Got cash? You won’t be able to use it at this famous Australian croissant retailer

Lune Croissanterie has been slammed over its payments and surcharge policy.

A surcharge has ruffled the feathers of customers hoping to sink their teeth into one of Australia’s most popular cafe chains.

Lune Croissanterie has been called out by a customer via Reddit, accusing the baked goods chain of illegal activity.

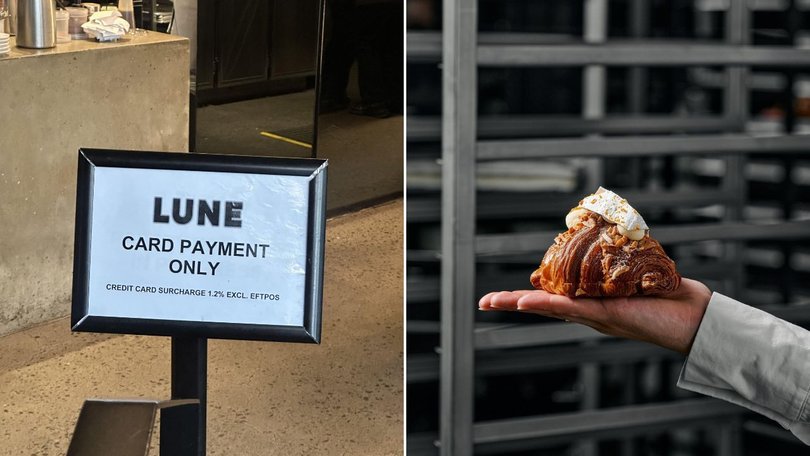

A photo of a sign at the start of a Lune queue clearly stating that the cafe only accepts card has triggered Reddit users.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.On the sign itself, the store clearly states a credit card surcharge of 1.2 per cent, excluding EFTPOS, applies to purchases.

This surcharge was accused of being illegal by the original poster, however other Redditors quickly jumped in to explain that it only applies to credit card users and those who use tap and go payments.

But some comments said that this isn’t fair as customers must insert the card and select EFTPOS to avoid paying the 1.2 per cent surcharge.

“Cash is king, boycott them. I refuse to shop anywhere that won’t accept cash,” one user said.

“A lot of peeps here are just saying ‘duh it says excl. eftpos’, they have to push the correct button on the till first before the payment comes up. Usually they are running on auto pilot and just press the most used type of payment and you end up getting surcharged anyway,” another Reddit user said.

“Some venues I’ve been to you don’t see what they’re really charging on the initial screen then suddenly after payment it pops up with a $1 something surcharge. Those QR code ones in restaurants are the worst for it too, showing ‘service fee’ after the fact. You can say it’s illegal all you want but they’re still doing it.”

The croissant business said is aware of the Reddit post and told 7NEWS.com.au the poster did not understand the sign.

Lune said that “EXCL. EFTPOS” on the sign “means exactly that, and our sign has been misread”.

“We don’t surcharge on EFTPOS or debit,” it said.

Lune’s surcharge does not breach any Australian Competition and Consumer Commission (ACCC) standards, with other stores such as ALDI commonly applying a surcharge to all credit card and contactless payments.

Businesses can charge a surcharge for paying by card, but the surcharge must not be more than what it costs the business to process that payment type.

If there is no way for a consumer to pay without paying a surcharge, the business must include the minimum surcharge in the displayed price of the item.

According to the ACCC, a business’s average cost of acceptance for Visa debit is 1 per cent and 1.5 per cent for Visa credit, with the businesses expected by the consumer watchdog to charge the same level of surcharge for each payment type.

If a business wants to set the same surcharge for all card payment types, debit and credit, it must not be more than the lowest surcharge they can set for a single card payment type.

They cannot average out the costs for both.

A business can, however, charge 1 per cent for debit card payments and 2 per cent for credit — but different surcharges must be clearly labelled.

The Reserve Bank of Australia’s 2023-2024 data shows the card payment processing costs incurred by medium-sized businesses processing from $1 million to $100 million in card transactions a year are likely to be 0.25 per cent to 1 per cent for debit or EPTPOS, and 0.75 per cent to 1.5 per cent for credit.

The business can’t slap the user with a service fee or handling fee on top of the card surcharge.

Originally published on 7NEWS