RBA rate rise: How much mortgage holders will pay with 0.25 basis points rise making cash rate 3.85 per cent

Homeowners are set to be thousands of dollars out of pocket after the Reserve Bank raised the interest rate today.

Homeowners are set to be thousands of dollars out of pocket after the Reserve Bank raised the interest rate on Tuesday.

The rise, which was announced to be 0.25 basis points to a cash rate of 3.85 per cent, means mortgage repayments are set to increase in the midst of an inflation crisis.

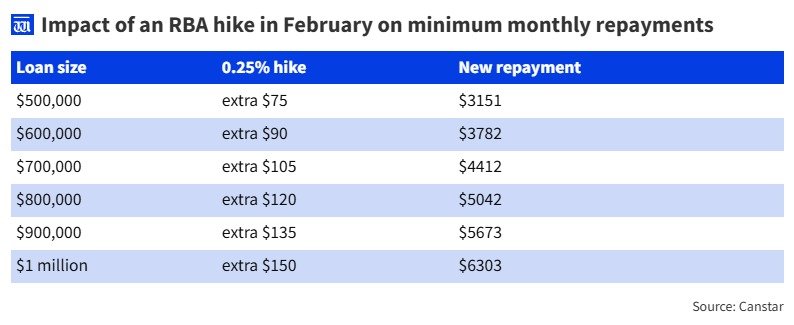

For an owner-occupier with a $600,000 mortgage and 25 years remaining, today’s rate rise would see about $90 a month added to minimum repayments — assuming banks pass it on in full.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.For borrowers with larger loans the hit could be even sharper, compounding cost of living pressures already squeezing household budgets.

The RBA board warned inflation was not being driven solely by one-off factors, such as the winding back of power bill rebates, and signalled price pressures could remain elevated.

“The board considers that inflation is likely to remain above target for some time,” it said.

RBA governor Michele Bullock has previously acknowledged that homeowners bear the brunt of rising rates but has argued failing to act would ultimately hurt the broader economy even more.

But the hike may be far from over — a wide range of data over recent months has confirmed that inflationary pressures picked up materially in the second half of 2025.

“While part of the pick-up in inflation is assessed to reflect temporary factors, it is evident that private demand is growing more quickly than expected, capacity pressures are greater than previously assessed and labour market conditions are a little tight,” one report said.

However, with competition heating up, banks are increasingly keen to retain customers, particularly those with strong equity positions.

Cracks are appearing in the facade of the big four banks, which combined have a market capital worth more than $625 billion.

Challengers such as Macquarie Bank are putting pressure on the big four, making it a buyer’s market for borrower willing to negotiate.

For many homeowners, a phone call to another bank could shave a meaningful chunk off repayments — potentially offsetting today’s hike altogether.