THE ECONOMIST: Fear the deficit-populism doom loop

Politicians, particularly in Europe, are in a terrible bind.

You are a finance minister after a decade of meagre economic growth, shocks from a financial crisis, a pandemic and sky-high energy prices. Public debt is worth more than your country’s gross domestic product, interest rates are at their highest in years and merely servicing outstanding debt is taking up an ever-greater share of tax revenue. Inflation is stubborn.

America’s profligacy is satisfying much of the world’s appetite for government bonds, meaning your debt must pay more to attract investors. You lie awake worrying about how to make the numbers add up.

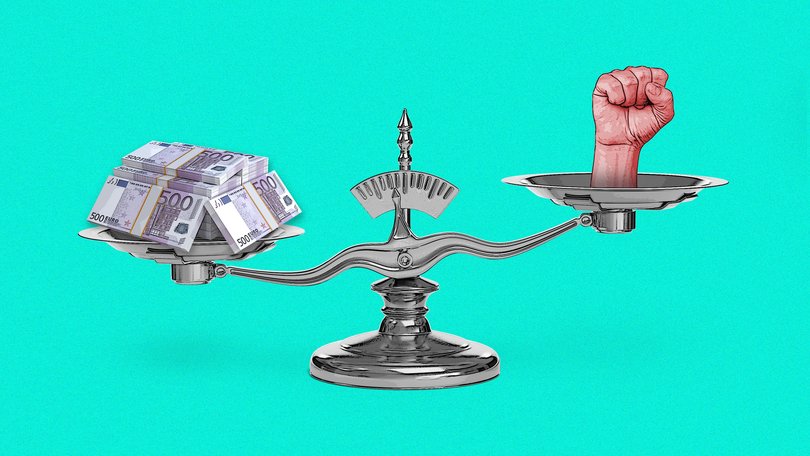

Your fellow ministers, meanwhile, fret for their careers: populist parties are on the rampage. The economic context calls for fiscal consolidation; the political one warns against austerity. What do you do?

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.This is the bind facing governments in much of the rich world. The average fiscal deficit in the OECD, a club of mostly rich countries, hit 4.6 per cent of GDP last year, up from an average of 2.9 per cent in the four years before the COVID-19 pandemic; interest payments on outstanding debt came to 3.3 per cent of GDP, only just below the amount NATO members hope to spend on defence by 2035.

The political-science literature offers some comfort — austerity is not usually a barrier to re-election — but also a warning. Research shows a link between spending cuts and populist success.

Indeed, in Britain, France and Germany such parties are already ascendant. Call it the deficit-populism doom loop: ministers face both big deficits and voter revolts, and there is little way of satisfying both the bond markets and the barbarians at the gate.

During the slow recovery from the global financial crisis of 2007-09, many governments delayed fiscal consolidation and borrowed.

Today’s macroeconomic backdrop is less conducive to such an approach: debt loads are higher and central banks are tightening policy, rather than engaging in quantitative easing.

The Bank of England has been reducing its bond holdings by about £100 billion ($208b) a year, making it harder for the state to find buyers for the £300bn or so of bonds it sells a year.

Bondholders are restive. France’s ten-year-bond yield is 3.4 per cent, up from less than 1 per cent a decade ago. Higher inflation and higher interest rates, which become more likely when governments borrow heavily, can also inflict political pain on incumbents, as President Joe Biden discovered.

Borrowing more is thus unappetising. The fiscal conditions also make the prospect of hard-right governments more worrying. They typically promise higher spending on pensions and family benefits, as well as tax cuts — a dangerous combination in present circumstances.

This dynamic means that unpopular spending cuts may be self-defeating: there is no point righting the fiscal ship only to put a free-spending populist in power.

Bond markets have already started to fret about hard-right success. When Emmanuel Macron called a snap election in June 2024 the spread between interest rates on the country’s ten-year bonds and those of Germany’s rose from 0.5 percentage points to 0.8 as investors worried about the potential success of the National Rally. An indecisive result left debt costs elevated.

In theory, it might be possible to sell spending cuts to voters. Governments are often re-elected after implementing austerity; a smart politician can get cuts out of the way well before an election comes round.

However, studies also suggest that, over time, spending cuts sap support for the political mainstream. A forthcoming review by Evelyne Hübscher of Central European University and Thomas Sattler of the University of Geneva finds that the spread of populism in western Europe has occurred in waves that coincide with episodes of austerity.

Debates about immigration, public services and benefits become more potent when what Stefanie Stantcheva of Harvard University calls a “zero-sum mentality” has developed.

This is borne out by small-scale studies. Simone Cremaschi of Bocconi University and co-authors looked at variations in Italian local-authority reforms. They found that, in areas where cuts to public services were deepest, hard-right parties went on to win more votes. Another paper by Zachary Dickson of the London School of Economics, Mr Cremaschi and co-authors finds that Reform UK thrives in areas with recently closed National Health Service practices. Potholes and poor roads seem to correlate with the party’s success, too.

“Invest in key public services to make people see that it is worthwhile paying their taxes and being part of this democratic system,” advises Catherine de Vries of Bocconi.

Putting money into public services would, though, require tax rises. They might be less likely than spending cuts to encourage the rise of populists. Jacopo Ponticelli of Northwestern University and Hans-Joachim Voth of the University of Zurich looked at fiscal consolidations across a number of countries from 1919 to 2008.

They discovered that although there is a clear association between spending cuts and instances of social instability, such as riots, tax rises had only a “small and insignificant” impact. The problem is that they would bring other costs. Alberto Alesina of Harvard and co-authors find that austerity packages that lean more on tax rises than spending cuts are worse for long-term economic growth. Free-market parties that implement tax rises are especially punished for doing so by voters.

Missing the cut

Are there other options? Sensible debt management might have been one. In recent decades, as Barry Eichengreen of the University of California, Berkeley, and Rui Esteves of the Geneva Graduate Institute have noted, credible economic policy and the issuance of long-duration bonds have prevented modest bouts of inflation from sending yields soaring, slowing the accumulation of debt.

The problem is that in recent years most countries have moved away from issuing long-term bonds. Indeed, quantitative easing, which involves swapping longer-dated government debt for overnight deposits with the central bank, has shortened the effective maturity of government liabilities, making them more sensitive to changes in short-term interest rates.

Messrs Eichengreen and Esteves point out that, since the Second World War, European governments have most commonly reduced their debt via either fast economic growth or financial repression. Fast economic growth does not seem likely, which leaves financial repression. It typically involves either capital controls or financial regulation that keeps nominal interest rates below the rate of inflation.

Although few governments are keen to return to the post-war era of capital controls, some are flirting with other forms of repression. Ideas include scrapping interest payments on central-bank reserves or making pension funds buy domestic assets. British policymakers may use tax incentives to encourage savers to invest at home.

Financial repression, however implemented, is ultimately a tax on savers, who receive worse returns when forced to invest in their domestic market. Far more voters now own assets and private pensions than during post-war episodes of repression. It is unclear how they would react to being forced, in effect, to hand over a chunk of their savings to the government, but it is not hard to imagine a backlash.

The populist bind, therefore, is a tight one. Pity the finance minister, hoping to keep debt burdens under control and the hard right at bay. At least, during his sleepless nights, he can console himself that, when he is booted from office, his populist successor will face many of the same constraints. See how they like it.