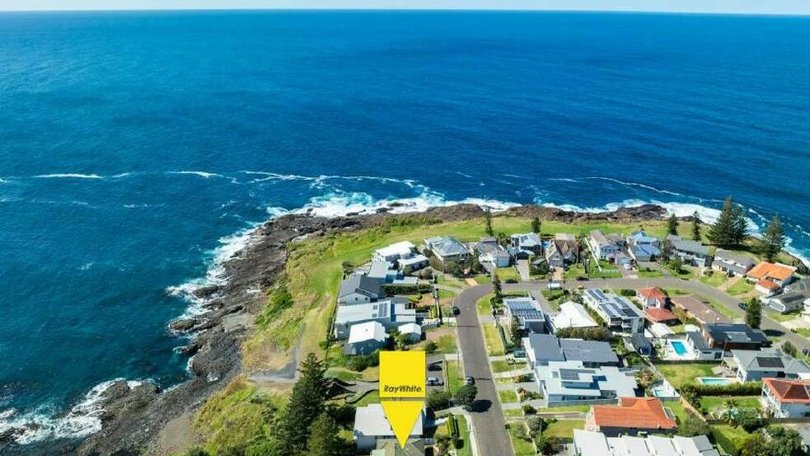

Why homeowners in this small coastal town made a median $758k profit when they sold

Home owners in the Kiama LGA who recently resold their properties recorded an average gross profit that's well into the six figures.

It's part of a trend that has resulted in regional Australia continuing to outperform capital cities in terms of profitability, according to Cotality's Q2 2025 Pain & Gain report.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The report for the June quarter revealed that the highest gross gain of LGA markets across Australia was in Kiama, with a median gross resale profit of $758,000.

Read more: Tennis court, B-ball hoop, 1500-bottle wine rack: Illawarra business exec lists Bowral estate

Why has Kiama performed so strongly?

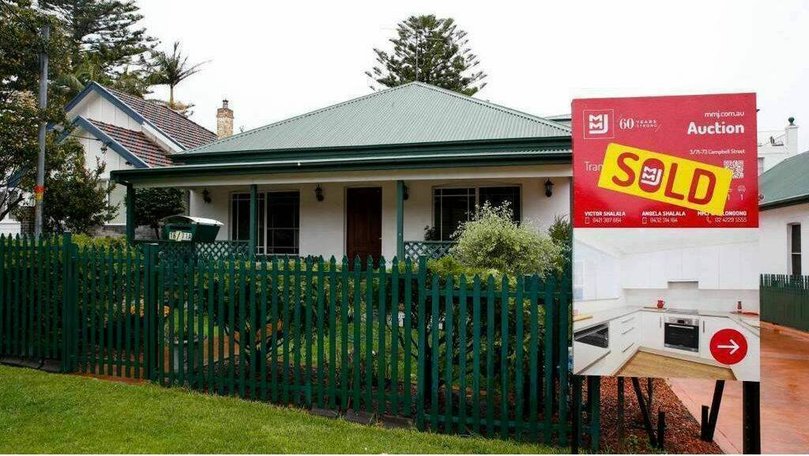

In the Kiama LGA, sellers recorded these significant gains, and held their properties for a median period of almost 12 years.

Over that time, the median dwelling value in the Kiama LGA has increased by 120 per cent.

Kiama is a popular tourist town with an enviable seaside lifestyle. During this quarter, there were 92 resales across the Kiama LGA.

Eliza Owen, Cotality's head of research said some regional markets have seen strong value uplift due to a number of reasons.

These included being a natural spillover from capital cities; having a strong lifestyle appeal and being popular weekend escapes; or because COVID and the rise of remote work just made it more feasible for people to move there.

"Kiama is a market that benefited from all of these factors," she said.

"The price reflects that, the growth reflects that, and the windfall profits for sellers reflect that too.

"Supply across the Kiama market is also a bit constrained."

Ms Owen said she believed Kiama would continue to be a popular housing market, "but I have some doubt as to whether these staggering increases can continue".

"That's because of the law of large numbers from a financial perspective," she said.

"Median dwelling values in the Kiama LGA market are now $1.4 million, and over time you would have to imagine that there's not too many Australians that can afford that, unless ownership just becomes more concentrated among higher-income households.

"I think the data shows a new reality for Kiama in terms of its price point, which could affect buyers in different ways.

"Investors may start to see the market as 'tapped out', first home buyers may look elsewhere, such as further south-west to Nowra, and of course there are some serious implications for housing affordability and the diversity of the region."

'We get a lot of flow-on'

Jayden Bennett from Ray White Kiama said Kiama's strong capital growth was a key factor that was crucial for investors.

"Being so close to Sydney, and Sydney is getting that busy, we get a lot of flow-on," he said.

"Our inquiry right now would probably be, depending on the property, but probably between 60 and 70 per cent from Sydney still.

"Of the remainder, 20 to 30 per cent would be local, and about 10 per cent from Canberra."

Mr Bennett said limited stock was also a factor.

"Obviously there's things in the pipeline... But from my experience, greenfield developments just boost the value of homes in town."

Mr Bennett said positive media coverage had also driven interest in the LGA from out-of-area buyers.

This included Kiama being named NSW Top Tourism Town for the second year running at the NSW Local Government Destination and Visitor Economy Conference.

Regions outperforming major cities

Regional Australia has continued to outperform capital cities in terms of profitability, a trend now sustained for more than five years.

In the June quarter, 96.4 per cent of regional resales made a nominal gain, compared with 93.9 per cent in capital cities.

Of the regional LGA markets analysed, 62 recorded a 100 per cent rate of profit-making resales led by regional South Australia. Only nine capital city LGA markets saw 100 per cent profitability, six of which were in Adelaide.

Ms Owen said the gap in profitability between capital cities and regions continued to narrow in the June quarter.

"The difference in the rate of profit-making sales between capital cities and regions fell 250 basis points in the June quarter, down from 270 basis points in March and a high of 340 basis points in early 2023.

"In the three months to August, capital city values rose 1.9 per cent, overtaking the 1.6 per cent rise in regional Australia, pointing to a further narrowing ahead."

Ms Owen said regional Australia continuing to outperform capital cities in terms of profitability was a combination of the COVID-related boom in regional Australia driving down the rate of loss-making sales, and a pick up in the many regional markets of Australia that have a resources-based economy.

"Prior to the pandemic, capital city dwelling markets were generally more profitable," she said.

"Another drag on profitability for capital cities is the high-density unit markets where value has not really changed in the past decade, which has increased the chance of loss-making sales in cities like Sydney and Melbourne."

The national outlook

The Cotality report analysed approximately 97,000 resales over the period, revealing that 94.8 per cent of transactions recorded a gross gain in the three months to June.

While still above the decade average of 91.5 per cent, this marks a slight decline from 95 per cent of resales in the March quarter.

Ms Owen said despite the slight dip in profitability, the median nominal gain from resales rose to a new record high.

"Across all profit-making resales nationally, we saw a median nominal gain of $315,000 for sellers recorded in the June quarter.

"This was a record high, up from $305,000 in the previous quarter, and the decade average of $250,000."

Originally published as Why homeowners in this small coastal town made a median $758k profit when they sold