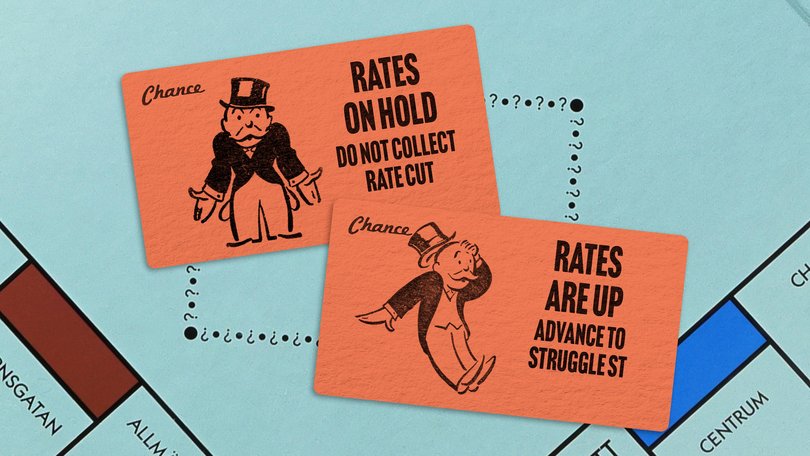

RBA interest rates: Economist Brendan Rynne warns Federal Government spending is driving Australian rate hikes

The Reserve Bank of Australia wouldn’t have to hike interest rates if the Federal Government made a tough decision, a leading economist says.

The Reserve Bank of Australia wouldn’t have to hike interest rates tomorrow if the Federal Government cut back on its high spending, a leading economist says.

On Monday morning financial markets saw a 72 per cent chance of a quarter-of-a-percentage-point increase on Tuesday. All four big banks believe the Reserve Bank will hike, reversing August’s cut.

With both headline and underlying inflation well above the Reserve Bank’s 2-3 per cent target, KPMG chief economist Brendan Rynne said a hike wouldn’t be necessary if the Government cut back spending on the NDIS and taxpayer-subsidised jobs.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“Yes, I do think so,” he told The Nightly. “It’s more consumption spending. The high level of spending that is going towards government services, which also include providing support into the non-market sector, need to be curtailed to help with the underlying price pressures.”

Dr Rynne questioned Treasurer Jim Chalmers’ assertion last week that government spending was falling and business was driving inflation.

“I would suggest the data doesn’t marry with that story. The data doesn’t fit the Treasurer’s narrative,” he said.

Dr Chalmers said the Government was cutting back on spending, after a headline inflation soared to 3.8 per cent at the end of last year, up from a 3.4 per cent annual pace in the year ended November 30.

This was after a new Opposition analysis, backed by independent economist Chris Richardson, showed a $57 billion Budget black hole by 2036 when Treasury’s Mid-Year Economic and Fiscal Outlook was compared with the forecast released before the May election which saw Labor re-elected.

An updated Parliamentary Budget Office analysis showed bigger deficits of $55.7 billion.

Hold not ruled out

Rate hike expectations sent the dollar last week to 71 US cents for the first time in three years. The higher currency could take the pressure off inflation if the currency remains above 70 US cents for several months and import prices fall.

While most economists expect a hike on Tuesday, a small minority argue rates will stay on hold at 3.6 per cent.

Housing and services-sector costs had been moderating on a monthly basis, which Deutsche Bank chief economist Phil O’Donoghue said showed underlying inflation, now at 3.3 per cent, was on track to fall back inside the RBA target band by August this year.

“There is a notable deceleration in the last two months of last year - November and December,” he told The Nightly. “If you look at the new information on a monthly basis, it’s coming back towards the target. I think, for that reason, the RBA should just wait, sit back and see where we go over the couple of months of 2026.”

A slowing labour market, despite very low unemployment, would make the case to leave rates on hold to preserve the gains in the labour market.

Futures market pricing for a February 3 hike jumped from 25 per cent to 60 per cent, on January 22, after labour force data showed unemployment in December had fallen to 4.1 per cent, down from 4.3 per cent in November.

But a closer reading of new ANZ-Indeed job ads data, released on Monday, showed that while the number of advertised positions grew by 4.4 per cent in January, the tally was 3.2 per cent weaker than a year earlier.

Annual growth in employment and the number of hours worked was relatively soft at 1 per cent, which could potentially reduce the risk of wages feeding into inflation, despite December’s low unemployment number.

“We do not think the December data signal a material tightening in the labour market in the near term,” ANZ economist Aaron Luk said.

Morgan Stanley analysts are also among a minority predicting rates remaining on hold.

“This is likely to be a closely debated decision. We expect the board to frame the decision as dependent on continued sequential slowing in demand and inflation, keeping future hikes firmly on the table — although we think an extended hold is ultimately more likely,” they said.

While national house price grew by 10.2 per cent in the year to January 31, Cotality research director Tim Lawless is expecting that to slow as immigration slows.

“After several years of exceptionally strong net overseas migration, the ‘catch up’ phase of population growth has moderated back toward longer-run averages,” he said.

“While still positive for underlying housing demand, the step-down removes some of the extreme pressure on housing demand.”