Fortescue’s Iron Bridge leaky pipeline fiasco purportedly spills on Viburnum-backed contractor MPC Kinetic

Fortescue and a contractor half-owned by a prominent fund manager are believed to be embroiled in a bitter battle over the eye-wateringly expensive fix of a leaky pipeline.

Fortescue and a contractor half-owned by prominent Nedlands investment firm Viburnum Funds are believed to be embroiled in a bitter battle over the eye-wateringly expensive fix of a leaky pipeline.

The 240km raw water pipeline extending from the Canning Basin to Fortescue’s Iron Bridge magnetite project west of Marble Bar in the Pilbara is causing fresh headaches for Andrew Forrest’s flagship company.

Multiple leaks from the pipeline at Iron Bridge, which churned out first product a little over a year ago well over budget, added to a litany of issues that have plagued the $5.9 billion project.

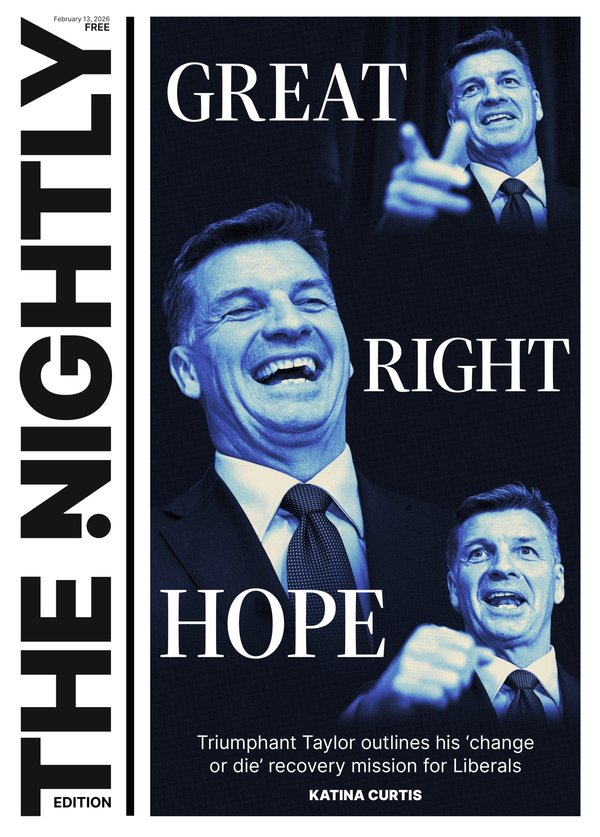

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Fortescue in January told investors it would have to overhaul a 65km stretch of the pipeline, setting aside $US100 million ($152.2m) for its share of the anticipated 18-month-long repair job.

Chief executive Dino Otranto three months later pinned the pipeline problems on a “manufacturer quality” issue but declined to elaborate further.

Queensland-based MPC Kinetic was the prime contractor for delivering and installing the water pipeline.

MPC is 50/50 owned by Viburnum Funds and the Texas-headquartered SCF Partners. The duo tried — and failed — to publicly list MPC in 2019 after slapping a $409m valuation on the pipeline contractor.

Sources have told The Nightly that Fortescue and MPC have been privately locking horns over the repair cost and deciding who is responsible for various aspects of the fix.

A Fortescue spokeswoman said the company was “unable” to comment on The Nightly’s queries regarding a remediation process with MPC.

An MPC spokesman declined to comment on the matter, and Viburnum did not respond to questions over whether it may have to dip into its own cash reserves to fund a resolution.

Viburnum has about $600m of funds under management and its clients skew towards high-net-worth individuals and family offices.

The cost to mend the big chunk of faulty pipeline does not take into account the revenue Fortescue is haemorrhaging at Iron Bridge largely due to the leaks.

Iron Bridge was originally expected to produce 5 million tonnes of magnetite for the 2024 financial year. This has been pared back to 2mt with Fortescue banking about $US144.50 per metric tonne over the past two quarters for the project’s exports.

Fortescue holds the controlling 69 per cent stake in Iron Bridge with the remainder owned by Taiwan’s Formosa Steel.

The joint venture is set to forgo more than $430m of revenue for this financial year alone based on that realised price and the 3mt production shortfall.

Fortescue’s share of this estimated revenue loss is nearly $300m.

Mr Forrest has reportedly described Iron Bridge finally reaching first production in August last year as “the biggest relief of my career”.

Iron ore projects in WA typically involve mining hematite ore instead of magnetite ore. Magnetite has more impurities than hematite so requires additional treatment, but the trade-off is that the final product is higher-grade.

However, Fortescue is not alone in its magnetite issues and the State has proven to be a graveyard for this type of iron ore mine.

CITIC Pacific’s $US12b Sino Iron magnetite project near Karratha was commissioned in 2013 at triple the cost of its original budget and took six years to turn its first annual profit.

Ansteel’s $4.7b Karara magnetite mine in the Mid West has bled cash since coming online in 2019. By the latter half of last year the operation had racked up accumulated losses of $6.3b.