THE ECONOMIST: Battle of AI business models as Google stacks up to Microsoft to lift profits

THE ECONOMIST: Google was written off as an AI laggard — now its all-in-one model and custom chips are powering a trillion-dollar comeback.

The era of artificial intelligence featured an unlikely early leader. Until ChatGPT came along in November 2022, Microsoft was better known for business software that was ubiquitous, worthy and dull. Suddenly, owing to an exclusive cloud partnership with the chatbot’s creator, OpenAI, the 47-year-old technology titan became the hottest thing in big tech.

Since then it has created over $US2 trillion ($3t) in shareholder value. That is ho-hum by the standards of Nvidia—which has furnished the AI revolution with chips and been furnished in turn with a market capitalisation of $US5t ($7.6t)—but astonishing by any other measure.

Microsoft has pulled this off while relaxing its grip on OpenAI by, for instance, letting it use alternative sources of computing power so long as it asks first.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.On October 28 Microsoft loosened the setup once again, allowing OpenAI to be boundlessly promiscuous in its choice of cloud partners, no permission required.

The new agreement also assigned Microsoft a 27 per cent stake in OpenAI and entitled the tech giant to 20 per cent of the startup’s revenue and, until 2032, all its technology—including, should it materialise, superintelligence. In addition, OpenAI will spend $US250b ($380b) on Microsoft’s cloud computing over the next few years.

This partnership approach to the AI “stack” has set the tone for the industry, much of which has also opted for a division of labour.

Chipmakers like Nvidia and AMD design the graphics-processing units (GPUs). AI labs like OpenAI and Anthropic devise the cutting-edge models.

Cloud “hyperscalers” like Microsoft and Amazon host the labs’ models on GPUs purchased from the chip firms. All co-operate where they can and compete where they must.

All except Google, that is. The search giant is the only one of tech’s big names to go all in on vertical integration. Google Cloud installs “tensor-processing units” (TPUs) designed in-house to train frontier models built by its lab, Google DeepMind. The models, in turn, power its own products, from search to YouTube.

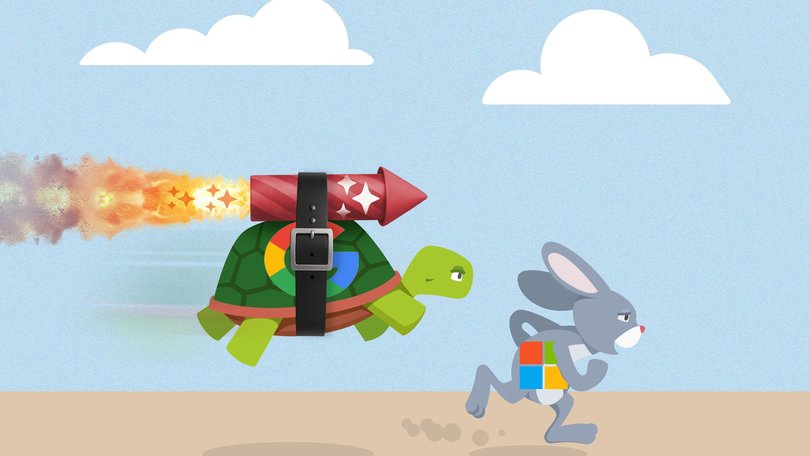

The trouble with a do-it-all-yourself approach is that it is less nimble than Microsoft’s and OpenAI’s mix-and-match strategy—a flaw when dealing with rapidly changing technology. Google has been branded an AI laggard.

The shares of its corporate parent, Alphabet, have traded at two-thirds the price of Microsoft’s, relative to earnings, on average since the ChatGPT moment.

That is despite the fact that its net profit is growing at a faster clip—as was on display when both tech giants reported their quarterly results on October 29.

Lately, though, the cold shoulder from investors has been turning into a warm embrace. In the past four months Alphabet has gained $US1t ($1.5t) in market value, more than in the previous two and a half years.

It has narrowed its valuation gap with Microsoft. And its vertically integrated approach is winning over not just markets but also rivals—including, deliciously, Microsoft and OpenAI.

Google’s earlier underperformance smarted all the more because it sees an AI windfall as a birthright. In contrast to Microsoft it has been a machine-learning company since its founders came up with their clever search algorithm in the late 1990s.

A year ago Demis Hassabis, the head of Google DeepMind, shared the Nobel Prize in Chemistry for his work on AI that predicts how proteins fold.

Most galling of all, it was Google researchers who in 2017 published the seminal academic paper that led directly to ChatGPT. Alphabet was sitting on a chatbot when OpenAI made a splash in late 2022, but released it only in February 2023.

The reason for the initial flatfootedness was bureaucratic inertia. As Alphabet has grown into a sprawling and stratified global organisation, decisions have become harder to make—especially when they involve all the different parts of the internal tech stack and, worse, could hurt its core search business.

It needn’t have worried. So far there is little sign that chatbots are eating search. On the contrary, AI Overviews, which began appearing above the signature blue links in May 2024, seem to be boosting it by keeping users engaged and searching for more.

Google’s search-advertising revenue has grown by a healthy 10 per cent or so in the past few quarters, year on year—a feat for a business that already generates around $US50b ($76b) in quarterly sales.

AI has also boosted Google’s non-ad revenue. Google Cloud sales are growing at an annual rate of 30 per cent. The unit accounts for nearly a tenth of Alphabet’s operating profit, having been a drag as recently as late 2022.

It is a favourite with AI firms. They prize TPUs’ higher energy efficiency compared with Nvidia’s GPUs, which Google Cloud also makes available, notes Ahmed Khan of Morningstar, a research firm.

On October 23 Anthropic said that it would buy an additional gigawatt of computing power from Google Cloud, worth perhaps $US8b-10b ($12b-15b) a year, insisting on access to as many as 1m TPUs.

The TPUs’ power frugality is a direct consequence of Google’s vertical approach. Since 2015 its processors have been tailor-made to work with the rest of its hardware and software—now including Gemini, its flagship AI model—which in turn are tailored for its processors.

The result is that Google’s cost per AI query is not five times that of traditional search, as early estimates suggested, but twice. Mr Khan calculates that AI dilutes the gross margin for Google’s search business only from 90 per cent to 86 per cent.

Stack overflow

Such economics explain why OpenAI, eager to stanch multibillion-dollar losses, wants to develop custom silicon. And why Microsoft is looking Googley: it unveiled an in-house chip-design studio in 2023 and an AI lab in 2024.

However, its second-generation Maia chip has been delayed and its model-building is inchoate; it will be years before either becomes truly competitive.

In the meantime, Google’s inertia is turning into momentum.

Originally published as Google v Microsoft: the battle of AI business models