The great divide: Houses outpace units by record 50 percent in recent market surge

The gap between what Australians pay for a house versus a unit has blown out to record levels, revealing what experts describe as a major structural shift in the nation's housing market.

New data from Cotality's November Monthly Housing Chart Pack shows the "house premium" across Australia's combined capital cities has climbed to around $363,000, or 49.9 per cent more than the median unit price, the highest level ever recorded.

Five years ago, that gap was just 20 per cent. Today, the median capital city house value sits at $1.09 million, compared to $728,000 for a unit, reflecting how detached homes have surged ahead despite ongoing affordability pressures.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Cotality economist Kaytlin Ezzy said the outperformance of houses has been building for years.

"Houses have always seen stronger uplift than units in the long term because of the associated land value," Ms Ezzy said. "That price sensitivity appears to have blown out through the strong growth cycle over the past five years."

Record disparities across capitals

The size of the house premium varies widely across the capitals - from 31.6 per cent in Hobart to a staggering 77.8 per cent in Sydney.

While Sydney's affordability challenges could temporarily push more buyers toward units, Ms Ezzy expects detached homes to retain the upper hand.

"Due to affordability constraints, we may see more deflection towards units in cities like Sydney in the short term," she said. "But over the long term, we still expect houses to outperform, even if the premium on houses falls."

Affordability drives growth in cheaper markets

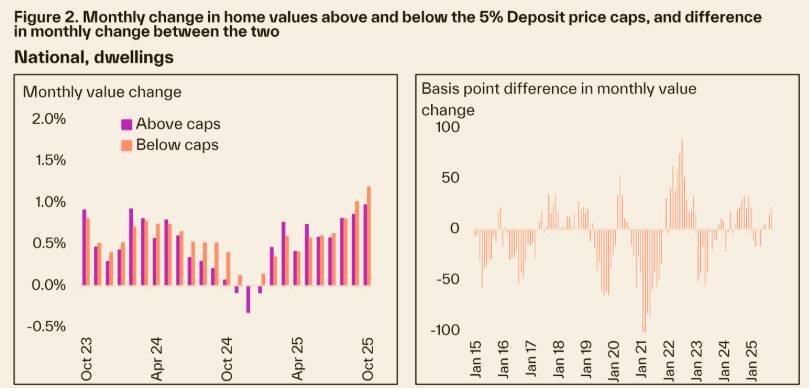

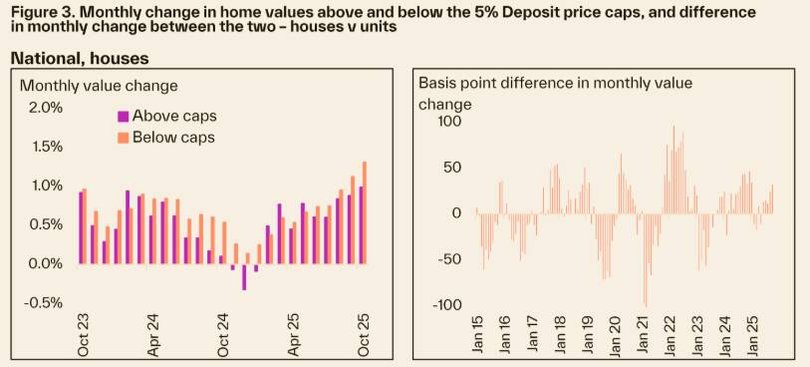

Cotality's data also shows that affordability is increasingly shaping buyer behaviour, with the strongest growth occurring in lower-to-middle value segments.

"The lowest 25 per cent or middle 50 per cent of market values are seeing the fastest appreciation," the report found.

Government support programs, such as the expanded 5 per cent deposit scheme, have further fuelled demand in this tier by allowing more first-home buyers to enter the market.

Ms Ezzy noted that demand in the more affordable brackets had remained unexpectedly strong, even after three rate cuts this year.

"It is somewhat surprising to see such persistent outperformance of lower-value housing market segments given there were three rate cuts in 2025," she said.

"Usually, the high end of the market is more responsive to rate cuts. But perhaps 75 basis points of easing just wasn't enough to push demand back into the top end."

Experts see shifting buyer strategies

According to Anissa Cavallo, property advisor at EDA Property Consultancy, the widening gap between houses and units is prompting many buyers to rethink their strategies.

"What we are genuinely seeing is less of a shift into units or townhouses in the same suburb," Ms Cavallo said.

"Instead, more buyers are choosing to move further out, opting for houses in growth corridors or fringe suburbs where their budget allows them to buy a house rather than compromising on a smaller dwelling in the inner zone."

Cavallo added that long-term data supports this preference.

"Houses typically outperform units, with land value remaining a key driver of growth," she explained. "The traditional trade-off of staying in a particular suburb but buying a unit or townhouse is becoming less appealing."

Instead, affordability pressures are steering more first-home and move-up buyers to outer suburbs where detached homes remain within reach.

"Many buyers are willing to compromise on distance in order to retain dwelling type and preserve growth potential," Cavallo said.

"Instead of trying to buy the smallest possible unit close in, many are asking: 'Can I afford a house further out?'"

BresicWhitney CEO Thomas McGlynn and President of the Real Estate Institute of NSW said of the Sydney market: "The current landscape will continue to be a mixed picture, with healthy competition for homes up to $2 million driven by first-home buyers and investors, but significant constraints in the middle market.

"Despite October being a record month for sales across Sydney's lifestyle markets (BresicWhitney sales increased 38 percent year-on-year), the appetite for buyers to extend themselves isn't as deep as in previous cycles.

"Properties between $3 million and $6 million are where we see the highest concentration of owners with substantial mortgages, meaning interest rates play a larger role in their purchasing decisions.

"We believe a new dynamic may emerge through 2026 where it's easier to invest or enter the market than it is to upsize within it, until longer-term change is a reality in Sydney."

Buyer tactics in a seller's market

With the market heavily favouring sellers, Cavallo advised buyers to focus on preparation and flexibility.

"Buyers need finance clarity, pre-approval and buffers are non-negotiable," she said.

"They also need to research infrastructure pipelines, competition risks, commute times, and amenities when buying further out."

She also highlighted the rise of rentvesting, a strategy where buyers rent in their preferred area but invest where the numbers work.

"For many, the focus is shifting toward owning where growth is likely, rather than simply owning where they live," she said.

Rate cuts bring confidence, but limited relief

Redom Syed, Managing Director of Flint mortgage brokers, said that while recent rate cuts have restored confidence, they haven't meaningfully improved affordability.

"Even with 75 basis points of cuts, the relief is marginal," Syed said.

"Confidence is creeping back, but affordability is still very stretched. Borrowing amounts are still materially lower than three or four years ago."

He noted that higher interest rates have already pushed more buyers into cheaper areas, a trend that could reverse if rates fall further.

"Bottom quartile prices have outperformed top quartile ones, but I expect that to change in coming years as lower rates increase buying power again," he said.

"Given how large the spread is between houses and units, apartments could outperform in the years ahead."

Syed also said the expanded 5% deposit scheme has created a "mini first-home-buyer boom."

"You can feel this on the ground," he said. "In Sydney, it's pushed more buyers into the $1-1.5 million range, especially for apartments, terraces, and smaller houses."

$12 trillion milestone and shifting state shares

The record house premium coincides with Australia's total residential property value surpassing $12 trillion, hitting the milestone sooner than expected.

While the national housing market has more than doubled in value over the past decade, the composition of that value is shifting.

States such as Queensland, South Australia, and Western Australia are taking a larger share of the pie, while Victoria and New South Wales now account for less than they did five years ago.

"Victoria has seen the biggest drop-off in housing market share in the past five years, from 29 per cent to less than a quarter," Ms Ezzy said. "That shift illuminates new opportunities across the property ecosystem."

Originally published as The great divide: Houses outpace units by record 50 percent in recent market surge