capital cities are now seeing house price growth outpace construction cost inflation for the first time in years - a crucial shift for housing supply."

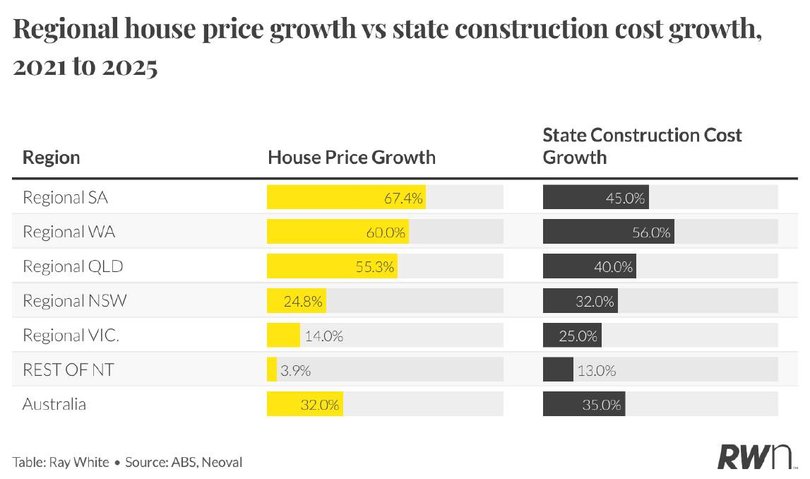

Over the four-year period from 2021 to 2025, construction costs rose 35 per cent while house prices increased by 32 per cent - a gap of just 2.3 percentage points.

This is a "remarkable narrowing" from the 16 percentage point gap Ms Conisbee reported in late 2023.

National builder Metricon is seeing these figures reflected in buyer sentiment and interest.

"The landscape has shifted noticeably over the past 12 months. After several years of double-digit cost surges, construction cost inflation has stabilised, giving buyers more confidence to commit," said Simon Taylor, General Manager, Regional Vic Metricon.

"Combined with the RBA's three rate cuts in February, May and August, we're seeing borrowing capacity improve and enquiry levels strengthen.

"That said, the challenges haven't disappeared. Building approvals remain down nationally, and average build times are still elevated due to planning delays, trade shortages and infrastructure bottlenecks."

Where it's now cheaper to build new

"The transformation has been particularly striking in Perth," said Ms Conisbee.

Perth previously had 20 per cent house price growth against 40 per cent construction cost increases. Now, Perth house prices have surged 66 per cent over the four-year period, outpacing the 56 per cent increase in Western Australian construction costs.

"Perth has not only closed the gap but reversed it - finally reaching replacement cost levels that encourage new home construction," she said.

A similar story can be found in Adelaide and Brisbane markets, including their state regionals.

"Adelaide shows a similar pattern, with house prices up 64 per cent compared to construction cost growth of 45 per cent," said Ms Conisbee.

Regionally, South Australia leads the charge with house price growth at 67.4 per cent over the last four years, compared to the 45 per cent rise in construction costs.

"Brisbane follows the same trend, with house prices rising 58 per cent against construction costs of 40 per cent," she said.

Regional Queensland had a similarly large flip in the cost gap, with house price growth at 55.3 per cent versus construction price growth of 40 per cent.

"We've definitely seen this shift playing out on the ground," said Mr Taylor.

"Metricon's enquiry levels and sales conversions have lifted in Brisbane and Adelaide, as buyers recognise the improved value equation of building new versus buying established.

"With construction costs stabilising and established home prices continuing to rise in these markets, building new has never been more attractive, and we're seeing buyers respond accordingly."

Where buying established is more affordable

Eastern markets continue to lag behind, with Sydney, Melbourne and Canberra still providing challenging conditions for those keen on building new.

"Sydney house prices have grown just 19 per cent since 2021, well below the 32 per cent increase in New South Wales construction costs," said Ms Conisbee.

"Melbourne presents an even more stark picture, with house price growth of only 4 per cent dramatically lagging behind Victoria's 25 per cent construction cost inflation.

"Canberra shows the most extreme divergence, with house prices up 10 per cent while Australian Capital Territory construction costs have soared 41 per cent."

Mr Taylor notes that in NSW and Victoria, location dramatically impacts affordability.

"Victoria and NSW are telling two very different stories depending on location," he said.

"In metro Melbourne and Sydney, established home prices haven't yet caught up to the cost increases of recent years, which means affordability remains more challenging than in markets like Brisbane and Adelaide."

He lists planning reform, faster approvals and reduced holding costs as critical to unlocking more supply in these states.

"Regionally, the picture is far more positive," Mr Taylor said.

"Locations like Geelong, Ballarat, Bendigo, the Hunter, Illawarra and Riverina are attracting strong levels of enquiry, driven by lifestyle appeal, infrastructure investment and relative price accessibility."

He also found that Metricon's above-industry average home delivery time (60 days for single storey and 100 days for double storey) has been a "powerful driver of confidence for regional buyers" as they can avoid excess rental costs and move in sooner, removing another hurdle to building new.

A welcome shift for supply

The Federal Government's Housing Accord plan to build 1.2 million homes over five years has been widely criticised as unrealistic, with many hurdles preventing builders and developers from being able to reach even close to the goal.

However, looking at the wider picture across Australia, Ms Conisbee can't deny there is a sense of hope.

"While there are many challenges to meeting this [Housing Accord] goal, the improving economics in some markets provide hope, even as the major eastern capitals remain constrained," she said.

"Until house prices rise further or construction costs moderate significantly, [Sydney, Melbourne and Canberra] markets will continue to see limited new supply.

"But in cities like Perth, Adelaide and Brisbane, where house prices now exceed construction cost growth, we should expect to see renewed interest in building new homes as the economics finally stack up."

Originally published as Where it's now cheaper to build a new house than buy an established home