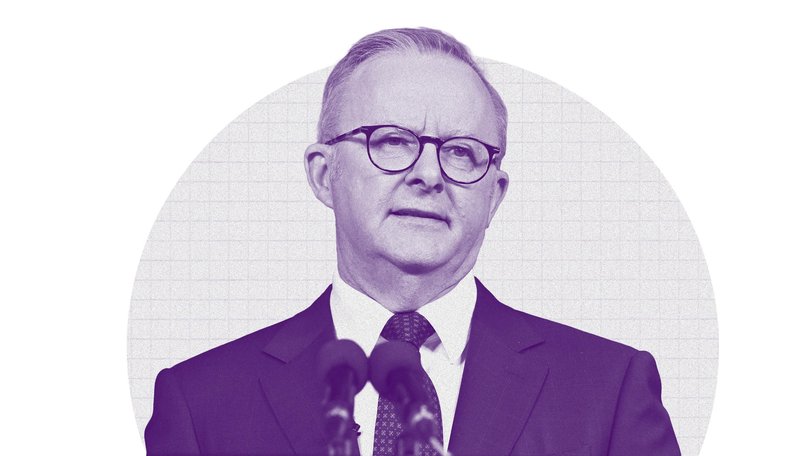

CAMERON MILNER: Anthony Albanese must come clean on special deal for cashed up politicians

CAMERON MILNER: Labor is waking up with a hangover after the greatest numerical victory in the Federal party’s electoral history. Whether it will be seen as a great Labor victory, only time will tell.

Labor is waking up with a super sized hangover after the greatest numerical victory in the Federal party’s electoral history.

Whether it will be seen as a great Labor victory, only time will tell. It’s not like Medicare, superannuation or a formal apology to the Stolen Generation is planned any time soon by Albo.

While we wait for the small target gang to invent a to-do list for the second term, Labor in the meantime is making a hash of their proposed changes to super tax.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Adding to the cluster show is now whether uber-rich Albo will vote to avoid this new tax entirely.

Kerry Packer might have famously said paying any more tax than the minimum was un-Australian, but voting yourself a tax avoidance measure is positively Banana Republic!

Treasurer Jim Chalmers is right to develop new areas of government revenue and as he did with stage three tax cut changes is proving to be a reformist Treasurer prepared to argue his case.

It’s also got a lot easier for Labor to simply ram through their version of the tax with 94 members in the Lower House and the Greens with the balance of power in the Senate.

Though independent David Pocock will no longer have a determinative vote, his holding up of this particular super legislation is informative. Senator Pocock is genuinely bright and had key reservations about this particular proposal.

Even though some corporate leaders stuck their necks out prior to the election many more have made their concerns publicly and privately to Labor about the direct effects and unintended consequences of the proposal to increase super taxes and include them on unrealised capital gains.

It’s informative that Paul Keating is said to be mulling a wider public criticism of the new tax alongside media reports that AustralianSuper and ART — the largest two industry super funds — have lobbied behind the scenes to have their concerns known.

The principal objections, other than from those who just don’t want to pay any more tax, can be boiled down to a few issues.

First, the fundamental change to taxing unrealised gains. Second, the non-indexation of the threshold and that we are likely to see double taxation occur under Labor’s current proposals.

There are also the massive practical effects of taxpayers having to create liquidity to pay the tax annually even if the underlying asset — their farm, the GP clinic or business premises is illiquid.

Unlike shares that form part of a portfolio and can be traded to pay the tax, no such arrangement is possible within super for fixed assets and the inability to borrow within the super system.

Labor needs to ensure these legitimate public policy questions about the previously accepted policy settings relating to tax are dealt with and not simply by saying “it’s such a small number of rich people who will pay a little more tax”.

It’s a glib response to a fundamental change to the way our tax system operates.

Because Labor has an even bigger problem to resolve: the even fewer uber rich people like the Prime Minister who appear to be being treated totally differently to all others covered by this new tax.

While ordinary and self-managed super fund members will need to pay the tax each year on balances greater than $3 million, those on defined benefit pension schemes — that is politicians and public servants who started their careers before the mid-2000s — will be able to defer payment until retirement.

There appears to be one rule for wealthy superannuants and a completely different one for the PM.

Also completely unexplained is what a whole host of other Labor luminaries like Kevin Rudd, Julia Gillard, the Treasurer’s mentor Wayne Swan and indeed Paul Keating will pay annually to the tax office.

What we do know is this tax change isn’t going to raise a small amount of money, it’s going to raise tens of billions over the next few years. It’s worth a lot to Labor’s spend and tax agenda.

But Albo needs to explain why he’s giving himself a leave pass for paying this new super tax.

Voters don’t like politicians at the best of times, but will openly revolt if the recent nurse graduate will get caught by Labor’s new tax in time, but the PM avoids his liability from early as July 1 next year.

If Labor wants this measure so badly it should actually come clean on how Albanese is affected.

It then needs to argue the case for why people should pay tax on a paper profit they may or may not ever realise with cold hard cash, despite their asset being illiquid.

Once breached, this fundamental change to our tax principles can be applied to investment properties or even family homes that are determined to be too nice not to tax.

The lack of indexation backs in yet another example of bracket creep. Every year, more and more will be caught up — not just the very few being claimed.

Labor has every right to make changes to our tax system. They have the numbers to make as many bad laws as they like.

But voters will quickly turn if that power is being used to increase taxes by stealth and to rewrite fundamental underpinnings of our tax system.

Workers aren’t asked to pay tax on earnings they are yet to make so why are paper profits now fair game to be treated completely differently? Tax on earnings already paid and at the point of making a profit when you have liquid assets with which to pay are fair taxes.

What’s particularly vexing though for voters is to think that the Prime Minister is voting for one rule for himself and a completely other one for hard working farmers and family business owners.

Tax changes need to be justified to voters, but blatant personal benefits are politically toxic, even with 94 seats and your mates in the Greens giving you unfettered legislative power.