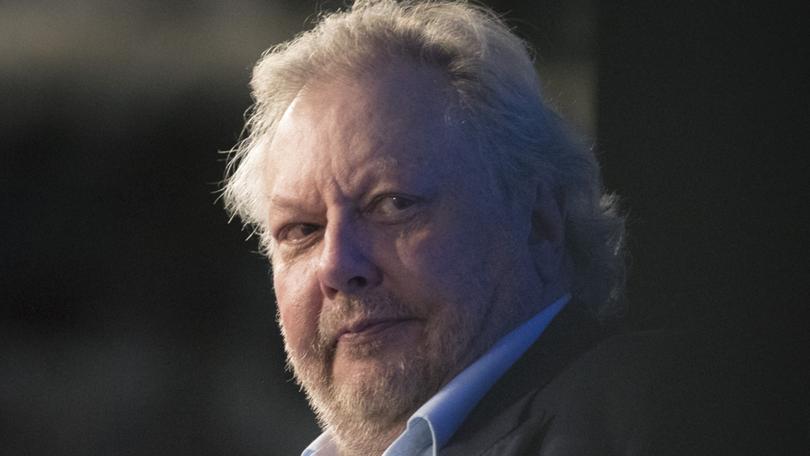

ASIC looking into WiseTech boardroom exodus as founder Richard White regains control

However, the corporate regulator says it is making ‘preliminary enquiries’ into the $32 billion logistics software giant ahead of quick call on any action.

WiseTech Global founder Richard White has promised investors he is back for “the long haul” after regaining management control of the logistics software group in the wake of a mass board walkout.

“I’m fully engaged and here for the long haul with invigorated vision, passion and a trove of new ideas,” Mr White said on a conference call with shareholders and analysts on Wednesday after WiseTech announced he had been appointed executive chair.

“You have my absolute commitment to do everything in my power and ability to accelerate the business you have invested in and that has been so successful over the nearly nine years since listing,” Mr White said.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The extraordinary turn of events caps months of turmoil at the $32 billion company founded by Mr White 30 years ago and will likely renew debate about how seriously big business and investors treat corporate governance.

There is now also doubt about whether an expanded board review into allegations levelled against him will ever be made public now that he is back at the helm.

The corporate regulator has taken an interest in the matter, confirming it is looking into the circumstances around the boardroom exodus.

“We acknowledge the concerns relayed in media reporting,” Australian Securities and Investments Commission chair Joe Longo said.

“We are conducting preliminary inquiries and will be making decisions imminently about any next steps for ASIC.”

Mr White, WiseTech’s biggest shareholder with 36.7 per cent as of December, quit as chief executive and resigned from the board in October amid revelations about his conduct, including allegations that used his influence to gain sexual favours, and paid for a multimillion-dollar house for an employee that he had been in a relationship with.

He stepped down into a consultancy role but friction with the board about his ongoing involvement with the company had unnerved those investors who worried WiseTech was at risk of losing the architect of its success, which has generated big gains for shareholders.

The power struggle came to a head just days ago with the departure of chair Richard Dammery and three other independent directors over “intractable differences” in relation to Mr White’s ongoing role.

On Wednesday, WiseTech said he had returned to the board as executive chair with oversight of product development and strategy. He would help oversee succession planning at the company, including the appointment of a new chief executive.

Monday’s walkout by Mr Dammery — along with Lisa Brock, iinet founder Michael Malone and Fiona Pak-Poy— shaved more than $9b off the company’s market capitalisation, prompting a “please explain” letter from the Australian Securities Exchange.

Initial findings of the board-commissioned probe by law firm Seyfarth Shaw in November concluded Mr White did not act inappropriately, found he disclosed all close personal relationships in the workplace, did not misuse company funds, and said there was no evidence of bullying, intimidation, or unlawful behaviour.

However, more allegations of inappropriate behaviour against him have emerged this month, widening the investigation.

WiseTech on Wednesday said Mike Gregg had rejoined the board as lead independent director and would take charge of governance, including overseeing the completion of the review and the appointment of new non-executive directors.

The company needs to add another director to its audit and risk committee to avoid being delisted by the ASX under rules that require three committee members.

As lead independent director, WiseTech said Mr Gregg would seek a briefing from Seyfarth Shaw on their progress and scope on its review and to ensure “that a thorough approach with due process is followed”.

The company on Wednesday also announced a 38 per cent increase in interim net profit to $US106.4 million as revenue grew 17 per cent to $US327m.

The interim dividend was increased to US6.7¢ a share.

Remarkably, analysts on Wednesday’s call barely touched on the corporate governance implosion, preferring to concentrate on WiseTech’s financials.

One, however, did query what the feedback about the governance concerns from customers.

According to Mr White, customers just don’t care.

“The issues that you’re referring to are uniquely Australian issues,” he said.

“They’re not to be discounted. They have to be properly managed, but in the customer’s mind, the value that we create for them is very substantial.

“Time and time again over the last six months, I’ve been asked, what does the future hold for the product?”

WiseTech shares were up 2 per cent in early trade to $96.57, still down 18 per cent over the past six months.

WiseTech has confirmed that the new complaints against Mr White came from a staff member and a supplier to the company, but it has not disclose the nature of any allegations.

In October, Mr White launched legal action to bankrupt his former alleged lover, wellness entrepreneur Linda Rogan, over a $90,000 bill for luxury furniture for a $13 million mansion he was said to have bought her in the ritzy waterfront suburb of Vaucluse in Sydney.

Ms Rogan later alleged that Mr White had sought a sexual relationship with her in exchange for investing in her Bionik Wellness business. The case was discontinued in October.

Media reports at the time also claimed Mr White had a lengthy relationship with a WiseTech employee and gave her a luxury waterfront mansion in Melbourne worth $7m.

It was also alleged he had signed at least two non-disclosure agreements with former lovers and had been accused by a WiseTech director of intimidation and bullying.

In response to the new complaints, Mr White told the Australian Financial Review he had been “open, trusting, generous and as a consequence, naive to how extreme wealth changes things”.

“I was certainly not prepared for the numerous attempts to extract money from me that I have received over the past five years from people from all walks of life (both male and female),” he said.

“I am now much more guarded, sceptical and prepared to defend myself against spurious claims.”