JACKSON HEWETT: Justin Trudeau’s downfall in Canada holds lessons for Anthony Albanese in Australia

JACKSON HEWETT: High immigration, unaffordable housing and falling disposable incomes were stirring voter anger in Trudeau’s Canada well before Trump’s meddling.

As Australia’s most comparable peer, Canada has shown that progressive politics can’t outrun hip pockets when it comes to voter anger.

The similarities between Canada and Australia are stark, starting with an immigration program that has failed to match the country’s capacity.

That secret sauce to manufacture growth has congealed and the blockages it has created are clogging up perceptions of national wellbeing.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Since COVID, Canada’s population has grown 6.7 per cent, while Australia’s has risen by 5.6 per cent. Foreign students grew by 30 per cent in Canada between 2022 and 2023 to be up 63 per cent in five years. Between 2022 and 2024, foreign students in Australia leapt by 55 per cent.

At a time of low growth and skills shortages, adding new migrants, whether permanent or temporary, is a great way to juice GDP. But it creates short-term frictions and exposes long-term structural issues.

Adding inflationary pressure

Trudeau’s Liberal Party, like many incumbent governments of the post-COVID era, has been hurt by the hangover caused by big government spending programs during the pandemic and supply chain issues that have driven up inflation.

The response, repeated by central banks across the world, has been the rapid ratcheting up of interest rates from effectively zero to five per cent, hurting homeowners who have watched their disposable income evaporate.

But while rates have gone up quickly, inflation has taken longer to abate. In Canada, it peaked at 6.6 per cent in 2022 and was still at 2.8 per cent in June this year. Australia, by comparison saw underlying inflation hit 6.8 per cent in December 2022 and it remains at 3.5 per cent today.

Food inflation continues to be a problem in both nations. In Canada grocery prices rose 2.8 per cent in December, driven by a big rise in the price of fresh produce. Australian grocery prices are up 3.3 per cent. Fruit and vegetables here spiked 8.6 per cent in the September quarter, according to the Australian Bureau of Statistics.

“We learned—or perhaps relearned—just how much people hate inflation,” Bank of Canada Governor Tiff Macklen said in a recent speech.

“All of a sudden, people couldn’t afford the things they need to live. And while inflation is low once again, many prices are still a lot higher than they were before the pandemic. So people feel ripped off. And that erodes public trust in our economic system.”

Insecure as houses

Canadians, like Australians are so attuned to the cost of living due to the high cost of housing.

A core driver on inflation in both countries has been accommodation.

In Canada, rents are growing at eight per cent per year. In Australia, they are growing at almost seven per cent.

Housing affordability is equally as dire for home-owners.

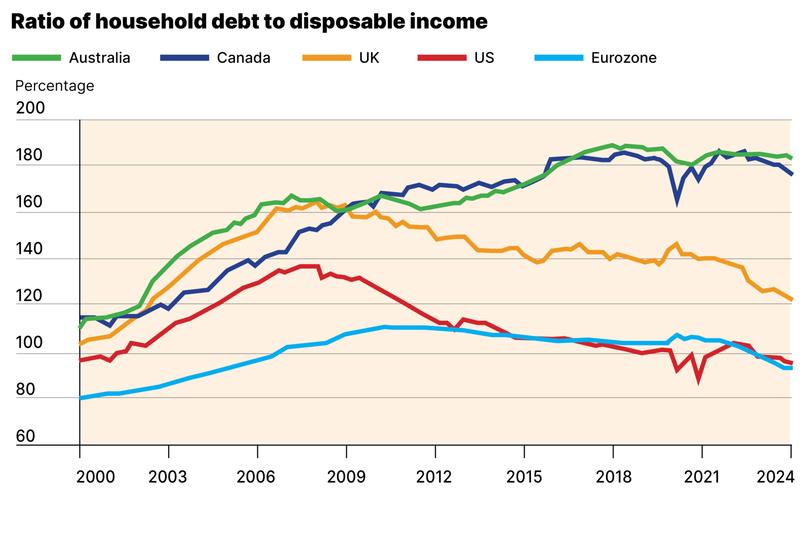

In Canada, household debt is a whopping 180 per cent of disposable income. Ours is the same.

Contrast that to the US or Eurozone, where the ratio is less than 100 per cent, or even the UK, where it is around 120 per cent.

That housing affordability is a key issue according to National Australia Bank chief executive, Andrew Irvine. The Canadian banker who was recruited in 2020 from one of Canada’s largest business banks said that it was no surprise that the two countries are attractive destinations, but warns that Australia is sleepwalking into a housing disaster.

“They’re both countries that are among the top destinations where people want to live and work, with great rule of law, good, healthy, safe environments to raise families and those types of things,” he said in a recent interview with NAB’s Morning Call podcast.

“(Housing) is still an issue there, no doubt about it – but I would say there’s things that we could learn here in Australia today from Canada around how you get moving in terms of dwelling construction. And it’s more of an issue, in my opinion, here.”

Irvine said that Canada has been better at managing supply, boosting new dwelling starts by simplifying planning permissions and increasing stock of medium density housing. They have also adopted more modern construction methods, including modular construction.

“I would focus on costs of labour, length of time it takes to get building construction done,” he said. “There’s still too much I think building of traditional single family dwellings, which of course people do aspire to, but we need housing stock that allows younger Australians to get on the housing ladder as a way to the kind of end home if you will.”

Falling living standards

Reliant on resource income, both governments have presided over a collapse in living standards, as migration eats up more of the total pie.

GDP per capita has been sinking, down 3.5 per cent in Canada in the last two years, versus a decline of 2.1 per cent here. Australia has performed worse however in terms of household disposable income per capita, due to higher income taxes, according to independent economist Saul Eslake. That will be the catchcry of the election year.

GDP is an equally anaemic 0.3 per cent for both countries, although Canada’s unemployment rate is far higher at 6.8 per cent.

Our higher employment is one of the reasons rates have not fallen as quickly here but even if the RBA cuts rates, it may not be enough to help the incumbent Albanese Government.

Five rate cuts from June, including a half a per cent cut in December to 3.25 per cent have not been enough to help ease voter concerns.

Sixty per cent of Canadians now believe that immigration is too high, and Canada is about to see its first contraction in terms of population since 1867. That will dampen growth, according to Oxford Economics, but over time improve the unemployment picture.

Long-term structural issues

A recent report by Royal Bank of Canada could easily have been produced for Treasurer Jim Chalmers.

“Our relatively low productivity —the amount of production and income generated per hour worked in the economy— has been held back by a shortfall in investment, especially outside real estate, construction and public services like hospitals. As a result, we’ve not been able to capitalise on the immigration boom that has added seven million people — most of them working-age and well-educated — since the turn of the century and offset the retirement wave of baby boomers,” the report laments.

The report tells a story of over-investment in real estate, high household debt dampening investment in more productive enterprises, and too much spent on health and other services. In Australia that story is also true and here, one of the productivity challenges we face has been the failure to place skilled workers into jobs.

Labour productivity, a key determinant of long term growth, is going nowhere or even backwards, for both Australia and Canada. By comparison it is growing at 2.2 per cent in the USA.

Treasurer Chalmers has tasked the productivity commission with rectifiying these long-term issues but looking to Canada, and Trudeau’s nine years in power, the lesson is clear. Fixing structural problems is a core need.

Trudeau’s issues began long before Trump started to meddle in Canadian politics, but there is always a black cloud on the horizon.

As Tiff Macklen said in the same speech.

“The future ... unfortunately, it looks more uncertain than it did before the pandemic,” he said.

“Big structural changes are already underway. Deglobalisation, demographic shifts, digitalisation and decarbonisation are all having significant effects on jobs, growth and inflation.

“Trade protectionism and economic fragmentation are rising, and the appetite for global cooperation is waning.

“Ageing populations and changes in immigration policies will also affect the supply and cost of labour. New technologies, including artificial intelligence (AI), will disrupt existing industries and create new ones. And the impacts of climate change and the transition to low-carbon economies are becoming more pervasive.”