Why regional home values are rising at their fastest pace in more than three years

Regional Australia is firmly back in growth mode, and the latest Cotality figures show the turnaround is broader and stronger than at any point since interest rates began rising.

Cotality's November Regional Market Update recorded a 2.4 per cent rise in regional dwelling values over the three months to October, the strongest quarterly growth rate in more than three years.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.According to Cotality Australia economist Kaytlin Ezzy, the shift signals a meaningful return to an upswing.

"The latest results confirm a renewed uplift in value growth across the regions, with buyers seeking value and accessible price points," Ms Ezzy said.

While capital city values rose slightly over the same period (2.9 per cent), the regions' renewed acceleration stands out, particularly after a sluggish stretch following the pandemic boom.

Why regional growth is rebounding

Unlike the COVID-era surge - which Ms Ezzy notes was "driven by remote work, lifestyle shifts and a desire for space" - today's growth is being fuelled by a new set of drivers.

"Demand is being shaped less by lifestyle changes and more by affordability, constrained supply and competitive buying conditions in the capitals," she said.

With many capital-city buyers now priced out or facing "constrained stock", regional markets offering more accessible price points are absorbing the overflow.

Buyers' borrowing power has also been boosted by recent rate cuts and federal schemes.

"Buyers have become increasingly active across regional areas, with improved borrowing capacity coming up against constrained stock, helping to push values higher," Ms Ezzy said.

Where regional values surged

The improvement isn't isolated to a handful of hotspots, either. Of the nation's 50 largest centres, around 60 per cent recorded an acceleration in growth compared with the previous quarter.

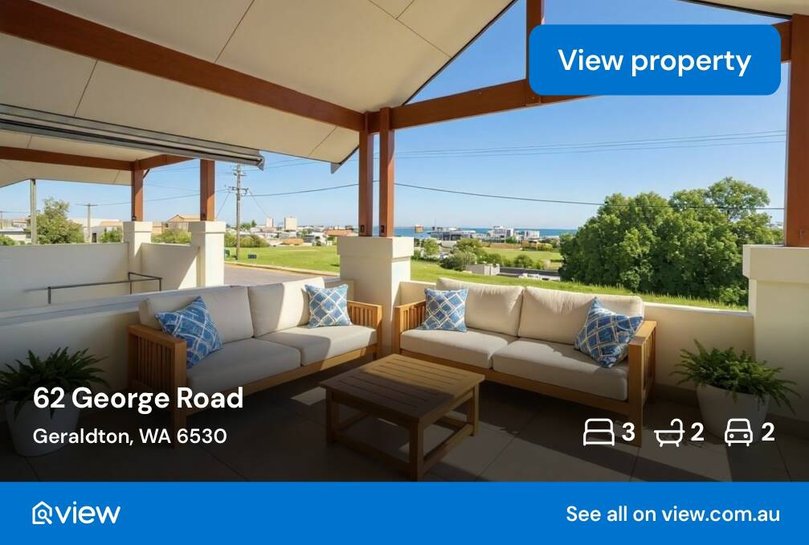

Western Australia leads by a wide margin: Kalgoorlie-Boulder (8.1 per cent), Geraldton (7.4 per cent) and Albany (6.2 per cent) delivered the biggest quarterly jumps nationally.

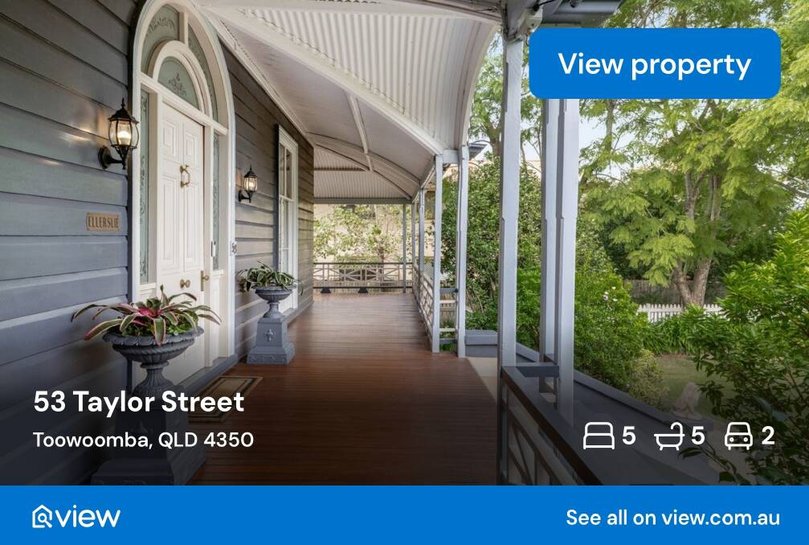

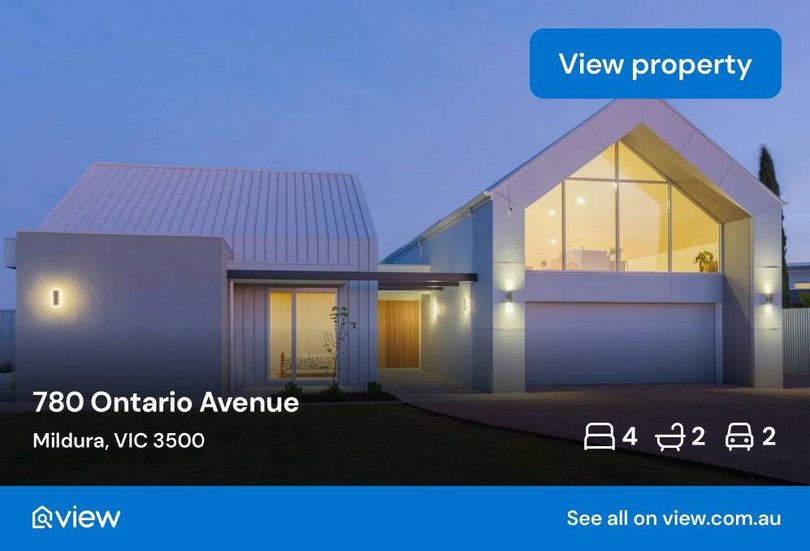

Mildura-Buronga on the NSW/Victoria border was the fourth-strongest performer, up 5.4 per cent, while Toowoomba in Queensland followed at 5.3 per cent.

The top-performing markets share a common trait: affordability. Nineteen of the 20 strongest quarterly markets had median values below $1 million, with Busselton (WA) the only exception at $1,000,130.

Ms Ezzy says that's no coincidence.

"The top 20 list...is dominated by markets where median prices remain well below the nearest capital city, and that speaks to where buyers are looking for value."

Even annual growth has been headlined by WA, with Albany up 23.3 per cent year-on-year, adding more than $136,000 to its median value.

It also recorded a median time on market of just 11 days and one of the lowest vendor discounting rates nationally (2.0 per cent).

Opportunities to watch

While the broader story is one of uplift, pockets of southern NSW - traditionally popular with Canberra and Sydney's weekenders, retirees and holiday-home hunters - have moved in the opposite direction.

Four regional centres recorded quarterly declines, and all are in NSW.

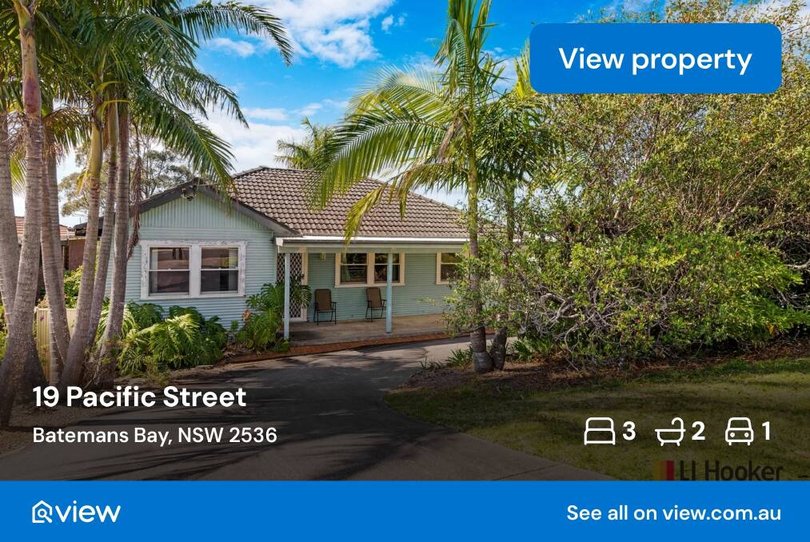

On the NSW South Coast, values fell in St Georges Basin - Sanctuary Point (down 1.2 per cent) and Batemans Bay (down 1.1 per cent).

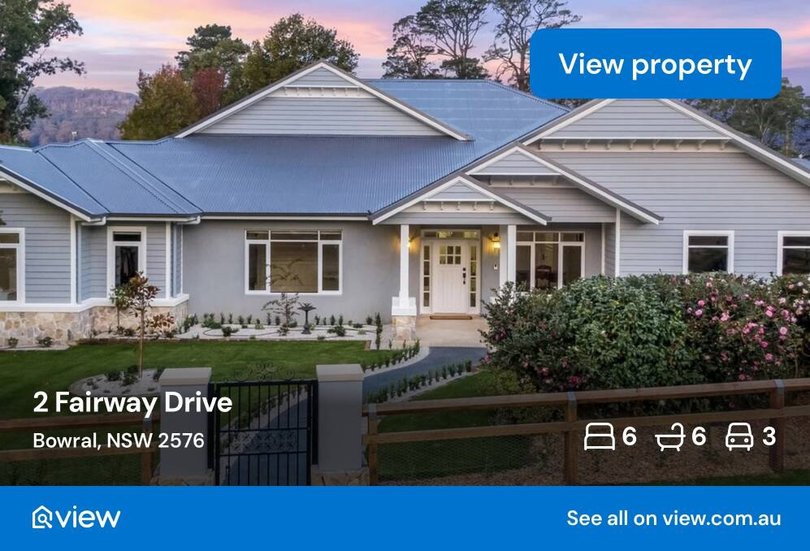

In the NSW Southern Highlands, Bowral - Mittagong prices are down 1.1 per cent and Bathurst in the state's Central West is fell 0.4 per cent.

These falls follow a long stretch where many South Coast and Southern Highlands markets surged ahead of the national trend.

For Bowral-Mittagong, the softening is part of a longer correction.

It was the only regional market in Australia to record an annual decline, dropping -1.2 per cent over the year. The region also posted the longest median selling time at 77 days and the highest vendor discounting rate at 5.4 per cent.

Ms Ezzy notes the area's once-intense post-COVID demand has tapered sharply.

"The Southern Highlands region was a favourite among COVID-era city leavers but since peaking at the start of the rate tightening cycle, the once-darling region has lagged behind."

Affordability is a clear factor. Despite being 13.5 per cent (or $181,901) below its May 2022 peak, Bowral-Mittagong still holds the highest median value among all 50 regional centres at $1,159,226.

By contrast, Batemans Bay (median $781,824) and St Georges Basin-Sanctuary Point (median $787,844) remain substantially more affordable, but both have seen momentum soften after strong pandemic-era gains.

Batemans Bay's annual growth sits at just 2.2 per cent, while St Georges Basin-Sanctuary Point is up 2.3 per cent year-on-year.

The decline may offer a window of opportunity for those eyeing long-awaited holiday home purchases, or those looking to upgrade without the fierce competition of previous years.

What's next for regional markets?

Ms Ezzy says affordability will be the key driver into 2026, as both owner-occupiers and investors return.

"ABS lending data shows that a record level of investor interest is emerging alongside consistent demand from first home buyers and subsequent buyer households," she said.

And as prices continue to firm, regions with accessible entry points and tight supply are likely to see further growth - even if a few South Coast and Southern Highlands favourites are currently taking a short breather.

Originally published as Why regional home values are rising at their fastest pace in more than three years