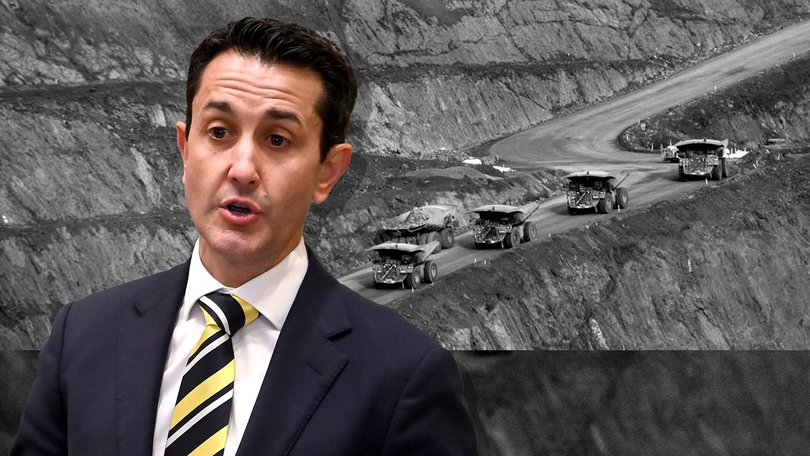

EDITORIAL: Resources industry is resilient, but not invincible

EDITORIAL: If governments continue to heap burdens upon our economy’s golden goose, we might just find it suffocates.

When Queensland’s Labor government introduced a punishing new coal royalty regime, then-opposition leader David Crisafulli called it and the introduction of other new taxes a “betrayal of Queensland families and those investing in our State”.

He has been proven right.

Three years after it came into effect, miner BHP has directly linked the three-tiered progressive taxation system to its decision to axe 750 jobs and mothball its Saraji South coal mine in the State’s Bowen Basin.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.That system has made it next to impossible for miners to make a profit from coal, with as much as 67c in every dollar now going straight into government coffers.

Mr Crisafulli is now Queensland’s Premier. But he is showing no appetite to wind back the regime now it is his LNP Government in control of the State’s finances, even as hundreds of Queensland families tonight find themselves facing an uncertain future.

The futures of many more of the next generation of resources workers are also under a cloud. Another casualty of the royalty regime — which is among the world’s highest-taxing — could be BHP’s FutureFit training academy in Mackay, which the miner has warned faces a strategic review as it seeks to cut labour costs.

The industry is resilient, but it’s not invincible

The impact on the BHP Mitsubishi Alliance bottom line in Queensland as a result of the changes has been stark. BMA paid $1.64 billion in royalties and taxes last financial year, compared to an after tax net profit of $206 million. That’s an eight-fold difference.

In a video message to staff, BMA boss Adam Lancey told employees the company’s return on capital employed in its Queensland coal businesses fell as low as 1 per cent, a situation which required “tough but necessary decisions”.

It’s little wonder the business is looking for better places to spend its cash. Under the current system, that’s not on Queensland coal.

The LNP Government is so far holding firm against pressure to wind back Labor’s changes — at least in this term of Parliament.

By the time it expires in 2028, there may not be much of a coal industry in Queensland left to save.

Deputy Premier Jarrod Bleijie said the LNP Government was “not at war with the mining sector”.

If that’s the case, it should act to prove it.

Any benefits to Queenslanders of a high-taxing royalty system will vanish — alongside jobs — if there’s no resources industry left to tax.

That is a lesson to other governments also.

The resources industry is too often treated like as a never-ending source of profit. That it can endure anything that’s thrown at it, and continue to generate squillions in the process.

So more taxes, more regulatory imposts are piled upon it.

The industry is resilient. But it’s not invincible. And if governments continue to heap those burdens upon our economy’s golden goose, we might just find it suffocates.