ASX reporting season: All the latest news as listed companies report their results to investors

Woolworths and Lynas Rare Earths reported on Wednesday to wrap up another day of reporting season.

But it was far from good news for either.

The supermarket giant admitted its half-year result was below expectations and flagged job losses as part of a $400 million cost-saving drive across the business.

All eyes were on the Amanda Bardwell-led business as it handed down its results for the six months to December, and the largest company reporting results on Wednesday.

Earnings at its Australian grocery business declined 12.8 per cent to $1.39 billion, which included a $95m hit as a result of industrial action in November and December.

Meanwhile in mining, Lynas Rare Earths suffered an 85 per cent fall in net profit for the period.

The rare earths miner with operations in Kalgoorlie and Malaysia struggled is under threat from China’s continued dominance in the commodity used in defence applications.

In other news WiseTech Global founder Richard White has promised investors he is back for “the long haul” after regaining management control of the logistics software group in the wake of a mass board walkout.

Key events

26 Feb 2025 - 12:52 PM

Does latest inflation read mean another rate cut?

26 Feb 2025 - 10:58 AM

Bus, ferry operator Kelsian books profit drop

26 Feb 2025 - 10:20 AM

Michael Hill chief executive dies

26 Feb 2025 - 10:19 AM

ANZ trading probe among most complex ever, says ASIC boss

26 Feb 2025 - 09:25 AM

Food price shifts add to inflation pressures

26 Feb 2025 - 09:22 AM

Investors left scratching heads over White’s return to WiseTech

26 Feb 2025 - 09:08 AM

Inflation up but holds within RBA target band

26 Feb 2025 - 08:34 AM

JUST IN: Inflation at 2.5 per cent

26 Feb 2025 - 07:13 AM

Richard White takes helm of WiseTech as executive chair

26 Feb 2025 - 07:02 AM

Flight Centre profit slips on tale of two quarters

26 Feb 2025 - 06:45 AM

Gold retreats from record highs

26 Feb 2025 - 06:36 AM

Lower prices obliterate Lynas profit

26 Feb 2025 - 06:23 AM

Woolworths reports lower earnings, slashes interim dividend

Does latest inflation read mean another rate cut?

Don’t count on it, says comparison site Canstar.

Annual trimmed mean inflation edged up from 2.7 per cent in December to 2.8 per cent in January, the Australian Bureau of Statistics reported this morning.

That, says Canstar, gives the RBA reason to hold the cash rate firm at 4.1 per cent when it next meets at the end of March.

The RBA has said Australians should not expect a blitz of rate cuts following the board’s decision to lower the cash rate last Tuesday.

Canstar data insights director Sally Tindall said core inflation was now heading in the wrong direction.

“While this is not cause for panic, it pours at least a bit of cold water on the prospect of further cash rate cuts in the near future,” she said.

“While there is plenty more data to come between now and the next board meeting, the central bank is poised to put the handbrake on the cash rate when it next meets.

“This brake could be applied until the second half of this year if inflation data throws up further spanners.”

Ms Tindall said Commonwealth Bank, Westpac and NAB still expect there will be three more cash rate cuts before the end of the year, however, borrowers should concentrate on what to do with the relief from this first rate cut, and refrain from baking further ones into their budget.

“If you’re a variable borrower, pick up the phone to your lender and ask them what they intend to do with your repayments,” she said.

“While you’re on the phone why not ask for a further discount on your rate – don’t wait for the RBA to serve you one up.”

Bus, ferry operator Kelsian books profit drop

The company behind Captain Cook Cruises, the SeaLink Rottnest Ferry and Swan Valley Tours - along with a massive portfolio of bus and ferry brands across Australia , the US and UK - has reported a fall in net profit.

Chief executive Clint Feuerherdt said some parts of its marine and tourism business experienced subdued demand, in particular K’gari in Queensland where occupancy was below the prior period.

He said tourism demand was impacted by subdued domestic tourism and international visitation which was still below pre-COVID levels.

“Elsewhere, the business delivered a solid result reflecting improved yield management, maximising capacity utilisation, particularly in parts of the portfolio experiencing high demand,” he said.

“Several bus contracts were renewed during the period including the Bunbury and Busselton bus services contract in Western Australia; and the Jersey contract in the Channel Islands which together secure over $360 million in revenue over the next 10 year.

“The USA and UK markets continue to represent important growth opportunities for the business.”

Kelsian reported net profit of $20.1m, down from $28.1m a year earlier.

Revenue was up 9.1 per cent to $1.07 billion. while underlying net profit rose 7.9 per cent to $39.7m.

The board declared a dividend of 8c a share, unchanged from last year’s interim payout.

Michael Hill chief executive dies

The boss of jewellery retailer Michael Hill, Daniel Bracken, has died overnight as a result of an adverse reaction to medical treatment for an underlying condition.

The company announced his passing in a brief statement to the market on Wednesday.

“The board, executive and all of the Michael Hill team express their deepest and sincerest condolences to his family and friends,” it said.

“On behalf of the board, we thank Daniel for his outstanding leadership and dedication to the Michael Hill Group and our people over the past 7 years. He will be dearly missed.

“Daniel was a passionate retailer, an innovative and strategic thinker and an inspiring leader, who transformed the Michael Hill group into the company that it is today.”

ANZ trading probe among most complex ever, says ASIC boss

Australia’s corporate watchdog is on track to conclude its investigation into bond trading activites at ANZ by the middle of this year, a probe the watchdog’s chief said was among the toughest in its history.

“It’s probably one of the most complex markets investigations we have ever undertaken,” Australian Securities and Investments Commission chair Joe Longo said in a Bloomberg TV interview today He expects the probe to end by the middle of 2025, reiterating a previously stated time line.

ANZ is under scrutiny for its role in the execution of a 10-year Treasury bond sale in 2023. ANZ chair Paul O’Sullivan told investors in December that the bank’s detailed investigation of the trading group’s work hadn’t found anything to support allegations of market manipulation.

The probe centres around concerns traders may have manipulated the sale of government debt, and set off wider allegations about the bank’s culture.

“The whole question of prehedging is a complex matter, different views about what is acceptable, what is unacceptable,” Mr Longo said. “We do have concerns about what happened here. But that investigation is ongoing and we’re hoping to land it in the next few months.”

Bloomberg

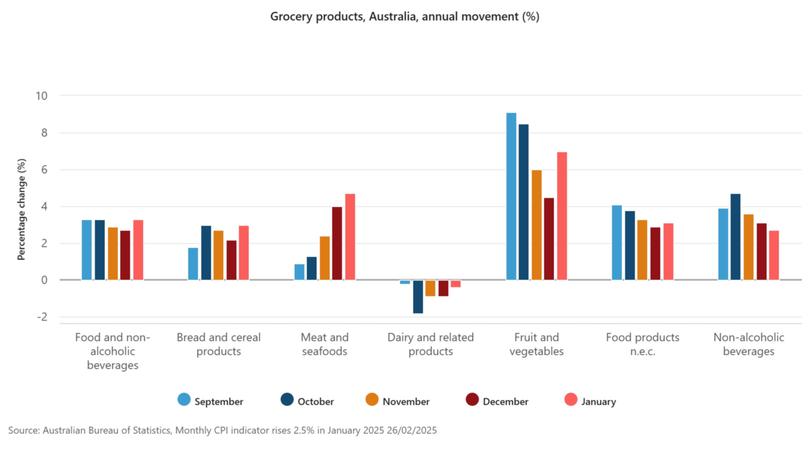

Food price shifts add to inflation pressures

Here’s how prices for grocery items pushed core infaltion slightly higher in January, according to ABS dat out today ...

Investors left scratching heads over White’s return to WiseTech

Founder Richard White may have declared he’s “here for the long haul” on his return to WiseTech as executive chair but investors are yet to buy into the hype.

The stock, which suffered a $9 billion wipeout on Monday when four directors - including the chair - quit in protest over Mr White’s future role within the business, was trading up just 0.2 per cent at 9.20am.

“I’m fully engaged and here for the long haul with invigorated vision, passion and a trove of new ideas,” Mr White said on a conference call this morning after WiseTech handed down its interim financial results.

“You have my absolute commitment to do everything in my power and ability to accelerate the business you have invested in and that has been so successful over the nearly nine years since listing.”

The stock is down more than 20 per cent over the past month.

Inflation up but holds within RBA target band

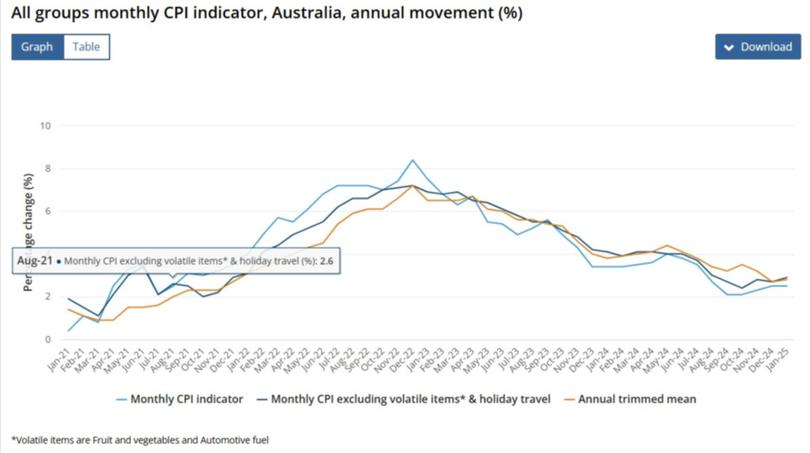

Australia’s core inflation has posted a second monthly reading within the Reserve Bank’s target band at 2.8 per cent in the year to the end of January.

That was up slightly from 2.7 per cent in the 12 months to December, according to the Australian Bureau of Statistics data released on Wednesday.

The Reserve Bank will likely brush off the monthly data because it only gives a partial picture of inflation — with the bureau’s quarterly assessment deemed a better gauge.

Read more here ...

And because we love a good visual ...

Here’s how the three measures of inflation have tracked since the start of 2021. So much hardship in just three lines ...

JUST IN: Inflation at 2.5 per cent

The latest data just releasd by the Australian Bureau of Statistics shows inflation running at 2.5 per cent fo rthe 12 months to the end of January.

Michelle Marquardt, ABS head of prices statistics, said the figure had not budged since the December reading.

The largest contributors to the annual movement were food and non-alcoholic beverages (+3.3 per cent), housing (+2.1 per cent), and alcohol and tobacco (+6.4 per cent).

When prices for some items change significantly, measures of underlying inflation (like the annual trimmed mean and CPI excluding volatile items and holiday travel) can give more insights into how inflation is trending.

“Annual trimmed mean inflation was 2.8 per cent in January, up slightly from 2.7 per cent in December,’ Ms Marquardt said.

“The CPI excluding volatile items and holiday travel measure rose 2.9 per cent in the 12 months to January, compared to a 2.7 per cent rise in the 12 months to December.”

Richard White takes helm of WiseTech as executive chair

WiseTech founder Richard White has regained management control of the software group as executive chair, despite it still investigating allegations against the billionaire.

The appointment comes just days after WiseTech chair Richard Dammery and three other directors said they were stepping down over “intractable differences” in relation to Mr White’s ongoing role.

WiseTech said on Wednesday Mr White would help oversee succession planning at the company, including the appointment of a new chief executive, while leading product development and its growth strategy.

WiseTech announced a 38 per cent increase in interim net profit to $US106.4 million as revenue grew 17 per cent to $US327m.

The interim dividend was increased to US6.7 cents a share.