BEN HARVEY: Tracking Australia’s interest rates against the States’ shows this is as good as it gets for us

BEN HARVEY: This chart tracking interest rates should scare the crap out of any Australian who has a mortgage — and also Wayne Swan.

The chart at the top of this page should scare the crap out of any Australian who has a mortgage.

Former treasurer Wayne Swan doesn’t owe money on his house but they should frighten him also, because they’re rude proof he is a numbskull.

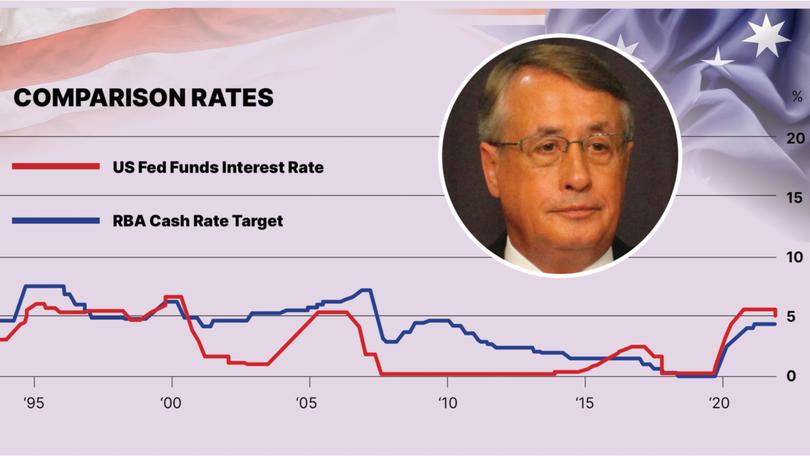

The graph traces official interest rates in Australia and the US over the past few decades.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The American rate is in the news courtesy of this week’s out-sized half-a-percentage point cut, which brought the official rate down around 5 per cent.

Swan says the dove-ish decision by the US Federal Reserve vindicates his recent demolition of our own central bank for putting “economic dogma over rational decision-making”.

Defending that attack on Friday, Swan said he was administering a “truth serum”.

“I think that the decision in the US gives the Reserve Bank more room to move,” he said.

“I think the employment numbers yesterday weren’t exceptionally strong, and I think that everything is heading in the right direction for a rate cut.”

Swan should run his theory past Scott Kleinman, who runs Wall Street financial giant Apollo Asset Management.

Whereas Swan was very good at spending money (have a look at how Australia’s debt pile grew under his watch), Kleinman is very good at making money.

The Apollo co-president reckons the US Federal Reserve could end up having to jack up rates again, and quickly because inflation around the world is far from under control.

He says the evidence is right in front of our noses in the form of an inflated housing market and a buoyant jobs sector.

“Nothing points to why rates will be falling massively other than people’s expectations they will,” Kleinman told a Sydney investment conference this week.

He is worried because he suspects it will be especially difficult to coach the inflation genie back into the bottle a second time.

Kleinman helped create a $1 trillion company. Wayne Swan helped create the Pink Batts program.

I know whose judgment I trust.

Despite what Swan thinks, inflation eclipses high interest rates as the biggest long-term threat to the economy. RBA governor Michele Bullock knows this and it is the primary reason she will likely hold the line.

There is a secondary reason that the woman is not for turning — the economic principle known as “reversion to mean”.

“Reversion to mean” is a fancy way of saying that eventually, every financial measure will return to its long-term average.

It is a financial theory proposing that after extreme price changes, asset values always return to long-term average levels.

That what always was will, eventually, once again, be.

Trace your finger along the red line above from right to left and you’ll see that prior to Monday’s cut, the US rate of 5.5 per cent was the highest in 23 years. You have to go back to March 2001 to find money that expensive.

Look closely at the blue line and you will see that over the same period, Australia’s official rates were regularly above the current 4.35 per cent. And they were well above that rate for the entire 10 year-period before that.

The US chart exposes the current situation in America as a statistical aberration crying out to be tamed by the reversion-to-mean theory.

The Australian chart suggests this is as good as it gets Down Under.

That an official rate of 4.35 per cent (and a subsequent standard variable mortgage rate of around 7 per cent) is the new normal.

Anyone paying off debt in Australia over the past third of a century would have taken 7 per cent in a heartbeat.

Current mortgage holders have been fooled into thinking the emergency monetary policies triggered by the GFC and pandemic were normal. They were not.

The first was the biggest economic shock since the Great Depression. The second was the biggest health shock since Spanish Flu.

We’re are in for a rude financial awakening.