Why credit card debt could be ruining your chances of mortgage approval

Australians' mounting credit card bills are adding new pressure to already stretched household budgets and could be quietly sabotaging home loan ambitions.

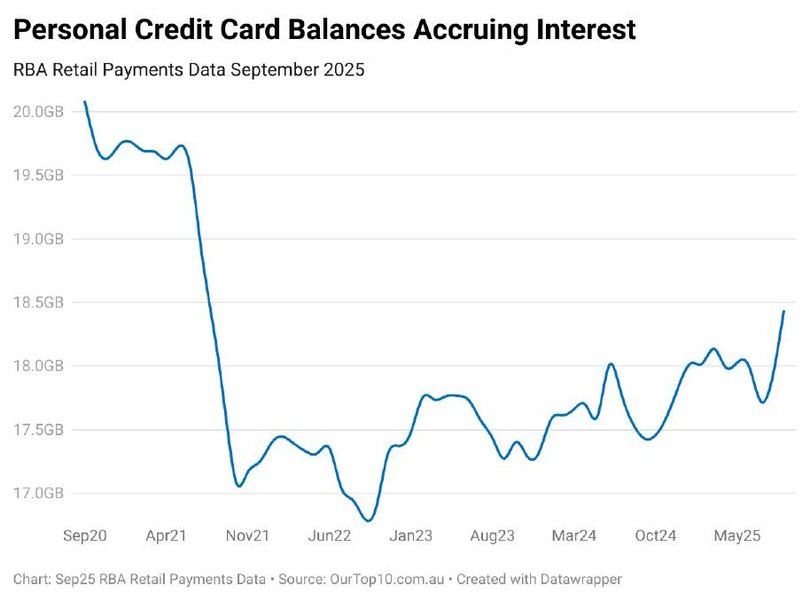

OurTop10.com.au's analysis of the just-released RBA Retail Payments data shows credit card balances accruing interest have surged to $18.43 billion, the highest level since mid-2021, as cost-of-living pressures push more households to rely on high-interest debt.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The surge marks a dramatic reversal from the years leading to 2021, when Australians aggressively paid down credit card debt to maximise their borrowing capacity for home loans. That strategic debt reduction is now unwinding as cost-of-living pressures force households back into expensive credit card debt.

While some borrowers are hoping for rate relief, experts warn that rising "bad debt", like credit cards and personal loans, is eating into people's capacity to pay down their mortgage or even qualify for one in the first place.

"Credit card debt is one of the most overlooked barriers to mortgage approval," says Simon Ma, CEO ofOurTop10.com.au.

"Banks assess your credit limits and how you manage debt. Even if you pay on time, high limits reduce how much they'll lend you. When you're carrying balances that accrue interest, that's a massive red flag."

Mortgage borrowing power takes a hit

September's data showed a 5.6 per cent jump in credit card balances accruing interest, the largest monthly increase in more than 14 years, adding almost $1 billion in new consumer debt.

At typical credit card interest rates of around 18 per cent, that means an extra $15 million a month flowing to banks in interest payments alone.

For would-be home buyers, that can be the difference between getting a loan and missing out.

"The best mortgage brokers will help clients develop a clear strategy to manage their credit card debt before applying for a mortgage," Mr Ma says.

"This might mean paying down balances, reducing credit limits, or restructuring debt entirely. Getting this right can mean the difference between approval and rejection."

Why it's 'bad debt'

Jessica Brady, finance expert at View.com.au, says the new figures highlight a growing gap between good and bad debt and why homeowners need to be strategic about where their extra cash goes.

"Non-deductible debts like credit cards, personal loans and your own home loan don't come with any tax perks, so you're paying full price on every dollar of interest," Brady explains.

"If you've got both bad debt and a mortgage, tackling that bad debt first makes the most sense. It's expensive and it's not working for you, in fact, it's holding you back from financial progress."

She adds that for mortgage holders without bad debt, directing surplus cash into the home loan via an offset or redraw account can shave years off repayments.

"If you had a $650,000 mortgage at 6.2 per cent and paid an extra $100 a week, you'd be debt-free almost seven years sooner. That's a powerful motivator but it all starts with getting rid of those credit cards first," Brady says.

Cost-of-living crunch bites

Credit card spending has climbed 34 per cent over the past four years, but debt levels have remained below $18 billion until now, suggesting households are turning to plastic just to keep up with rising living costs.

Financial experts agree that paying down bad debt should be the top priority before tackling other loans or investments.

"For most people, prioritising bad debt first makes sense, it costs you the most and doesn't give you anything back in tax benefits," Brady says.

"Give some thought to why you've gone into debt and whether it's helping you reach your long-term financial goals. Clearing that high-interest debt is one of the best moves you can make for your future borrowing power."

*Data analysed by Primara Research for ourtop10.com.au for this news story uses the latest ABS Regional Population data from June 2024.

Originally published as Why credit card debt could be ruining your chances of mortgage approval