THE NEW YORK TIMES: Why the AI boom is different to the dot-com boom

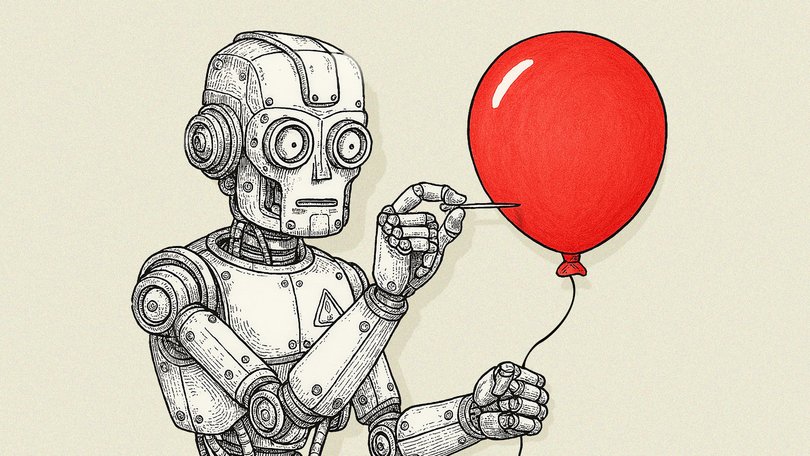

THE NEW YORK TIMES: Silicon Valley is experiencing an AI boom that bears resemblance to the dot-com boom. But despite the similarities, there are many differences that could lead to a wildly different outcome.

The dot-com boom, a period of wild exuberance and extreme hype that began in the mid-1990s, built the foundations for the contemporary wired world. When the internet mania turned to bust in March 2000, it made a bit of a mess.

The trouble spread from Silicon Valley to the larger economy, which went into recession. More than $5 trillion in stock market value was destroyed. The unemployment rate rose to 6 per cent from 4 per cent. It was not the worst crash ever, but the hangover lasted a few years.

Now Silicon Valley is in the middle of an artificial intelligence boom that bears some obvious resemblances to the dot-com boom. Much of the rhetoric about a glorious world to come is the same. Fortunes are again being made, sometimes by the same tech people who made fortunes the first time around. Extravagant valuations are being given to companies that didn’t exist yesterday.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.For all the similarities, however, there are many differences that could lead to a distinctly different outcome. The main one is that AI is being financed and controlled by multitrillion-dollar companies like Microsoft, Google and Meta that are in no danger of going kaput, unlike the dot-com startups that were little more than an idea and a bunch of engineers.

Amazon is not selling less toothpaste as it shells out billions on AI data centres, and Google is not selling fewer ads as it develops foundational AI models.

The internet was a new platform in the 1990s. It took time for people to accept the idea of being online, and for technology like broadband to be put in place that allowed them to thrive there. Many business leaders, by contrast, are eager to take up AI as soon as they can.

Another difference between then and now: relatively few regulatory barriers are standing in the way of AI. The Trump administration is doing all it can to enable an AI future. The Clinton administration’s big tech move in the 1990s was suing Microsoft.

Yet another factor pushing against a repeat of the dot-com collapse: worrying that things are getting out of hand is paradoxically a sign that things are not out of hand. At least, not yet.

“We get bubbles when everybody believes the price cannot go down,” venture capitalist Ben Horowitz wrote in an email. “The clearest sign that we are not actually in a bubble is the fact that everyone is talking about a bubble.”

When the last critic says that he or she was wrong and announces that he or she is forming an AI investment company, that is the signal to look for shelter.

“We do not have capitulation yet,” Mr Horowitz said.

The dot-com boom and the AI boom were both narrowly focused. Eighty per cent of venture investments in 2000 went to internet companies. This year, 64 per cent went to AI startups. The technical term for this is “putting all your eggs in one basket.”

But the two booms have otherwise diverged in scale. The three most highly valued companies of the dot-com era were Cisco, Microsoft and Intel, all of which supplied the technology that made internet startups possible. Each was valued around $500 billion at its peak.

Today, Nvidia, the chipmaker that plays a similar role for the AI boom, is valued at more than $4.5 trillion. It and other AI companies such as Amazon, Google, Meta and the privately held OpenAI are together worth more than the $17 trillion capitalisation of the entire stock market in 2000.

That difference in scale is both alarming and — conversely — a comfort. The wealth and power of these AI companies are partly why Federal Reserve Chair Jerome Powell sees no cause for worry. These companies “actually have business models and profits and that kind of thing,” he said in October. “So it’s really a different thing” from the dot-com bubble.

To a large extent, the dot-com boom was a revolution from below. People around the country packed their bags and headed to San Francisco in the hopes of striking it big, just as they did in the original gold rush 150 years before. More than 2,200 dot-com companies went public between 1996 and 2001. At the time, it seemed like a lot.

By contrast, AI is a less populist phenomenon. OpenAI, Google, Meta and Microsoft have been engaged in a well-documented bidding war for talent, but those without expertise have little chance. There are 972,000 companies with .ai internet addresses, although it is unclear how many are viable enterprises.

(The New York Times has sued OpenAI and Microsoft, claiming copyright infringement of news content related to AI systems. The two companies have denied the suit’s claims.)

Mr Horowitz, a major AI investor, worked early in his career at Netscape, which popularised the web browser in the 1990s. Netscape was the inescapable company at the centre of the dot-com boom in the same way OpenAI is now in the AI boom. But the scales they were operating at were very different.

“In 1996, Netscape had 90 per cent of the browser share, and we only had 50 million users, so there were 55 million people total in the internet market and roughly half of those were on dial-up,” Mr Horowitz said. “At the same time, the software to build internet services was super immature and expensive, as was the corresponding hardware and the bandwidth.”

Evite, a company that did online greeting cards, had 290 engineers, he noted. As a result, many dot-com businesses did not work because the products were too expensive and the customers too few.

AI is very different, Mr Horowitz contended. The internet is a network, and its value increases as more people are added, he said. Online retailers in 1996 could reach only a small fraction of the population. Amazon now reaches just about everyone.

AI, on the other hand, is a computer, Mr Horowitz said. “Computers can be valuable immediately. AI is certainly valuable immediately,” he added. “AI products are working so well that we are seeing revenue growth that dwarfs anything that came before it.”

Giuseppe Sette, a co-founder and president of Reflexivity, which uses AI to help traders make investment decisions, estimated that AI adoption was progressing at 15 to 60 times the speed of early internet access.

“I’m going to go out on a limb and say, looking at the balance of probabilities, that this time is different,” he said. “That’s a bold statement, and I do not make it lightly.”

A little-acknowledged worry with the AI boom is that impulses toward fraud will find fertile soil. That means the more unsavoury aspects of the dot-com era may be the likeliest elements to make a comeback.

Dot-coms were under great pressure to rack up revenue and justify their extreme valuations. Some managed to do this legitimately. Others did not. Homestore.com, a real estate listings company worth $6 billion, paid inflated sums for services or products. The vendors used the money to buy advertising from two media companies, which in turn bought advertising from Homestore. Eleven Homestore executives were charged with fraud.

In recent months, the overlapping web of deals between top AI companies has become a prime topic. In an October research note, J.P. Morgan analysts said that “some caution is warranted” but argued that “today’s deals look different” from the dot-com era. “Capital is arguably chasing AI, not the other way around,” the note said.

Boom or bust, one thing is for sure: Silicon Valley will take care of itself.

“Not all AI products are magical or even work,” Mr Horowitz said. “It’s not clear that they will work before the companies providing them run out of cash. So are some valuations in the private markets out of whack? Always. That’s how I stay in business.”

This article originally appeared in The New York Times.

© 2025 The New York Times Company

Originally published on The New York Times