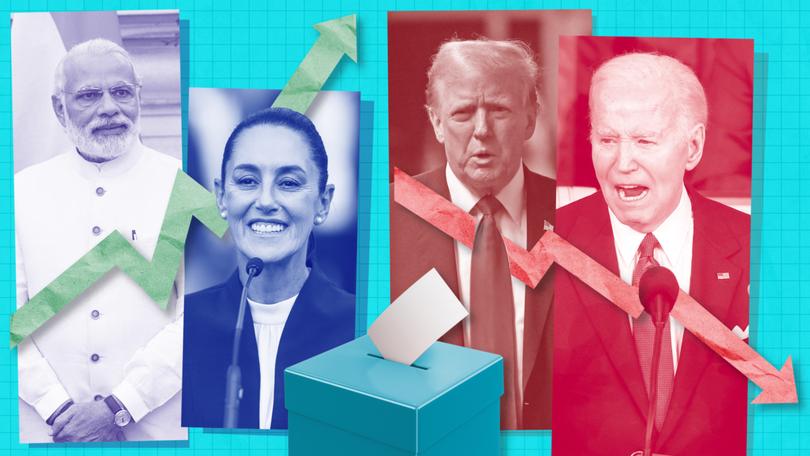

Trump, Biden, Modhi: A CEO’s guide to doing better business in a big election year

There’s some momentous elections ahead in 2024. Here’s a CEO’s survival guide on how to handle the outcomes.

This year Western bosses must work their way through a lengthy list of obsequious phone calls.

Around 80 countries, home to some 4 billion people, are holding elections in 2024 (not always freely, as in Russia in March). Some chief executives may already have drafted their compliments for Narendra Modi, who is almost certain to keep his job as prime minister of India, where citizens are now casting ballots in a weeks-long festival of democracy. After Mexico’s election in June most corporate leaders expect to be congratulating president-elect Claudia Sheinbaum, the anointed successor of the incumbent, Andrés Manuel López Obrador.

Western firms working to reduce their reliance on China have turned to India and Mexico. But neither prospect fills them with unadulterated delight. Mr Modi may have made his country an easier place to do business, by simplifying its tax system and investing in infrastructure, among other things. But he has also raised tariffs on goods like cars and increased the tax advantage that domestic firms enjoy over foreign ones.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr López Obrador has been nationalising the assets of Western firms in industries from construction materials to energy and has allowed Mexico’s criminal gangs to run rampant. Indonesia, another market that has caught the eye of Western businesses, elected a populist of its own, Prabowo Subianto, in February.

CEOs are finding little comfort in elections closer to home. Few are thrilled at the prospect of Donald Trump, a self-described “Tariff Man”, triumphing in November, even with his talk of slashing red tape. They also feel ambivalent about Joe Biden, the incumbent who talks of raising corporate taxes and blames greedy businesses for stubborn inflation.

In Britain, the ruling Conservatives have scorned the pleas of companies to keep trade with the EU flowing. Yet many corporate grandees remain sceptical that Labour will champion their interests if, as expected, the left-of-centre party sails into government later this year.

Nationalist parties dubious of free trade are predicted to expand their foothold in the European Parliament after elections in June. One such party is on track to win Austria’s national poll later this year.

The long-term trend is clear. The Economist, using data from the Manifesto Project, a research group, has looked at the ratio of favourable to unfavourable discussions of free enterprise in the manifestos of political parties in 35 Western countries from 1975 to 2021, the most recent year available.

We used a five-year-moving average and excluded political parties that won less than 5 per cent of the vote. In the 1990s deregulation, privatisation, unfettered trade and other policies that bring joy to the hearts of businessmen were praised almost twice as often as they were criticised.

Now politicians are more likely to trash these ideas than celebrate them.

Any residual business-friendliness no longer stems from a belief that what is good for business is good for citizens — and so, by extension, for their elected representative’s prospects.

Instead, governments are asking not what they can do for business but what business can do for them. The West’s corporate titans are thus learning to adapt to a world in which their success can turn on a government’s whim. The outlines of a playbook are slowly taking shape.

Knowledge is the starting point. Bosses are turning in droves to specialist consultancies like Dentons Global Advisors (DGA), McLarty Associates and Macro Advisory Partners (MAP) that promise to demystify politics at home and abroad. Consulting giants like McKinsey and investment banks like Lazard and Rothschild & Co offer similar counsel. These consiglieri, often former government insiders, help companies understand the political calculations and constraints that shape government policy.

That allows bosses to know which political curveballs to worry about most. Consider what may come of America’s coin-toss presidential election. Corporate chiefs can be confident that hostility towards China will persist regardless of who wins in November.

Mr Biden, fearful of appearing soft on America’s economic rival, is turning steadily more hawkish. In April he called for tariffs on Chinese steel and aluminium to be tripled, from 7.5 per cent, and announced an investigation into subsidised Chinese shipbuilders. On April 24th he signed a bill that, among other things, will ban TikTok in America unless its Chinese owner sells the hit video app to non-Chinese interests.

Although Mr Trump may seek to decouple the American and Chinese economies more quickly than Mr Biden, the direction of travel looks similar.

A victory for Mr Trump could prove more consequential for transatlantic business, argues Kate Kalutkiewicz of McLarty Associates. If he were to follow through on his threat to slap a 10 per cent tariff on all goods imports, regardless of origin, retaliation from Europe is likely, thinks Sir Mark Sedwill, a former boss of Britain’s civil service who now works for Rothschild & Co.

Last year listed American firms generated around an eighth of their revenues in Europe, three times what they made from China, according to estimates from Morgan Stanley, a bank. Their European counterparts, which make around a fifth of their revenues from America, would be even harder hit.

A Trump-shaped uncertainty also hangs over businesses that have come to rely on producing in Mexico for export to America. Mr Trump, who thinks trade deficits are for losers, may take aim at America’s one with Mexico, which reached a record high last year.

The trade agreement he negotiated with Mexico and Canada in 2018 is up for review in 2026. If Mr Trump shuts the border to fulfil his pledge to crack down on illegal immigration, trade would suffer, too.

Mapping out such scenarios helps businesses to better balance risks with rewards when making investments, argues Ed Reilly, the chief executive of DGA. Firms can hold fire on big commitments whose pay-offs hinge on close elections, notes Nader Mousavizadeh, who runs MAP, or otherwise hedge their bets.

Some companies, however, are not content with mere political spectating. As one consulting boss puts it, meddling politicians create uncertainty, but can also bring benefits to those that win their favour.

This need not be as flagrant as turning up for dinner at Mar-a-Lago. Consider Intel, an American chipmaker that in March nabbed an $US8.5 billion ($13b) grant from the US federal government. Pat Gelsinger, its boss since 2021, has diligently courted Mr Biden’s administration, presenting Intel as the answer to America’s efforts to reduce dependence on semiconductors manufactured in potentially perilous spots like Taiwan.

Besides wrapping itself rhetorically in the flag, the company has more than doubled its spending on lobbying on Mr Gelsinger’s watch, to $US7m ($10.5m) last year, according to figures from OpenSecrets, a non-profit. The charm offensive seems to have paid off. Gina Raimondo, America’s commerce secretary, now calls Intel “our champion”.

Other firms have been busy on Capitol Hill, and not just American ones. Volkswagen, which last year became the first foreign carmaker to gain eligibility for the federal government’s tax rebates for electric vehicles (EVs), has almost tripled its lobbying budget since Mr Biden came to power.

One jaded corporate emissary in Washington muses on how he spent much of Mr Trump’s term helping clients sneak exemptions from tariffs and has now spent much of Mr Biden’s helping them weasel handouts. Between 2020 and 2023 the number of lobbyists fanning out of K Street increased from 11,500 to almost 13,000.

Nor is the situation unique to America. A business envoy in Brussels says he has been run off his feet by clients angling to benefit from the EU’s efforts to decarbonise.

Western companies have also been busy trying to prove their value to Mr Modi and his inner circle, says Teddy Bunzel of Lazard. “Never before has alignment with government policy been more important for success in India,” explains Mr Mousavizadeh of MAP.

After meeting Mr Modi last year, Tim Cook, the boss of Apple, tweeted that he shared the prime minister’s “vision of the positive impact technology can make on India’s future”.

Some Western firms, including Mr Cook’s, are courting favour by opening factories in India, with the added bonus of subsidies via Mr Modi’s “production-linked incentives scheme”.

Others have opted to hitch themselves to India’s national champions.

In February Disney, an American media giant, announced it would merge its Indian business with Viacom18, the media arm of Reliance Industries, an Indian conglomerate whose boss, Mukesh Ambani, is well-connected. TotalEnergies, a French energy giant, has buddied up with the Adani Group, an industrial group in Mr Modi’s good books.

Not all politicians are equally open to overtures. Forging ties with Mr López Obrador, who is hostile even to Mexico’s businessmen, has been tricky, notes Mr Bunzel.

But not impossible. In February last year, Mr López Obrador declared he would bar Tesla, an American EV maker, from building a new factory in Mexico’s arid north. He reversed course after a phone call from Elon Musk, the company’s boss, who promised to use recycled water throughout the plant. Many CEOs believe that Ms Sheinbaum will be more pragmatic than her predecessor in her dealings with business.

Cosying up to governments is no guarantee of success. Intel’s share price slumped by 9 per cent on April 26 after the company projected soggy growth in sales and profits. Mr Biden’s handouts will not do much to help it regain the technological lead it has ceded to competitors of late.

What is more, as politics grows more polarised, companies viewed as belonging to an incumbent political camp could find their fortunes reversed if power changes hands.

Still, with politicians around the world bending markets to their will, plenty of CEOs will be unable to resist the allure of power. Whatever qualms chief executives in Britain might have about Labour, they snapped up all the available tickets to the “business day” at the party’s conference later this year in less than 24 hours when these went on sale on April 23.

As Grégoire Poisson of dga counsels clients, “If you’re not at the table, you’re on the menu.”