RBA hits pause on rate cuts - but savvy borrowers are quietly racing ahead

The Reserve Bank has decided to keep the cash rate steady at 3.6 per cent today, holding off on another cut as it waits to see how the economy responds to the three reductions already delivered this year.

A September cut was always unlikely, given the RBA's preference for a slow and steady approach, and recent data hasn't forced its hand.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Inflation remains sticky - the latest ABS data shows higher-than-expected monthly inflation at 3 per cent - while unemployment is holding firm at 4.2 per cent and the economy is showing signs of resilience with 0.6 per cent growth in the June quarter.

"It's little surprise the RBA has kept the cash rate on hold," said Canstar's data insights director, Sally Tindall.

"The task at hand for the central bank is to stabilise prices and protect jobs.

"There was no way the Board could justify a cash rate cut when a number of inflation indicators were back on the rise."

With no real pressure coming from the jobs market, it's clear the Board is waiting for the full September quarterly CPI results before making a potential move.

Those results, due out at the end of October, will likely decide whether the RBA delivers one more cut before Christmas.

CBA, Westpac and ANZ still expect a move in November, but NAB has pushed its forecast out to May 2026.

Rate cuts are already saving borrowers hundreds

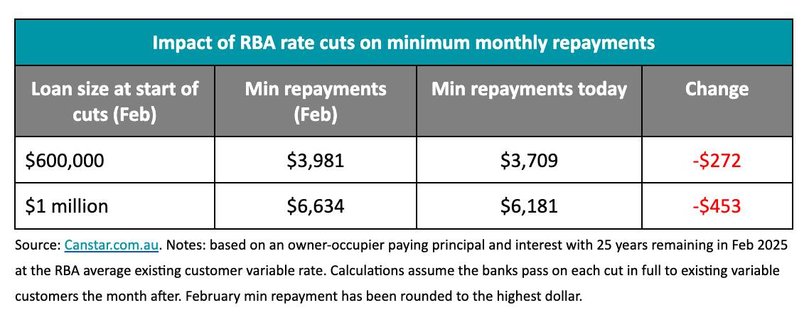

While today's decision keeps the cash rate on hold, the three cuts delivered so far this year - in February, May and August - are already making a big difference to Aussie households.

Canstar analysis shows that someone with a $600,000 home loan has seen their minimum monthly repayments fall by about $272 since the first cut.

For those with a $1 million mortgage, the monthly savings are around $453.

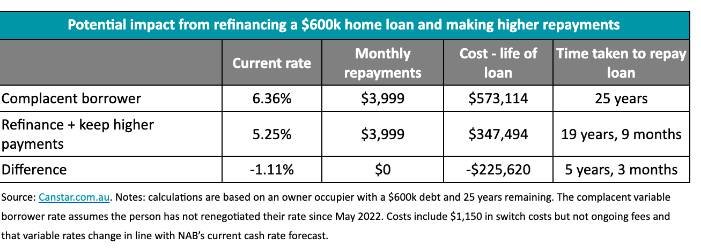

However, new analysis from Canstar shows that if you haven't seen these cuts passed on to you, you have an opportunity to impact your bottom line significantly.

"A complacent owner-occupier who hasn't refinanced their mortgage recently is sitting on a rate of around 6.36 per cent," Ms Tindall said.

"If they switched to a competitive rate of 5.25 per cent on a $600,000 debt and 25 years remaining, they could put $403 a month back in their pocket."

While that's a decent chunk of change, most Australians are choosing not to pocket the savings.

Instead, they're hacking their mortgages; shaving years off the loan term and saving tens of thousands in interest.

An unspoken mortgage hack: keeping repayments high

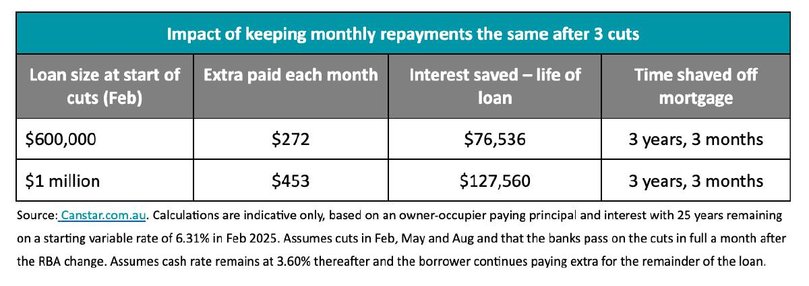

"For those that can, the real secret is to keep your repayments the same," Ms Tindall said.

It's a powerful strategy that both reduces your total interest paid over the life of the loan while reducing the loan term.

Canstar's modelling shows that a borrower with a $600,000 mortgage who keeps repayments unchanged is now contributing an extra $272 per month above the minimum amount required.

Over the life of the loan, that could save them over $76,500 in interest and reduce their mortgage term by three years and three months.

For the borrower who is yet to renegotiate to a lower rate since May 2022, it's even more dramatic news.

"On a $600,000 loan, paying an extra $403 a month could potentially shave more than $220,000 off your interest bill and knock over five years off a 25-year loan," Ms Tindall said.

Fresh data from CommBank shows that it's a strategy the bulk of their customers are utilising.

Just 11 per cent of eligible home loan customers reduced their direct debit repayments after the August cut.

"What really stands out is the consistency," said CBA executive general manager, home buying, Marcos Meneguzzi.

"Following each rate cut this year, the percentage of customers reducing their direct debit repayments has been almost identical at the same point in time.

"That is even as the potential savings from reducing repayments have increased."

Ms Tindall said if you're able, keeping your repayments the same as rates lower is a "game changer".

"It's astounding to see that so many eligible borrowers aren't pocketing this relief into their bank account but rather, reinvesting it into their mortgage instead," she said.

"By keeping their repayments unchanged, they're effectively turning each RBA cut into an extra mortgage repayment, which, if kept up for the remainder of their loan, could see them save thousands.

"Refinancing does involve about paperwork, which can be a turnoff, but the numbers show it's a game-changer."

Which Australians are choosing to reduce repayments?

Not all homeowners can get ahead on their mortgage.

Others are adjusting their repayments to free up cash, depending on their age and life stage.

CBA data shows that Millennials aged 31 to 40 - currently the 'sandwich generation', typically juggling mortgages, kids, ageing parents and rising household costs, - have the highest proportion of borrowers choosing to reduce their payments.

Nearly 14 per cent opted to lower them.

First-home buyers and those over 60 are the least likely to reduce their repayments, with only 8 per cent and 7 per cent, respectively, having done so, compared to 11 per cent of subsequent buyers.

"Those in their thirties and forties could be raising young families and may need more immediate financial relief, while customers over 60 or just starting on their home loan journey were less likely to make changes, as their priorities and circumstances are quite different," Mr Meneguzzi said.

There's also a clear geographic divide.

Borrowers in NSW and the ACT were the most likely to trim their repayments (about 14 per cent), followed by Victoria (12 per cent). Queensland and South Australia both saw only 9 per cent of borrowers drop their repayments.

Borrowers in the Northern Territory, Western Australia and Tasmania were the least likely to lower their repayments, all at 7 per cent.

Don't wait for the next cut to review your rate

Whether you're using the savings from recent cuts to accelerate paying down your mortgage or to ease pressure on your household budget, experts say now is the time to check if you're on a competitive deal.

"Right now, the average owner-occupier on a variable rate is estimated to be paying 5.53 per cent, yet there are more than 30 lenders on Canstar offering at least one variable rate under this mark," Ms Tindall said.

The lowest variable rate currently available is 4.99 per cent (usually for first home buyers), while refinancers could access around 5.08 per cent. Investor loans start from about 5.24 per cent for principal and interest, or 5.39 per cent for interest-only.

Whether or not the RBA moves again in November, today's decision serves as a reminder that homeowners don't need to wait to take action to improve their financial position.

"Instead of waiting for the RBA to cut again, borrowers can take control of their mortgage," Ms Tindall said.

"The only guaranteed rate cut at this point is the one you secure yourself," said Ms Tindall.

Originally published as RBA hits pause on rate cuts - but savvy borrowers are quietly racing ahead