First Home Guarantee launches today - how it can help first home buyers get off the rental rollercoaster

The Federal Government's expanded First Home Guarantee Scheme has come into effect this week, giving thousands more Australians the chance to enter the housing market with just a 5 percent deposit.

But new analysis from Cotality suggests the scheme's benefits come with trade-offs, and in some cases, hidden costs.

Head of Research at Cotality, Eliza Owen, believes the expansion will help first-home buyers get into the market sooner, particularly as rents continue to climb across the country.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy."While the scheme comes with higher interest costs, the savings on rent - particularly in cities like Sydney and Brisbane - may outweigh the long-term loan burden." Owen said.

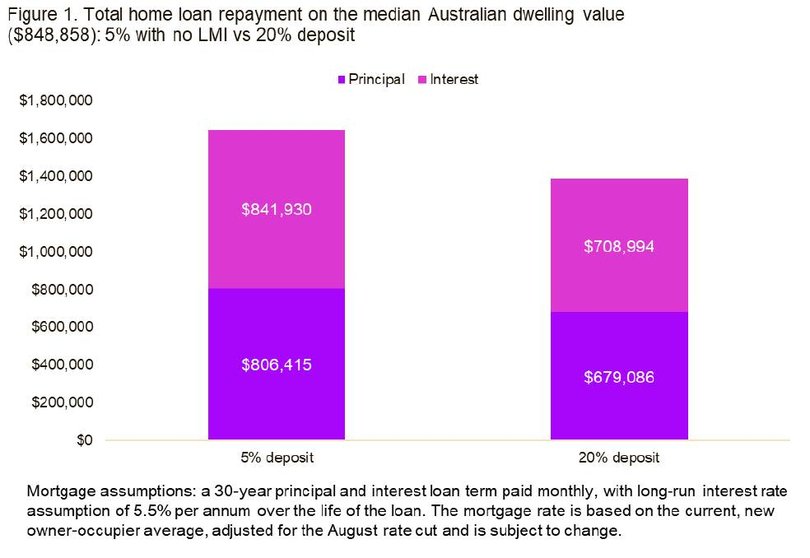

"First home guarantee schemes come at a cost, both to individuals who take them up, and the broader housing system. The main cost for individuals is extra interest paid over the life of a loan.

"The flipside of a 5 percent deposit on a home purchase is a 95 percent loan to value ratio on the home loan. Taking out the extra debt means paying extra interest compared to the traditional 20 percent deposit."

View.com.au economics expert Cameron Kusher said of the First Home Guarantee Scheme:

"First home buyers are a relatively small part of the overall market however; more demand from them then allows existing home owners to upgrade into more expensive homes while lower interest rates are expected to stimulate an increase in investor activity in the market."

Renting vs. paying extra interest

Under the scheme, eligible buyers can purchase a home with a 5 percent deposit, while the government guarantees the gap to a standard 20 percent deposit, helping them avoid lenders mortgage insurance (LMI).

On a 30-year loan, however, that 95 percent loan-to-value ratio could mean significantly higher interest costs compared to a traditional 20 percent deposit loan. Owen's analysis suggests the extra interest can run into the hundreds of thousands of dollars over time.

Yet in high-rent markets like Sydney and Brisbane, the savings from avoiding years in the rental market can outweigh those costs. Since January 2020, the median weekly rent across Australian dwellings has increased an estimated $200 per week, to $669. That's an uplift of over $10,000 per year.

In Sydney, for example, the scheme reduces the time needed to save a 20 percent deposit for a $1.5 million property by more than 12 years, avoiding an estimated $502,000 in rent at current median rates of $801 per week.

Rising demand, limited supply

Since the launch of the 'First Home Loan Deposit Scheme' in January 2020, more than 168,000 buyers have accessed federal home guarantee schemes.

Owen cautions that the latest expansion, which raises both income and property price caps, is likely to further fuel demand at a time when housing supply remains historically tight.

She commented: "While individuals on the scheme could leap over the deposit hurdle faster, this policy is ultimately a demand side stimulus which fails to address why deposits - and now rents - are so unaffordable in the first place."

That surge makes the First Home Guarantee more attractive than ever, but also highlights the structural pressures driving affordability further out of reach.

For renters facing years of saving while prices and rents climb, the First Home Guarantee can offer a way in.

For those able to stay out of the rental market, or save longer for a 20 percent deposit, the long-term interest savings may prove more valuable.

Kusher said: "This stimulus is coming into effect at a time when interest rates are already falling and home prices are already rising."

"We've seen this play out before in 2008-09 and again in 2020, when there is a significant increase to the incentives for first home buyers that eventually feeds through to more demand across the market pushing housing prices higher."