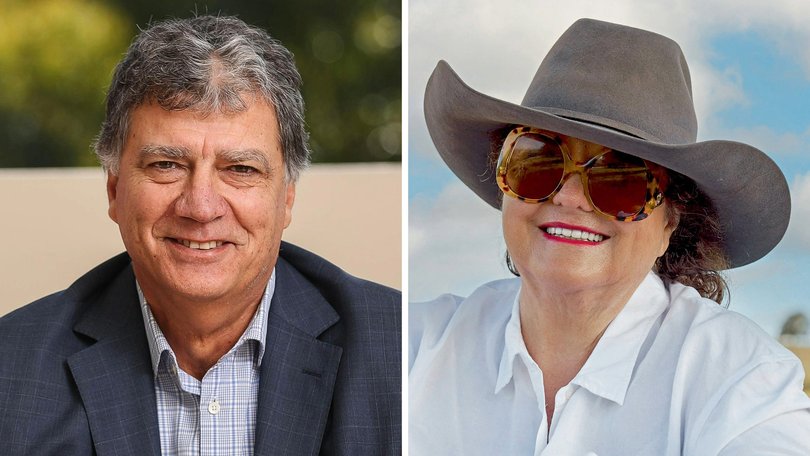

How ex-Azure Minerals CEO Tony Rovira went looking for nickel but found lithium Gina Rinehart wanted to buy

BUILDING BILLIONS: Their offices were walking distance apart. Yet Tony Rovira had never met Gina Rinehart when Australia’s richest woman and her Chilean partner lobbed a takeover bid for Azure Minerals in 2023.

Their offices were walking distance apart in West Perth.

Yet Tony Rovira had never met Gina Rinehart when Australia’s richest woman and her new-found Chilean partner lobbed a knock-out $1.7 billion takeover bid for his lithium company Azure Minerals in December 2023.

In fact, more than a year after his shareholders trousered the cash from Mrs Rinehart’s Hancock Prospecting and SQM, he still hasn’t.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Funnily enough, the closest Mr Rovira and Mrs Rinehart ever came to ever seeing the whites of each other’s eyes wasn’t in West Perth’s golden triangle, but a far more unlikely setting — the Bunbury Farmers Market.

And it could hardly have come at a more sensitive time for the Azure chief executive.

On Sunday December 17, 2023, rugby tragic Mr Rovira and his wife Edna were driving south from Perth to Dunsborough when they made an unscheduled stop at the popular South West market.

Sitting in the passenger seat, Mr Rovira was understandably pre-occupied. And a little anxious. With the once-booming lithium price on the turn, he was eager to finalise the paperwork with the Azure board for the joint $3.70 per share takeover bid Hancock Prospecting and SQM had made for the company.

“Edna’s driving, and I’m in the passenger seat with my laptop hot-spotted to my phone, and we’re going through the (takeover) agreement,” Rovira recalled. “And we sign it while I’m in the car driving down there.

“Edna says to me ‘I just need to stop at the market and get some things.’ I said ‘OK, I’ll just stay here in the car on my laptop for a bit’.

“Anyway, she walks in there and walks straight back out and says ‘Gina’s in there.’ And sure enough, Gina’s at the front door greeting people because it’s the day she just bought the markets. She was greeting everyone as they were coming in saying ‘thank you for coming’.

“And I’m looking at her (Edna) and saying ‘well, I don’t want to go in there.’ And she said ‘why not?’ And I said ‘What am I going to say — ‘hi, you just bought my company for $1.7 billion. Do you know who I am?’

“So I didn’t see her. And we closed the deal that day.”

Azure had been late to the lithium party which reshaped Western Australia’s resources sector in 2022-23. But through a covert operation dubbed Project Storm, Mr Rovira’s company was one of the quickest to cash in on it. All the more remarkably, even before defining a mineable deposit — or mineral resource — at its Andover lithium discovery in the West Pilbara.

Along with fellow Perth mining mogul Chris Ellison and the former son-in-law of late Chilean dictator Augusto Pinochet, Julio Ponce Lerou, Mrs Rinehart was one of no less than four billionaires to feature in the remarkable story of how the Azure board and its advisers pulled off a spectacular pay day for shareholders.

With a poker face Kenny Rogers’ Gambler would have been proud of, they knew precisely when to hold ’em, and when to fold ’em. And, most importantly, when to cut and run.

Watching with glee from the sidelines was Australia’s richest prospector, Mark Creasy, as the scramble for Azure shares by the three billionaires boosted the implied value of his 40 per cent free-carried share of Azure’s Andover lithium discovery to more than $1b.

Crammed with historic geological samples, maps, artefacts and prospecting curio, Mr Creasy’s office on West Perth’s Kings Park Road was effectively where the Azure story started.

It was there, in March 2020, Adelaide-born geologist Mr Rovira went cap-in-hand for some new exploration tenements after Azure had lucked out in Mexico, effectively using COVID to quietly exit the country after spending a decade exploring a silver deposit.

Mr Rovira knew Mr Creasy from his days working with another Perth mining rich-lister, Kerry Harmanis, where he had been a key player in the rich Cosmos nickel sulphide discovery in the late 1990s.

On the back of his Cosmos success, Mr Creasy had been an early backer of Mr Rovira in what was his first stock exchange-listed venture and had later helped fund its exploits in Mexico.

“(After exiting Mexico) it was like ‘OK, now what do we do? We better find a project in Australia’,” Mr Rovira said.

“I was just lying in bed one night thinking ‘what can I do, where can we find a gold project?’ And I thought ‘Creasy’. So the next day I rang him up and he said ‘come and see me’. He said ‘I’ve got something really up your alley Tony, it’s a nickel project — I’ve already found some nickel on it and you can find a whole lot more’.”

That nickel exploration project was called Andover.

Mr Rovira and Mr Creasy shook hands on the prospecting guru’s standard vendor terms: Azure would fund all the exploration costs to earn 60 per cent, leaving him with a 40 per cent free-carried interest in any future discovery.

Things got off to a good start for Azure’s second incarnation.

“So we did the deal in July 2020, started drilling in October, and hit it (nickel) with the first hole,” Mr Rovira said.

Azure continued to build the nickel resource at Andover over the next two years. However, by then, as demand for lithium used to make electric vehicle batteries surged, there was only one commodity share-market punters wanted to know about. And it wasn’t nickel.

“In 2022 we were busy drilling out the nickel and lithium’s going bonkers out in the market,” Mr Rovira said. “You just had to put out an announcement and say ‘I woke up this morning and I think I might go looking for lithium’ and the share price goes up.”

Fighting the tide of investment sentiment, Mr Rovira asked his geologists to see if they could find any lithium within the Andover tenements.

As luck would have it, just like the surface nickel sulphide mineralisation at Cosmos, there were lithium-bearing pegmatites outcropping at Andover which were easy to collect samples from to test their lithium content.

“Those pegmatites had been sticking out of the ground for millions of years,” Mr Rovira said. “But no one had really recognised their significance.”

Azure announced its first batches of rock chip assay results to the stock exchange in October 2022. The results confirmed the outcropping pegmatites at Andover hosted lithium.

It wasn’t long before the phone rang in Azure’s modest Colin Street office in West Perth. The Chileans were on the line.

“About an hour after that ASX release, the phone rings,” Mr Rovira said. “And some guy goes ‘I’m Louis from SQM, you may not know of us but we’re a Chilean company looking for lithium and lithium projects. Can I come and see you?’

“I said ‘sure, when do you want to come? He said ‘how about now?’ So he rocks up and he’s got three or four geos with him. I’m looking around going ‘well, I’m seriously outnumbered here,’ so I went and got a couple of mine.

“I said to Louis ‘why have you rung me up when there are so many lithium announcements? He said ‘because most of them are crap, but we recognised from your announcements you know what you’re doing. We think you’re onto something’.”

SQM had ridden the lithium boom through its well-established mining operations in northern Chile’s Atacama Desert, which involved pumping brine from beneath salt flats into huge evaporation ponds.

SQM’s success had in turn generated a multi-billion-dollar fortune for Mr Ponce Lerou, who had emerged as one of SQM’s biggest shareholders when the former state-owned enterprise was privatized in the 1980s by President Pinochet.

Facing increasing environmental scrutiny at home and keen to leverage its lithium smarts, SQM was looking to expand its international footprint. With abundant untapped lithium resources, Australia was on its radar.

Kicking some rocks at Andover on a field trip convinced SQM’s geologists that Azure was indeed onto something in the remote West Pilbara. And in January 2023, the Chilean lithium giant offered Mr Rovira $20 million cash for a 20 per cent share in the company at a premium to its market price. The Azure board jumped at it.

Critically, SQM’s cash enabled Azure to aggressively step up its exploration programs at Andover in what was becoming a white-hot lithium market. Within months, one drilling rig had become six.

By mid-May 2023, the excitement levels at Colin Street were growing as the board awaited the first drilling assay results from the laboratory. Then the phone rang. It was SQM on the line again.

“Two weeks before we got any results, SQM’s business development manager here in Australia and his boss from Chile rang me up and said ‘can we have a meeting and can you bring the chairman as well’,” Mr Rovira said.

When they arrived at Colin Street, Azure’s South American guests cut straight to the chase.

“They sat down … and said ‘we’re making a non-binding indicative offer for your company’,” Mr Rovira said. “So here we are two weeks away from getting our drilling results and they wanted an answer within a week. They really put the pressure on us.

“The first thing I did was I said to (Azure chairman) Brian Thomas ‘we need to get some serious takeover advice here’. I said ‘I know someone from Macquarie, I’ll give him a call.’ So I rang this guy and I said ‘Hi Mark, it’s Tony Rovira here, you probably don’t remember me, I’m from Azure’ … and he goes ‘Stop right there, I’m already representing the other side’.”

The Macquarie rebuff led Azure to Barrenjoey, where Paul Watson and Paul Early quickly went to work on Project Storm.

Their first bit of advice was to keep SQM on the hook until after the drilling results arrived by asking for clarification on certain details of what was a highly-conditional offer.

The tactic worked.

“So after pushing back with delaying tactics for two weeks, we got the assays in,” Mr Rovira said. “And when we announced those assays (to the stock exchange) the share price went way past their non-binding indicative offer price.”

Still, SQM wasn’t going away.

“By June we had six rigs on the ground and we’re pumping the results out and the share price is continuing to go up,” Mr Rovira said. “And they (SQM) came back with a second offer, still non-binding and confidential, and at a premium. We pushed back and said ‘no’.”

Finally, after watching its first two offers swamped by the surging Azure share price, SQM returned in October 2023 with a third offer the Azure board couldn’t refuse: $3.52 cash per share.

The offer was announced to the stock exchange on October 26. Still, the Azure board had reason to be anxious.

That’s because just a week earlier, Mrs Rinehart’s Hancock Prospecting had effectively torpedoed a $6.6b takeover bid made by New York-listed lithium giant Albermarle for another WA lithium company, Liontown Resources — controlled by yet another WA mining billionaire in Tim Goyder — by spending $1.2b to buy a blocking stake.

And sure enough, when the Andover drilling results were announced, the seagulls came from everywhere to fight over the same chip.

In the feeding frenzy which followed, Hancock Prospecting outlaid hundreds of millions of dollars to snatch an 18 per cent stake in Azure. Mr Ellison’s Mineral Resources joined the raid on Azure’s share register, building a 13 per cent stake.

Fellow lithium miner Pilbara Minerals was also buying up, sending shares in Australia’s hottest lithium stock to more than $4, well above SQM’s offer price.

“All the big players were in there buying,” Mr Rovira said. “The only one who wasn’t was Twiggy.”

After a tense stand-off, Mrs Rinehart dispatched her senior aides Garry Korte and Dan Wade around the road to Colin Street to visit Mr Rovira and the Azure board in early December 2023 with a deal to break the deadlock: Hancock Prospecting would team up with SQM to make a joint $3.70 bid for Azure. All cash, no strings attached.

It was game over. Thank you linesmen, thank you ball boys.

Just six months after getting the first drilling assay results from Andover — and with the lithium price heading south — Azure was sold for a spectacular valuation of $1.7b.

For his part, Mr Rovira pocketed about $20m of Hancock Prospecting/SQM’s cash or his shares in Azure, a sliver of which no doubt found its way across the bar at his beloved Associates Rugby Union Club in Swanbourne.

However, like many geologists, the lure of making another discovery soon overcame any misplaced thoughts of an early retirement.

“I thought I could put my feet up and retire, I went on a couple of overseas holidays,” he said. “But I love exploration, the thrill of the chase, the discovery. It’s in my blood.

“I don’t expect ever to replicate what we did with Azure. But just to go and find another gold deposit and build a mine — or sell it to someone else — that sort of thing, I love it.”

And why wouldn’t he.