Record-low vacancy rates and rising regional rents put investors in prime position

Australia's rental market is showing renewed momentum amid record-low vacancy rates, while regional areas continue to enjoy sustained strong performance.

According to Cotality's Quarterly Rental Review, September data reveals Australia is experiencing the tightest vacancy rates on record.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

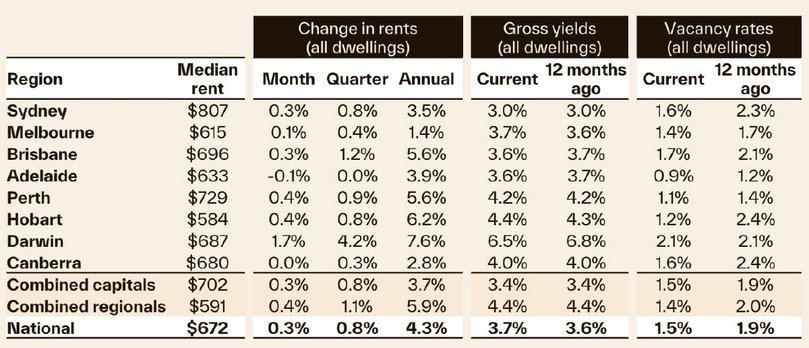

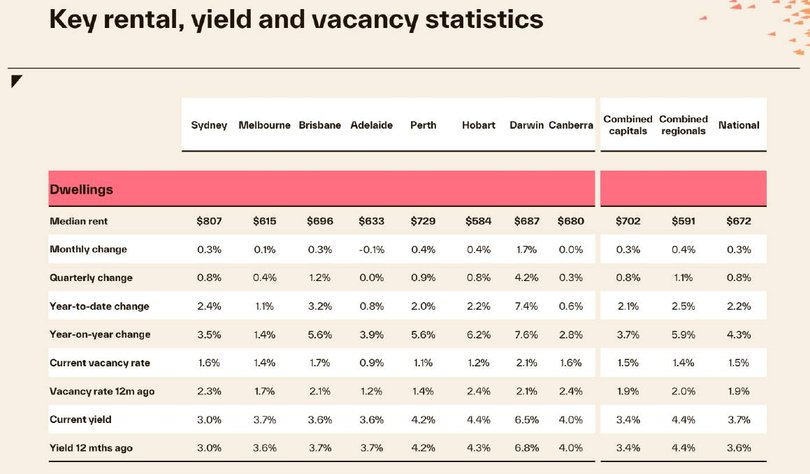

By continuing you agree to our Terms and Privacy Policy.National dwelling rents climbed 1.4 per cent over the September quarter - the steepest quarterly rise since mid-2024 - pushing annual growth to 4.3 per cent.

The combined regional market remains the standout, with rents rising 5.9 per cent over the past year, compared to 3.7 per cent across the capitals.

This re-acceleration in rental growth is being spurred on by a persistent shortage in rental supply. Read - there simply aren't enough listings on the market to sustain current demand.

"Ongoing scarcity in 'for rent' listings, coupled with continued strength in rental demand has pushed the national vacancy rate to a new record low of 1.47 per cent - less than half the pre-COVID decade average of 3.3 per cent," Cotality economist Kaytlin Ezzy said.

"Limited supply continues to be a major catalyst in rising rents, with the number of rental listings tracking approximately 25 per cent below the previous five-year average nationally for this time of year."

Despite investors buying more rental stock, there hasn't been a boost to supply.

"While investors have comprised an elevated portion of home lending over the past two years, this hasn't translated into additional available rental stock," Ms Ezzy said.

She said that supply is particularly tight in the unit sector, especially in Sydney.

With tenant demand outstripping supply nationally, and weekly rents rising faster regionally than in the capitals, investors are in a plum position across the board.

Supply shortage keeps regional rents rising

Cotality's head of research Tim Lawless said the underlying imbalance between supply and demand is the key driver of rental growth in regional markets.

"Regional rental markets are consistently performing a little stronger than their capital city counterparts," he said.

"We're likely seeing reasonably strong rental demand against that backdrop of low supply."

Despite a slowdown in population growth from pandemic peaks, regional demand remains robust.

"Even though population growth is slowing, it's slowing from a relatively high base," Mr Lawless said.

Nationally, the rental vacancy rate fell to a record low 1.47 per cent in September - less than half the decade-long pre-COVID average of 3.3 per cent.

Regional vacancy rates remain even tighter in many markets, currently at 1.4 per cent; down from two per cent 12 months ago.

The result is stiff competition among tenants and continued upward pressure on rents, meaning regional markets are presenting investors with strong rental conditions.

Rents still climbing - but is that a good thing?

Median weekly rents across the combined capital cities surpassed the $700 mark for the first time in August, before landing at $702 per week in September.

By comparison, regional rents remain somewhat more affordable, holding below the $600 mark, with the typical regional dwelling renting for $591 per week.

But the gap is clearly narrowing.

"With the regions outperforming the capitals through the second half of 2024 and into 2025 the affordability advantage offered by regional rental markets has reduced from $123 in May 2024, to $111 in September," he said.

Across the capitals, Sydney remains by far the most expensive, with a typical home renting for $807 per week, while Hobart maintained its title as the country's most affordable city to rent in, with a median weekly rental value of $584 per week.

Ms Ezzy pointed out that the recent uptick in rent growth is not only bad news for tenants, but it could also complicate the inflation and cash rate outlook.

"The news that rents are once again rising at a higher rate will be unwelcome news for renters already struggling with the 43.8 per cent or $204 per week increase in rents seen nationally over the past five years.

"But it's probably also unwanted news for homeowners and landlords servicing a mortgage."

With "rents paid" a key component of the Consumer Price Index (CPI), the increased pace of rental value growth seen in recent months could push inflation higher.

"Along with some renewed upwards pressure from the cost of new dwellings, this renewed momentum in rents may lead to inflation exceeding RBA forecasts, which could keep the cash rate elevated for longer," she said.

Top-performing regional rental hubs

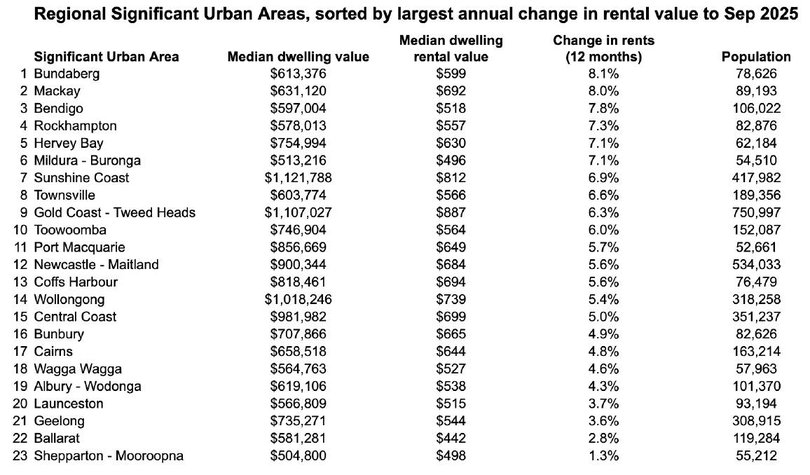

Several regional markets with populations over 50,000 recorded standout rental growth over the year to September.

Queensland had eight of the 10 strongest performers, with Bundaberg and Mackay at the top with annual rent growth of 8.1 and 8 per cent, respectively.

Bendigo and Mildura in Victoria saw annual rents rise 7.8 and 7.1 per cent respectively, reflecting strong demand in these key hubs.

These growth rates exceed the national average and demonstrate the diverse range of regional markets where rental demand remains elevated.

With vacancy rates at record lows and no meaningful increase in rental supply on the horizon, certain regional markets are an attractive option for investors seeking strong yields and low vacancy risk - and the data suggests those fundamentals are unlikely to shift in the near term.

Originally published as Record-low vacancy rates and rising regional rents put investors in prime position