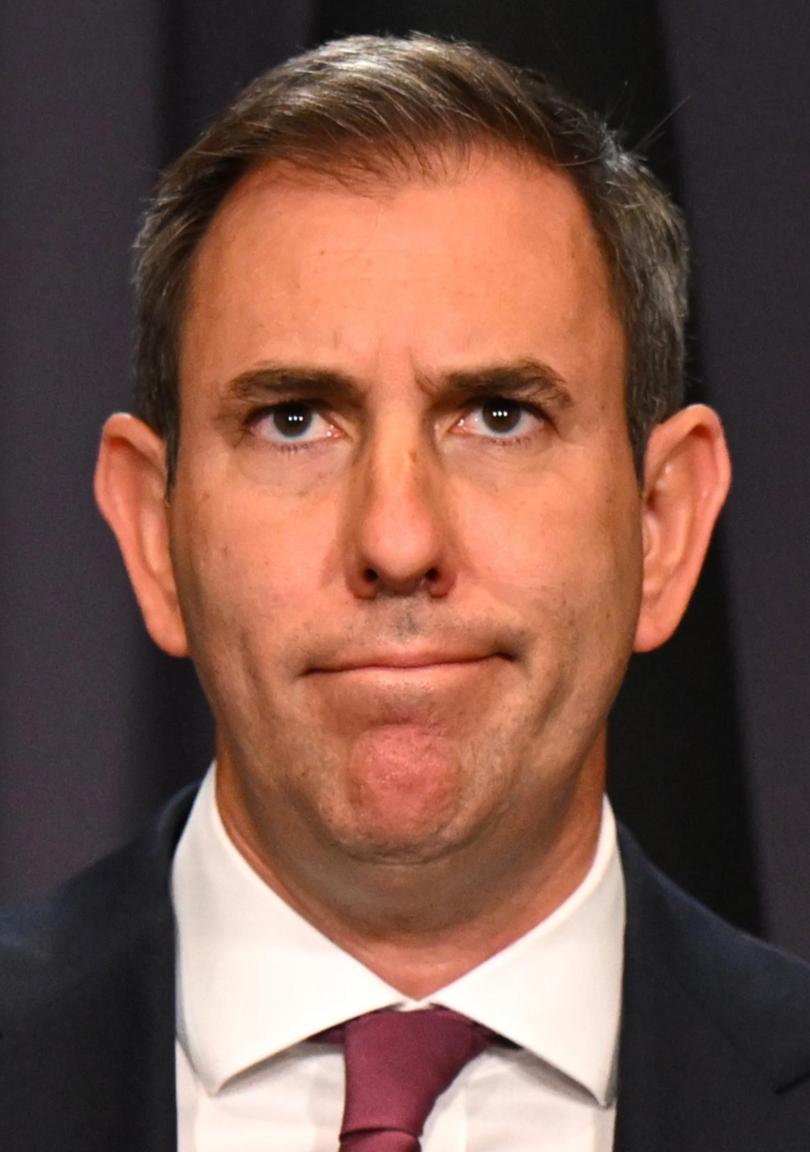

PAUL MURRAY: It seems no one can keep Australia safe from failing Treasurer Jim Chalmers

PAUL MURRAY: While a tsunami of bad economic news engulfs households, Jim Chalmers plays King Canute, willing the tide to recede, but the Treasurer shows no signs of turning back the waves.

It should be obvious to all Australians by now that our self-styled economic emperor has no clothes.

While a tsunami of bad economic news engulfs households, Jim Chalmers plays King Canute, willing the tide to recede.

This week’s national accounts showing dismally low growth were the latest in what has become an election-defining story of failure.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.We are now suffering the longest household recession — which is measured as negative GDP per capita — on record.

A real recession was forestalled by massive government spending as inflation persists. What a toxic mess.

But Chalmers told Channel Seven’s Spotlight back in October that “the worst is behind us”.

It was an insufferably tin-earned comment when mortgage-holders have not seen any drop in their monthly repayments since Labor came to power — but suffered 13 increases under Chalmers’ watch.

After his first two spluttering attempts at an economic plan fell far short of addressing the inflation threat, this column labelled him the “Treasurer on trainer wheels”.

At least there was the prospect in that epithet of improvement with time. But the Canberra press gallery continued to treat him like a rock star.

And, sadly, he’s just got worse. The gallery wanted another Keating. They couldn’t countenance getting Labor’s version of Billy McMahon.

And this week’s national accounts — in sight of what might be an early election next year — are proof positive of his incompetence.

If Chalmers had acted firmly in the early stages of those 13 rates rises, when householders were better placed to deal with the financial pressures, the economic pain would now be over.

The September quarter figures, showing growth in the period at just 0.3 per cent when economists expected between 0.5-0.7, were said by EY chief economist Cherelle Murphy to “paint a picture of a sad economy without much hope”.

Murphy said only the public sector — both Federal and State — was propping up the economy, with the figures showing government spending hitting its highest level ever. That was caused by excessive living-cost relief handouts, the rapid expansion of the care sector and public servants’ wage increases.

“Never before have governments pumped so much into the economy via rebates, tax cuts, infrastructure, health and disability support and defence,” Murphy said.

Total public spending grew strongly by 2.4 per cent through the September quarter, lifting the share of government expenditure to a record 28 per cent of GDP compared with 22.5 per cent over the decade before the pandemic.

Chalmers should have cut spending in the early years of government, when hard decisions are easier, but he didn’t.

The Cook Labor Government in WA can’t escape its share of the blame for this profligacy.

Just this week, Premier Roger Cook put out a media release patting his government on the back: “Over the past four years, our WA Labor Government has delivered $2100 in power bill relief to every single WA household.”

And why did Labor governments across the nation have to pay those bills? Because Anthony Albanese rode to power on a promise that Labor’s renewables revolution would lower them by $275 a year by now.

Power costs have skyrocketed and there is no end to the increases in sight because rebates don’t fix what’s driving up electricity bills.

If punters continue to swallow Chalmers’ excuses, they will have to take their share of the blame for what’s coming down the pipe.

Chalmers should have cut spending in the early years of government, when hard decisions are easier, but he didn’t. Wanted to be a nice guy. Finished last.

So Labor threw open the borders to provide an economic stimulus through the lazy demand that migration provides, but it quickly was shown to be causing more social harm than economic good.

And then when things got really tight, instead of learning from his earlier mistakes, Chalmers shovelled more taxpayer funds onto the fire, making a bad situation worse for longer.

In another blast of misguided socialist theory, Labor opened the borders of the public service, employing lots of people on high salaries who produce nothing of economic value.

When an economist of Chris Richardson’s standing puts out a public warning that our national accounts are tanking, all Australians should take notice. And that happened two weeks ago in his report called The Carnival Is Over.

The main difference between him and Chalmers is that Richardson is not only an economist, but was also a senior officer in the Federal Treasury and at the International Monetary Fund in Washington before moving into the commercial world.

Chalmers controls Treasury on the basis of an arts degree and a thesis on political bastardry entitled: “Brawler Statesman: Paul Keating and Prime Ministerial Leadership in Australia.”

The rest of his qualifications to run our economy is that he once worked as a media adviser and then chief of staff to another Labor treasurer, Wayne Swan.

And, as he has proved over the past three years to almost everyone other than the Canberra press gallery, his plausibility masks his real ability.

Richardson’s report was provoked by Chalmers’ ministerial statement in the House of Representatives on November 20 in which he once again claimed economic success on the basis that “inflation has halved”.

Gallery reporters also use this line consistently, blindly ignoring that most economies against which we measure ourselves have killed off inflation over the same period and are now growing much faster than us. Our core inflation is persistent at 3.5 per cent.

Richardson called out Chalmers for wasting a period of record revenues which are drying up. His powerful rationale is the complete opposite of what the Treasurer has been bloviating.

“Since the Government came to power, expected revenues across a four-year period have been revised up by a third of a trillion dollars,” Richardson wrote.

“Yes, you read that right. That’s not because the Government raised taxes. It’s because of war, migration and inflation. “War drove up the price of things we sell to the world — so the pie we tax got bigger. Migration saw population growth roar — which also meant the pie got bigger, and the tax take rose (most of the budget costs of migration fall to the States). “And inflation changed slices of the pie — families got less and the taxman got more. But those factors have now faded. Iron ore prices are down, inflation is downk, too, and migration is slowing. “So today the Treasurer said any revenue upgrade in the coming budget would only be a ‘sliver’ of what it has been enjoying. Like Paris Hilton, the budget has been ‘sliving’ until now. It’s been ‘slaying, mixed with living its best life’. “But the transition from ‘sliving’ to ‘sliver’ means that the carnival is over.

“In fact, if I were doing the Treasury estimates of the coming tax take, I’d be edging them lower, not higher. That says the choices we make as a society are about to lose the cushion we’ve enjoyed in recent years.”

Richardson offered a very chilling assessment of what’s ahead for the national economy if Labor retains power at next year’s election.

But the grim picture he paints poses real questions about whether Albanese really wants Chalmers to produce another Budget before the election.

Chalmers will have a sad story to tell of massive deficits out to the horizon which destroy the narrative he built up around the two “accidental” surpluses Labor enjoyed in its first years in office.

As Richardson exposed, they had nothing to do with good economic management, but with windfall revenue growth — much of which was squandered.

Would a rate cut in the middle of an election campaign really change voters’ intentions?

Richardson’s old firm, Deloitte Access Economics, is predicting the most severe deterioration in the Budget bottom line recorded outside of the coronavirus crisis. It estimates the underlying cash deficit will be $33.5b this financial year, $5.2b worse than expected.

After last financial year’s cash surplus of $15.8b, this would be a turnaround of around $50b, making it a deterioration of crisis proportions. A crisis of Chalmers’ making.

And it gets worse. Deloitte predicts the deficit to widen further in 2025-26 to $46.8b, $6b worse than Treasury’s official projections.

Richardson forecasts underlying cash deficits to be at least a further $10b worse by 2027-28. He said “lucky Chalmers” had enjoyed the “most favourable environment to the Budget in a century and a half”.

Albanese desperately wants a pre-election interest rate cut from the Reserve Bank in the hope it would save his political skin.

The Budget is sketched in for March 25, two months ahead of the usual date, which would allow Albanese to go to the polls in May, the earliest that most economists expect the RBA might cut the cash rate.

Would a rate cut in the middle of an election campaign really change voters’ intentions?

There is an ugly Budget story in the figures, but it remains a political opportunity for a hopeless Treasurer to splash even more cash and a diminished Prime Minister to make more unachievable promises about power prices.