On a $100K single salary? Here's what you can actually afford to buy around Australia

Nine great buys across regional Australia and city markets.

It's an interesting week for Aussie property - national property prices continue to hold firm despite a mixed bag of economic signals, and the Reserve Bank's July decision to keep the cash rate on hold at 3.85 per cent is disappointing for borrowers under cost of living pressure.

In its statement, the RBA board said, "it could wait for a little more information to confirm that inflation remains on track to reach 2.5 per cent on a sustainable basis."

But as view.com.au reported, the pause will do little to cool the market, as resilient buyer demand and limited stock are keeping prices buoyant across much of the country.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Against this backdrop, and speculation that cash rate cuts will only further fuel property price surges, wage growth and borrowing capacity remain key considerations for aspiring homeowners.

What can you buy with a $100,000 salary?

According to the latest Australian Bureau of Statistics, the average Aussie full-time salary now sits at just over $100,000.

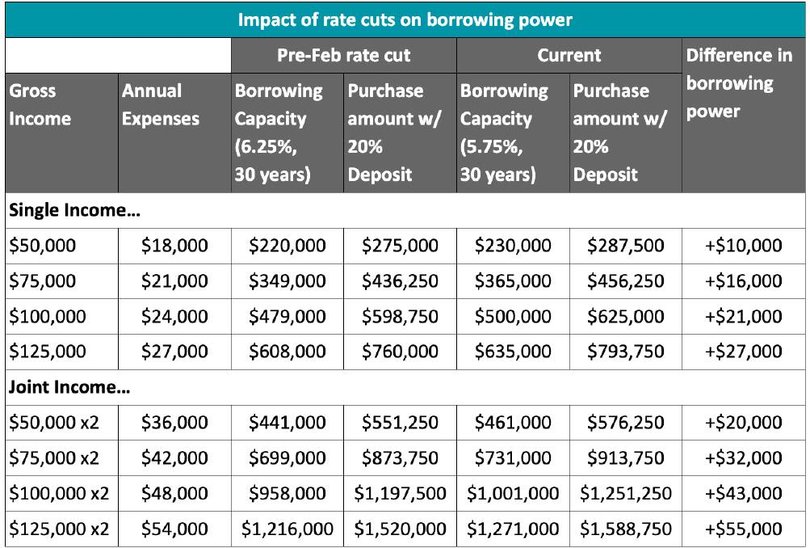

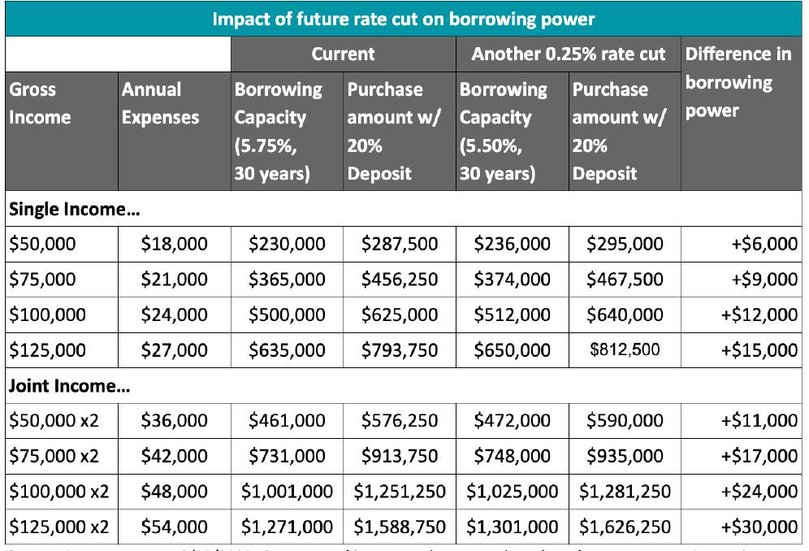

Canstar modelling shows exactly what this salary could stretch to in real estate terms, factoring in today's interest rate climate and the impact of an expected rate cut in August.

With a loan at 5.75 per cent

As it stands, a single person earning $100,000 could potentially be able to borrow an extra $21,000 since the start of the year.

This is based on someone taking out a 30-year loan at the average new customer variable rate of 6.25 per cent in January, compared to the current rate of 5.75 per cent.

On a 30-year loan, you could borrow up to $500,000, and with a 20 per cent deposit factored in, buy a home worth up to $625,000.

With a loan at 5.50 per cent

Even though the RBA left the cash rate on hold for July, Canstar pulled together the figures to show the impact that another 0.25 percentage point rate cut could have on borrowing power.

They found there are 35 lenders currently offering at least one rate under 5.50 per cent, regardless of the RBA decision.

A single person earning $100,000 could potentially borrow an additional $12,000 if lenders pass on a cut in full.

That means for a 30-year loan at a lower rate of 5.50 per cent, you could borrow up to $512,000, and with a 20 per cent deposit factored in, translating to a home worth $640,000.

On a 30-year loan, you could borrow up to $500,000, and with a 20 per cent deposit factored in, buy a home worth up to $625,000.

The takeaway? Borrowers shouldn't wait for an official cut and take matters into their own hands by haggling or refinancing their loan to a lower-rate lender.

The uplift to borrowing capacity with a 5.50 per cent rate gives prospective buyers up to an extra $33,000 since the start of the year.

This opens up new buying opportunities across a range of regions.

Here are some of the houses, townhomes and apartments you could buy for $640,000 or less.

The Hunter, NSW

Federation home with a modern twist on over 600 square metres? This lovely renovated three-bedroom home offers charm and character with crisp and contemporary updates.

Expect features like French doors, an ornate display coal oven, a wood-burning fireplace and two separate decks.

This three-bed townhome in Port Stephens' Tanilba Bay boasts direct access to the lush greens of Tanilba Bay Golf Course, so waking up to leafy, peaceful surrounds each day is guaranteed.

Nearby you have access to all the water activities you could wish for in this scenic stretch.

Illawarra, NSW

A highly sought-after beach enclave north of Wollongong in a beautifully landscaped, gated estate spanning 2.3 acres? Say no more.

The two-bed apartment with parking can offer instant rental returns or be a great coastal base if you're after a low-maintenance sea change.

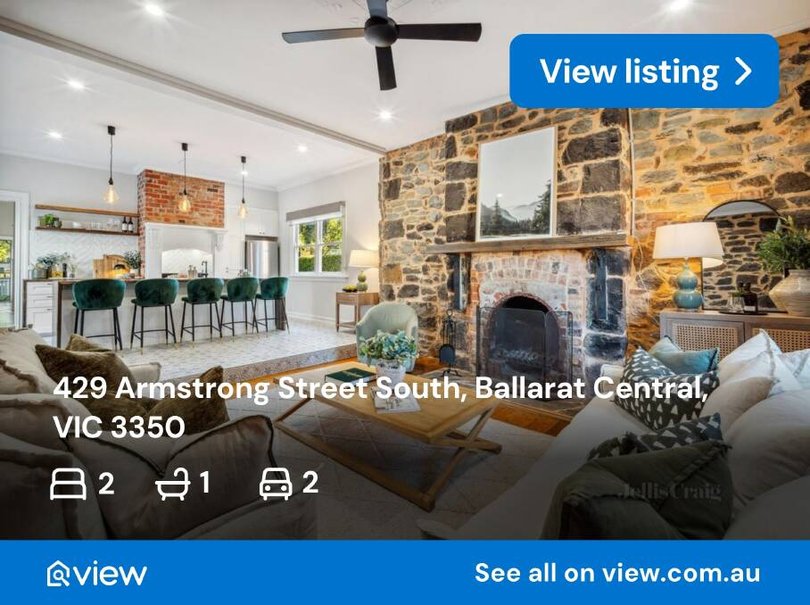

Ballarat, VIC

This Bluestone beauty sits behind a timeless white picket fence with prized side driveway access from Sebastopol Street. The stunning 1850s home is believed to feature some of

Ballarat's earliest residential stonework and offers a rare opportunity to secure a piece of the region's architectural legacy.

Orange, NSW

This three-bed charmer in Orange isn't short on street appeal, and sits on over 550 square metres of land a stroll away from the town's vibrant CBD.

Another charming house in a great Orange location, this house sits at the pointy end of the budget but has three bedrooms, two bathrooms and two living spaces.

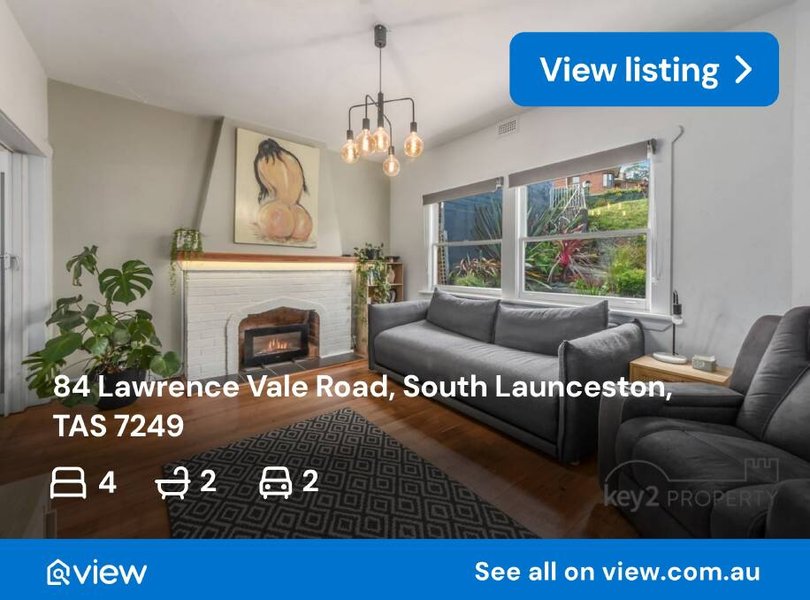

Launceston, TAS

A versatile brick home with a flexible floorplan, this four-bed, two-bath Launceston pad has three bedrooms upstairs, with the fourth downstairs with its own bathroom and kitchenette. It's ideal as a multigenerational option, a teenager's retreat, or if you'd like to rent out the lower level.

There are also established gardens with a functional greenhouse and handy storage shed.

Melbourne, VIC

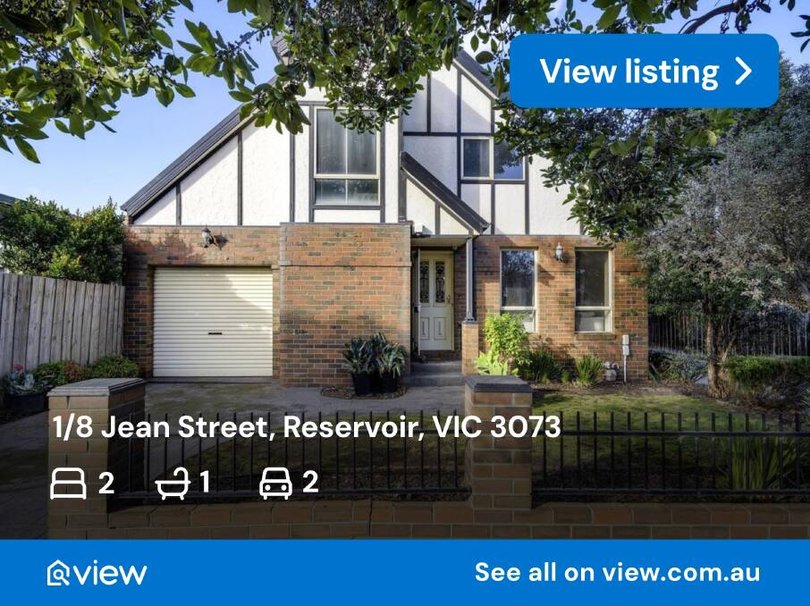

Join the burgeoning Reservoir area with this charming Tudor-style townhome, one of only four in a boutique block. Ideal as a first home, downsizer's delight or easy-care investment, this refreshed haven sits peacefully between beloved Edwardes Lake and blissful Reservoir Village.

Sydney, NSW

We recently reported on where first-home buyers with a realistic wage and budget can still buy something with two bedrooms near transport in Sydney.

One of these areas is Campsie, which will benefit from next year's City & Southwest Metro line launch. This two-bed, two-bath, parking apartment has high ceilings, engineered timber floors, an internal laundry and air conditioning.

Originally published as On a $100K single salary? Here's what you can actually afford to buy around Australia