THE ECONOMIST: Move over, Tim Cook. Jensen Huang is America Inc’s new China envoy

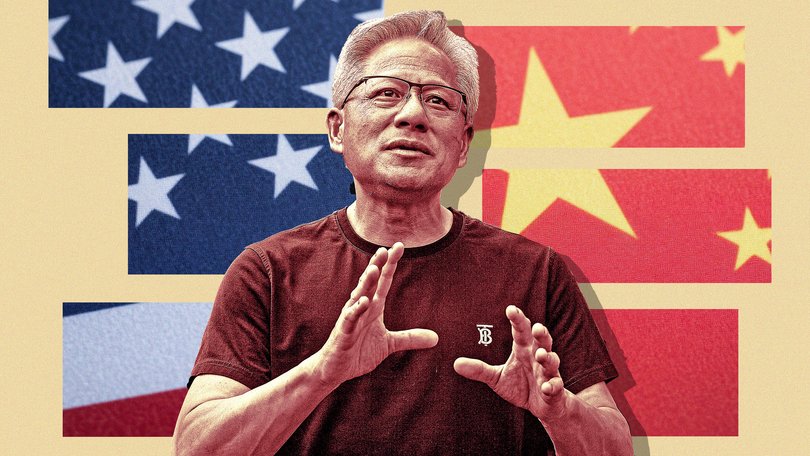

THE ECONOMIST: As America and China swap shots in the trade battle served up by Donald Trump, tech boss Jensen Huang is proving to be a canny diplomat.

Nvidia’s boss is proving to be a canny diplomat.

As a teenager in Oregon, Jensen Huang was one mean ping-pong player. In 1978 his mentor, Lou Bochenski, described him in a letter to Sports Illustrated as “perhaps the most promising junior ever to play table tennis” in the American north-west.

Had he been a bit older, who knows, he might well have joined Mr Bochenski’s daughter, Judy, who toured China in 1971 as part of Richard Nixon’s “ping-pong diplomacy” initiative to improve relations between the capitalist and communist worlds.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.What the co-founder and chief executive of Nvidia missed out on then he is making up for now, minus the table-tennis paddle. As America and China swap shots in the trade battle served up by Donald Trump, Mr Huang has pinged and ponged between Washington and Beijing to reassure both sides it is in their mutual interest to let his company keep selling some of its artificial-intelligence (AI) chips to Chinese buyers. In the past week he talked to Mr Trump and then jetted to China, for the third time this year.

On July 14 he notched up a big win. Nvidia said it would once again be permitted to sell its H20 AI processors in China.

A de facto ban in April by the Trump administration on the sale of the chips, specially designed to comply with earlier export restrictions, may already have cost Nvidia around $US10 billion ($15.4b) in forgone Chinese revenue.

Its lifting may raise Nvidia’s sales this year by $US10b-15b, around a tenth of the previously forecast total, and its net profit by $US6b-9b. The day after the announcement the firm’s market value jumped by $US160b, to nearly $US4.2t. Its boss, who holds a 3.5 per cent stake, scored nearly $US6b. Game, match, Huang?

Not quite. To see how things might play out differently for Nvidia, consider the experience of Tim Cook. For years Apple’s boss has been the undisputed champion of Sino-American commercial co-operation. First he engineered a hyper-efficient China-centric supply chain.

Then, during Mr Trump’s first four years as president in 2017-21 and Joe Biden’s equally China-wary tenure, he safeguarded this network while hooking more Chinese consumers on iPhones. In 2019 he personally persuaded Mr Trump to scrap a proposed 25 per cent tariff on certain imports from China by promising to make more Mac computers in America (never mind that Apple was probably going to do this anyway).

For a time the quiet lobbying paid off. Between 2012 and 2022 Apple’s sales and operating profits in China (and Taiwan) more than trebled, to $US74b and $US31b, respectively.

In 2022 they made up 19 per cent and 26 per cent of the company’s total, up from 15 per cent and 18 per cent ten years earlier.

As for the supply chain, examine the back of your iGizmo and the odds are it was “Designed by Apple in California. Assembled in China.”

Now, though, Mr Cook’s powers of persuasion appear to be waning. In 2023 news reports surfaced that Chinese authorities had banned government employees from using iPhones. In part this was to reduce reliance on Western technology and promote domestic companies such as Huawei.

It was also to spite America. Last year Apple sold just $US67b-worth of wares in China, down by 10 per cent from its peak in 2022, even as its global sales grew.

In April Mr Cook helped secure an early exemption for electronics in Mr Trump’s latest tariff ruckus. Yet his effort to preserve Apple’s Chinese supply chain risks storing up more trouble for the future.

Despite moving some production to places like India and Vietnam, one in five Apple suppliers remains Chinese.

Its biggest contract manufacturer, Foxconn of Taiwan, has half its factories in China.

This leaves the firm parlously exposed to the mood swings of Mr Trump and his Chinese counterpart, Xi Jinping. In today’s bipolar geopolitics these are only a matter of time.

The effort Mr Cook has put into conserving the status quo may also have distracted him from more pressing concerns, such as coming up with a coherent AI strategy. The lack of one, combined with exposure to tariffs, is now hurting shareholders. Apple’s market value has shed close to $US800b since late December.

Mr Huang is not Mr Cook. He may lack the Alabamian’s disarming lilt but he seems more fluent both in MAGA and in Xi Jinping Thought. His company’s blog post announcing his recent globetrotting and success in reversing the H20 ban included shibboleths of America First (“. . . support for the Administration’s effort to create jobs, strengthen domestic AI infrastructure and onshore manufacturing, and ensure that America leads in AI worldwide”) and of Mr Xi (“The discussions underscored how researchers worldwide can advance safe and secure AI for the benefit of all.”)

Moreover, Nvidia is not Apple. Though it earns a sixth of its revenue from China, it is not reliant on suppliers there. None of its 20 biggest is Chinese, compared with four for Apple (which pays them $US10b a quarter not counting Foxconn, which gets $US15.5b). And in contrast to Apple, it has continued innovating relentlessly.

Break point

However, the chipmaker has more at stake — and not just because it is now the one defending the title of the world’s most valuable company.

Its products are much more geopolitically sensitive than smartphones and thus likelier to face curbs of one form or another. On July 15th Mr Trump threatened fresh tariffs on chips. He also has yet to officially confirm the H20 reversal.

If Nvidia were forced to forfeit China, that would deprive it of a growing market, unlike Apple’s stagnating one.

Worse, it would be a boon for Chinese rivals such as Huawei. The local tech giant already offers AI chips more powerful than the H20 (though not yet Nvidia’s flagship processors). Having China all to itself would help it nurture a tech ecosystem to rival Nvidia’s, and export this globally.

This gives Mr Huang as strong an incentive as Mr Cook had to protect the status quo. He must be careful that guarding the playing field doesn’t make him take his eye off the ball.

Originally published as Move over, Tim Cook. Jensen Huang is America Inc’s new China envoy