Regional home values climb as demand outpaces listings across Australia

Australia’s housing market is gaining momentum, with new data showing that September saw the strongest monthly increase in national dwelling values since October 2023.

Regional home values continue to edge higher as the spring selling season gets underway, with new data showing values rising across the country - although the story behind that growth differs from what’s unfolding in the capital cities.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Cotality’s Home Value Index (HVI) for September shows national dwelling values rose 0.8 per cent in September, the strongest monthly rise in almost two years.

Capital city prices grew a little faster, up 0.9 per cent for the month and 2.3 per cent over the quarter, but the regions weren’t far behind, posting a 0.7 per cent monthly gain and a 1.8 per cent rise for the September quarter.

Over the past year, combined regional values have increased 6.6 per cent, outpacing the 4.3 per cent rise seen across the capitals.

The median regional dwelling value now stands at $700,688, significantly lower than the $941,457 median in the capitals, and this price gap remains a major drawcard for buyers looking to move regionally.

Cotality’s Head of Research, Tim Lawless, said that at the moment, there is a marked imbalance between demand and supply, a defining feature of the market and a key reason values continue to climb.

“The number of homes for sale at the end of September was well below average in almost every market,” Mr Lawless said.

“We’re not seeing enough listings coming into the market to satisfy the level of buyer demand, which is keeping overall advertised supply levels very low.

“That creates some urgency amongst buyers, generally puts sellers in a good position when it comes to negotiating, and homes are selling relatively quickly.”

Regional markets still rising, but pace is moderating

While regional property prices are still on the rise, they’re not accelerating quite as quickly as their capital city counterparts.

Mr Lawless said these supply shortages are evident across both markets, but slightly less pronounced outside the cities.

“The flow of new listings coming into regional markets is tracking about 8.5 per cent lower than a year ago,” he said.

“In the capitals it’s down about 9.5 per cent, and total listings are 15.3 per cent lower than last year in the capitals compared with 13.9 per cent lower across regional areas.”

Mr Lawless said another factor behind the difference is a slowdown in people moving to the regions.

“The Regional Movers Index is clearly showing a slowdown in internal migration rates to regional Australia,” he said.

“With that in mind, we probably will see the capitals showing a stronger performance for a little while, maybe rippling out towards some of the more commutable regional markets, which still do have a bit of an affordability advantage.”

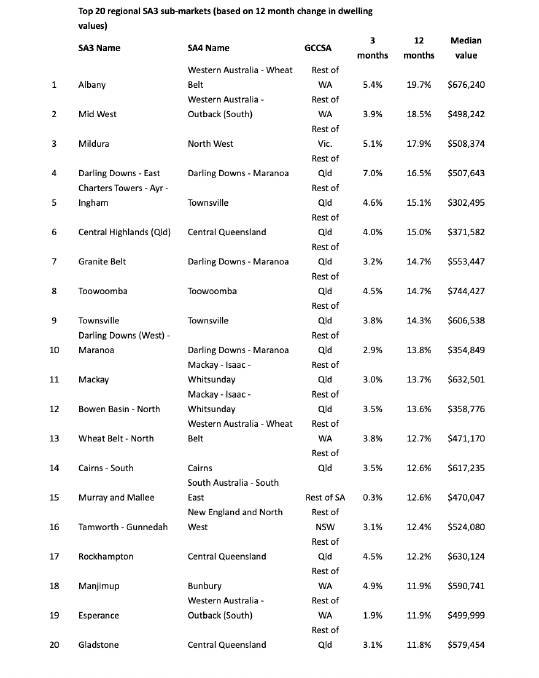

Top regional performers

Even so, certain regional areas continue to boom, posting impressive annual gains.

Albany in Western Australia has seen values surge 19.7 per cent over the past year, while the Mid West including Geraldton (18.5 per cent) and Mildura (17.9 per cent) are also among the nation’s strongest-performing regional markets.

Save for Toowoomba and Albany, the 20 top annual performers are affordable centres with median values well below the $650,000 mark.

Regional buyers are seeking affordable entry points - another highlight from Cotality’s HVI report.

Price growth still strongest at the affordable end

One of the clearest differences between city and regional markets right now is which price brackets are growing the fastest.

The report noted that in the capitals, demand has started shifting from the lower end up toward the middle, as cheaper borrowing costs improve purchasing power.

“The strongest pace of growth has rippled from the lower quartile of the market to the broad middle,” the report said.

Across the combined capitals, lower quartile values rose 2.6 per cent over the September quarter, but growth was slightly stronger in the middle of the market at 2.7 per cent.

It’s a different story in the regions.

“It’s still the lower quartile across regional Australia that’s showing the strongest growth,” Mr Lawless said.

“For the September quarter, the lower quartile is up 2.5 per cent, the middle of the market is up 2 per cent, and the upper quartile is up one and a half per cent.”

Looking at a state level, Mr Lawless found that for regional NSW, “it’s by far the lower quartile that’s outperforming” and in regional Victoria, “the upper quartile is virtually flat, only at 0.1 per cent.”

Entry point affordability continues to shape regional buying behaviour.

Steady gains likely, but capitals pulling ahead

Looking ahead, Mr Lawless expects regional markets to continue pushing higher, albeit at a slower pace than seen in the capital cities.

“Growth will still be there,” he said. “It’s just likely to be a little slower.”

Factors such as population trends, stock levels and the relative gap between regional and capital city medians will remain key indicators to watch for buyers and investors alike.

And while affordability continues to underpin regional demand, the combination of stronger population growth, improved borrowing capacity and ongoing supply constraints could see the performance gap between the capitals and the regions widen over the coming months.

Originally published as Regional home values climb as demand outpaces listings across Australia