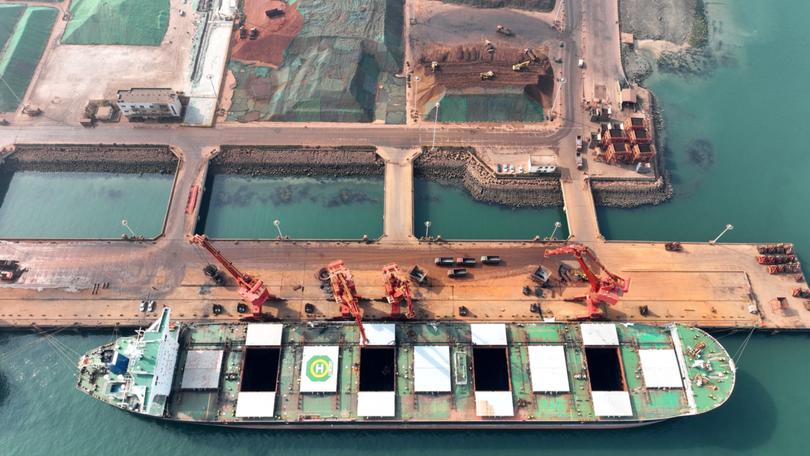

Iron ore sinks to 10-month low on gloom over China construction

Iron ore dropped to the lowest level in 10 months as the steelmaking material faced a double whammy of limp Chinese construction activity and a renewed surge in supply.

Iron ore dropped to the lowest level in 10 months as the steelmaking material faced a double whammy of limp Chinese construction activity and a renewed surge in supply.

Futures in Singapore slumped through $US100 a tonne early Monday, tumbling almost 4 per cent. China’s years-long property crisis is still wreaking havoc on demand, while rising availability is compounding the pressure on prices.

“The move in iron ore this morning represents a return to basics and fundamentals,” Atilla Widnell, managing director at Navigate Commodities, said. A rebound in shipments of the raw material from Australia is likely to make port-side inventories in China even more bloated, he said.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Iron ore has been closely tied to swings in the Chinese property industry over the past two decades. Singapore futures are now down about 30 per cent this year, underscoring how President Xi Jinping’s campaign to revamp the economy is hurting a key commodity used in construction.

Disappointment over steel demand is coinciding with a period of relatively abundant supply, piling even more pressure on prices. Australia, the top shipper, saw a surge in exports in the week ending March 15 — the most recent for which data is available. Stockpiles held at China’s ports are the largest in more than a year at about 142 million tonnes.

Iron ore in Singapore was trading just above $US97/t by 11.30am. Dalian iron ore futures for September also fell Monday, adding to an 8.5 per cent decline last week. Futures for steel rebar — basic metal rods used in construction — fell to the lowest in almost four years.

There are few indications that a meaningful turnaround in China’s property industry is on the cards. The value of new home sales from the 100 biggest real estate companies dropped about 46 per cent in March from a year earlier.

The China Iron & Steel Association last week warned that the property downturn and relatively weak infrastructure were delaying a recovery in steel demand. The steel industry’s purchasing managers index for March sank to 44.2 — its lowest reading since May last year.

Bloomberg

Originally published as Iron ore sinks to 10-month low on gloom over China construction