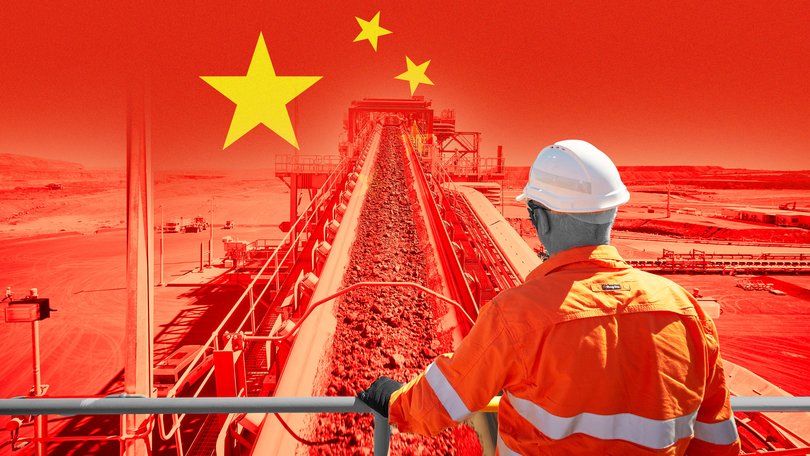

BHP open to WA iron ore alliance with Rio Tinto or a different Pilbara miner amid China’s tough trade stance

BHP has not ruled out joining forces with Rio Tinto, or another Pilbara iron ore player, to confront its biggest customer flexing its market muscle.

BHP has not ruled out joining forces with Rio Tinto, or another Pilbara iron ore player, to confront China flexing its market muscle.

The Big Australian is currently embroiled in tense negotiations with Beijing’s key commodities buyer — China Mineral Resources Group.

CMRG has reportedly banned shipments of BHP’s WA iron ore until the mining giant caves in to demands for spot cargo discounts and more sales to be settled in Chinese yuan instead of the US dollar.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.On Monday, RBC Capital Markets said it would be in the best interests of BHP and Rio Tinto to form a cartel-like alliance in the Pilbara to stop China’s growing push to consolidate its iron ore purchasing power.

When asked at BHP’s annual general meeting on Thursday about the potential for such an alliance, chair Ross McEwan said there were no talks with Rio at this stage, but he did not shut the door on the possibility of cutting a deal with Rio or a different iron ore miner.

“We always look at where is the infrastructure, where can we use it? Forget about it being Rio, it could be somebody else,” Mr McEwan said.

BHP and Rio tried to merge in 2010 — a move blocked by competition regulators across the globe.

“A ‘joint-venture light’ approach would aim to recreate the industrial logic of the 2010 BHP/Rio JV (like) shared infrastructure, cost leverage (and) disciplined pricing, but would likely be based on a networked alliance model, not a merger, that aligns Pilbara producers on infrastructure, decarbonisation, and logistics,” RBC stated in its note on Monday.

The proposed JV framework would stay within competition law, according to RBC, and unlike in 2010 the iron ore market concentration is much lower, which would potentially ease lingering “antitrust concerns”.

Fortescue, Gina Rinehart’s Roy Hill and Hancock, and Mineral Resources have all muscled in on BHP and Rio’s Pilbara iron ore dominance in recent years.

BHP boss Mike Henry said the company’s relationship with its Chinese customers and suppliers was “very strong”.

“But of course, from time to time, you’re going to find that commercial negotiations are more protracted, or there’ll be more back and forth along the way,” he said.

Mr Henry also downplayed concerns tied to reports that CMRG wants more of BHP’s iron ore sales settled in Chinese yuan — also known as the renminbi.

“One of the things that drives sales and different currencies are our China port-side iron ore sales,” Mr Henry said.

“And so it’s quite sensible that when we as BHP have imported iron ore into China and we’re selling it to our steel mills customers from port-side in China, those sales would be denominated in renminbi.

“It’s a pretty standard industry practice. Both ourselves and our competitors do this, and that’s a big portion of the numbers that the chair mentioned.”

Mr McEwan had previously mentioned that “probably less” than 10 per cent of BHP’s sales across its total global portfolio are settled in currencies other than the US dollar.

Meanwhile, Fortescue director of sales Ben Kuchel recently met with CMRG in Beijing and appeared he not to be concerned about the BHP situation when speaking to analysts on Thursday.

“Ultimately, (in the) long run, pricing is definitely a function of supply and demand, so in that context, you don’t feel as much material impact,” Mr Kuchel said.

“But nonetheless, commercial discussions are ongoing, and these do occur at different points in time for different participants in the market.”