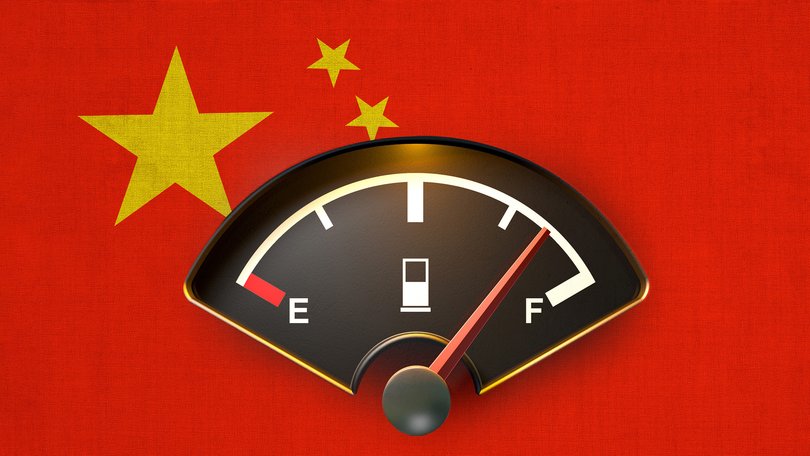

THE ECONOMIST: China stockpiles oil, metals and food to brace for new Trump trade war

THE ECONOMIST: Xi is desperate for Trump-proof access to food, fuels and metals.

Seen from the skies, China’s Dongjiakou oil storage looks like a tray of god-sized cake tins. As fuel fills up the tanks, their floating roofs rise, turning the containers into panettone-shaped domes. And lately the bakers have been busy.

Some 10 million barrels of crude have been added since mid-January, taking the total to 24 million. The state-owned Qingdao Port Crude Oil Terminal — the largest facility of its kind on the Chinese coast — is barely two years old. It is already 56 per cent full.

China’s craze for crude is part of a grander plan. Since early 2024, when it became clear that President Donald Trump might return to the White House, officials have stockpiled fuel, food and metals to limit exposure to sanctions and tariffs.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Those measures accelerated, and broadened, after Mr Trump slapped high duties on Chinese goods in the spring. And they are continuing apace as the countries’ leaders prepare to meet on October 30.

Some see China’s scramble as a symptom of paranoia; perhaps even preparation for an invasion of Taiwan. Whatever the motive, the campaign is making China harder to bully, giving it an edge in trade talks.

Yet the effort also has drawbacks. As the world’s largest importer of commodities transforms global markets, it is wasting money, creating dependencies and exposing itself to new risks.

Hard power

China does have reason to fret about its energy supply. Despite booming electric-vehicle sales, it will continue to need 16 million or so oil barrels a day (b/d) for years—three-quarters of which it must import.

Its purchases of natural gas have tripled in the past ten years as urban heating and fertiliser plants demand more. And it imports half a billion tonnes a year of coal, which remains the fuel for 60 per cent of its power.

Although the country is one of the world’s mineral refining centres, it imports 85 per cent of the iron it bakes into steel; is short of bauxite, the underlying ore for aluminium; and its smelters ship in 88 per cent of their raw copper.

China needs cobalt, nickel and lithium with which to make batteries. And, as incomes have risen and diets have changed, its food imports have soared, too.

It buys four-fifths of the 100–120 million tonnes of soyabeans it feeds to its 430 million hogs and 70 per cent of the edible oil it blends into processed food. No other country imports so many cows.

Chinese officials, therefore, are discreetly pulling three levers to reduce these vulnerabilities. They are boosting domestic production, building stockpiles and diversifying imports.

The domestic-production campaign began in 2019 when Xi Jinping, China’s supreme leader, launched a seven-year scheme to develop domestic oil and gas resources. This scrapped taxes and spurred investment.

Defying predictions of decline, China’s oil output has risen from 3.8 million b/d in 2019 to 4.4 million b/d. Its gas production has jumped by half. This year, with oil prices low, Chinese energy firms have trimmed spending abroad. But not at home, where they are doubling down on ambitious projects. Gas production is expected to rise by 3–6 per cent this year and next.

Oil output will remain near record highs. Even coal, a filthy fuel, is back in fashion. In May China’s energy-planning body called for a batch of new mines. And in September eight government bodies released a two-year plan calling for exploration to find greater supplies of ten metals, including copper, lithium and cobalt.

New projects can take years to complete. In parallel, therefore, China is building bigger reserves—its second lever. This is clearest in oil. Since early February China’s observable stocks grew by 110 million barrels, to a record 1.2 billion, reckons Kayrros, a data firm—triple the size of America’s reserves.

A law passed in January requires all energy firms to hold strategic stocks. China has been a keen buyer from Iran, Russia and Venezuela, all subject to American sanctions; exports from the trio to Qingdao, Shandong’s largest port, hit 590,000 b/d in September, a record.

Although on October 23 Mr Trump threatened sanctions on countries buying crude from Russia’s biggest oil firms, the impact remains uncertain: many Chinese refiners do not rely on the dollar system.

And there is scope to keep buying. China’s storage capacity of 2 billion barrels is only 58 per cent full, and more capacity will be built next year. Should the country stockpile at today’s rate, as traders expect, it could have 1.5 billion barrels by next year, enough to cover 140–150 days of imports. China also wants to stash more gas.

It has just 30–40 billion cubic metres (bcm) in reserve — less than 10 per cent of its annual demand — partly because of limited space. In July its largest storage facility, buried kilometres underground, added a 700 million-cubic-metre reservoir. At the same time, it is building super-sized tanks to house liquefied natural gas (LNG).

Within China, talking about the country’s metal reserves can land you in jail. But analysts detect change there, too. Tom Price of Panmure Liberum, a bank, notes that imports have soared even though China’s metal-hungry industries have slumped.

He estimates that stocks built in the last 20 months are sufficient to cover 20, 50 and 108 per cent of its annual demand for copper, zinc and nickel, respectively. Yet some resources are too scarce, perishable or voluminous to be stored at scale. Hence China’s efforts to diversify supply — its third lever.

Since 2022 Russia has been trying to get China to buy more gas. On October 23 China received its 11th shipment from Russia’s Arctic LNG 2 project, once frozen by sanctions.

It will take a record 38 bcm of gas in 2025 via a pipeline from Russia; it could receive another 50 bcm if and when Power of Siberia 2, a mega-pipeline Russia says China agreed to in September, is completed. China is also buying more from Malaysia and Qatar.

Meanwhile, China is increasing investments in foreign mines and infrastructure. In April it began building a railway to move more coal from Mongolia. Its copper firms have gobbled up nine foreign rivals since 2024; the three deals this year are bigger than the previous seven combined, according to CRU, a consultancy.

A Chinese company is in talks to buy much of the grid in Chile, which holds the world’s largest reserves of copper and lithium. China’s nickel miners are expanding in Indonesia even though the metal’s price is at rock bottom.

Most striking is the effort to ditch American soyabeans. They accounted for a quarter of China’s imports last year but have been subject to a 20 per cent tariff since April. China is yet to purchase a single cargo of America’s recent harvest. Instead, it is buying record amounts from Brazil and large amounts from Argentina. Soya futures suggest China is unlikely to resume big imports from America this season.

Reap what you sow

China’s vast commodity campaign is transforming not just Chinese markets, but global ones, too. Brazilian farmers will soon plant more soyabeans at the same time as American ones reduce their acreage.

China is becoming the world’s swing supplier of gas; it is reselling LNG cargoes when prices are high, and so denting the clout of big exporters. Its vast, opaque stocks make prices even less predictable.

Its covert purchases of Russian oil and now gas are adding to the fog, allowing a clandestine shipping and financing industry to thrive.

These changes are largely to China’s benefit. But its scramble for supply has drawbacks. For one, it is expensive. China is loading up on oil ahead of an expected glut.

Since many analysts expect a barrel of crude to be $US10–20 cheaper next year, China may be wasting billions of yuan a month. Its refiners are also securing copper at an enormous loss: the “treatment” fee they usually charge miners to process ores has turned deeply negative—a feat enabled, traders suspect, by cheap state loans. Brazil has been selling soyabeans to China at a hefty premium.

And in concentrated markets China is swapping one dependency for another. According to a NATO expert, its pool of food suppliers is less diverse today than a decade ago.

The country is particularly vulnerable to poor weather, political storms or economic turmoil in Brazil, which has become its chief source of meat, oilseeds and sugar.

The stockpiling strategy may have been successful so far; that does not make it any less of a gamble.

Originally published as China’s secret stockpiles have been a great success—so far