Regional vs capital city: what is the best choice for an investment property right now?

Australia’s property market is showing renewed momentum, but the big question for investors remains: should you buy in a regional hub or stick with the capitals?

While capital cities are seeing renewed rental momentum, regional areas are still drawing lifestyle-driven movers - even if migration has slowed.

With both sides of the market offering reasons to be optimistic, it can be tricky for investors to know their next best move.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Rental markets regaining strength

Fresh figures show both capitals and regions have picked up pace after a quieter stretch.

Cotality data shows capital city rents have gained traction in recent months after bottoming out in June, with growth lifting from 2.7 per cent to 3.4 per cent in the year to August.

Regional rents have also strengthened, moving from 5.3 per cent growth to 5.8 per cent over the year to August.

That means yields are improving across the board, making the choice between city and country less about short-term gains and more about long-term strategy.

Migration patterns tell a positive story for regions

While fewer Australians are moving overall, those who are still show a preference for the regions.

The latest Regional Movers Index from Commonwealth Bank and the Regional Australia Institute found capital-to-regional migration fell 19.3 per cent in the June quarter - the lowest level since 2019.

But despite the slowdown, more people are still leaving the cities than heading back to them.

City-to-country movers made up 11.2 per cent of all migration compared to just 8.9 per cent going the other way.

That leaves a 26 per cent net gain in favour of the regions.

The Sunshine Coast, Greater Geelong, Lake Macquarie, Maitland and Fraser Coast were the most in-demand spots, while Albury stood out with a staggering 1,520 per cent jump in net migration over the past year.

So, while the ‘treechange’ trend may have cooled since its pandemic-era peak, lifestyle hubs remain firmly on the radar.

Stability vs affordability

Christian Stevens, CEO and mortgage broker at Farmer’s Finance, says both capitals and regions are showing solid momentum, but they suit different investor profiles.

“Metropolitan markets still hold the edge when it comes to long-term stability,” Mr Stevens said.

“Cities like Sydney, Melbourne and Brisbane have deeper tenant pools, more diverse economies, and major infrastructure projects that underpin growth.

“That means more consistency and lower vacancy risk, though entry prices are higher and yields are thinner.”

By contrast, regional areas have lower buy-in costs and often stronger rental returns.

“The trade-off is that they can be more volatile. Many rely on a single industry or infrastructure project, which can make them more exposed in downturns,” Mr Stevens said.

Todd Sloan, property expert, investor and host of the Pizza and Property podcast agrees that the ‘better buy’ will depend on your overall strategy.

“The choice between city and country depends on the goal,” Mr Sloan said.

“Some people’s goal is to own two properties, and that’s cool - if you want to own two properties, you can absolutely buy in capital cities, and it doesn’t matter if you tap out your borrowing capacity.

“But if your goal is to grow more of a portfolio, and you want to buy five, six, seven properties, then that’s when you really need to pay attention to regions and balance the two,” he said.

Mr Sloan warns that only buying in the big cities may provide capital growth, but the lower cash flow can make it difficult to scale.

When you combine capital city investments with quality regional assets that have a good upside for capital growth as well, it provides balance alongside stronger cash flow - and that’s when you can really start scaling your portfolio.”

The pros and cons

“When you look at the capital cities, the big advantages are stability and growth,” said Mr Stevens.

“They generally offer more consistent long-term capital growth because of stronger infrastructure, diverse job markets and larger populations. Vacancy rates also tend to be lower, which gives investors more confidence that their property will stay tenanted.”

The cons are a higher barrier to entry and tougher cash flow.

“The downsides are the higher buy-in cost and the fact that yields are usually thinner, so you’re paying more up front for a slower build in cash flow,” Mr Stevens said.

Meanwhile, it’s precisely affordability and cash flow that are the major attractions in the regions.

“Regional markets are almost the reverse story. The lower entry price makes them more accessible, and in many cases the rental yields are stronger, which can deliver better cash flow from day one,” said Mr Stevens.

“They’ve also enjoyed lifestyle-driven demand, with more people choosing space and affordability.

“But the trade-off is that regional areas can be more volatile - they’re often dependent on a single industry or infrastructure project - and they don’t always have the same depth of jobs, schools or healthcare services, which can impact both growth and resilience over the long term.”

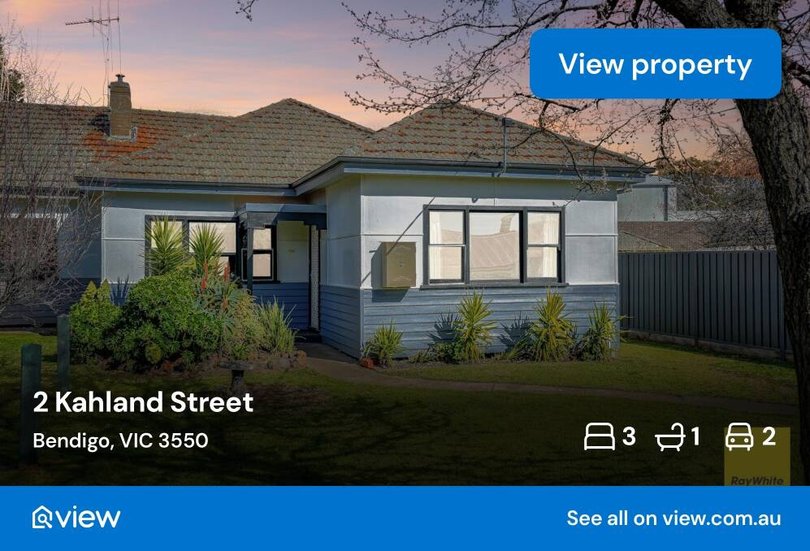

Mr Sloan agrees that when you’ve done your research on the market and determined if the regional area is a resilient hub with solid yield, there are some great regional buys to be had.

“If you go into Bendigo right now, for example, there are places you can buy with a four in front of them.

“There are places in Tassie right now where you can still buy in some regional markets with a three in front of them and a five per cent yield.”

What to look for in any market

No matter which path you choose, both Mr Stevens and Mr Sloan advise that the fundamentals of a strong investment don’t change.

Mr Stevens said that buyers should be “focusing on areas with strong employment drivers and good transport connections” while ensuring vacancy rates are tight.

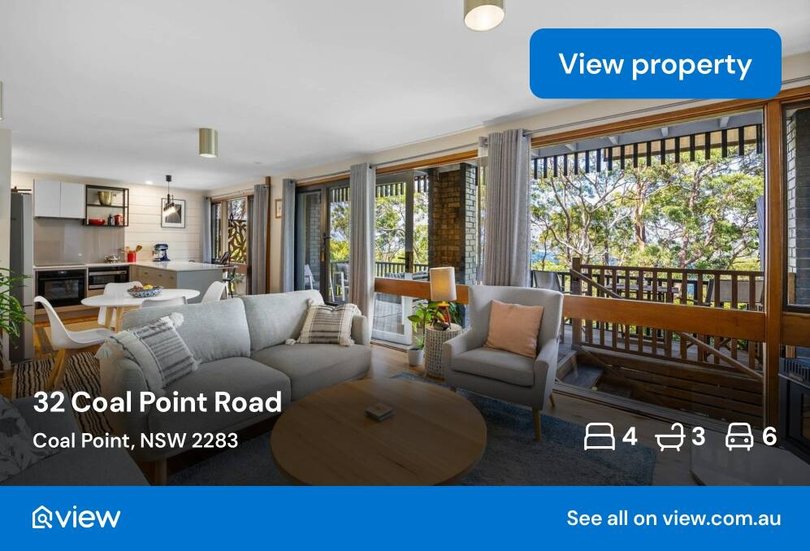

Properties should appeal to both tenants and future owner-occupiers, with features like light, functionality and parking adding long-term value.

Lifestyle amenities are also key, like good schools, healthcare, retail, and recreational options.

You’re more likely to see steady demand, whether in Sydney’s inner ring or a fast-growing regional hub.

Mr Sloan stresses the importance of thinking holistically and planning ahead.

“Always sit down with your broker and ask the question: ‘how is this property going to help me get the next property?’ And if they can’t actually help you answer that, then that’s a big red flag for whether you should be buying it.”

So, which is the best buy right now?

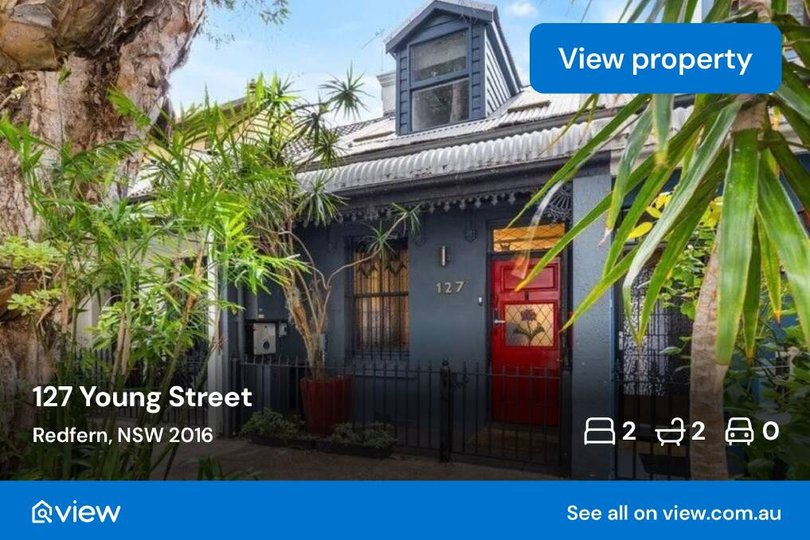

If stability and long-term growth are your priorities - and your budget stretches far enough - a capital city investment remains the safer bet.

There is a caveat: Mr Sloan says to avoid buying in cities at the peak of a cycle, such as Brisbane and Adelaide at the moment.

Melbourne, however, is one capital city coming out of the bottom of a lull and, despite soon trending upward, is still offering affordable property prices.

Investors chasing stronger cash flow or an easier entry point may find better opportunities in regional centres, especially in markets with diversified economies and growing populations.

But really, with rents strengthening across both the capitals and regions, and migration patterns still leaning in favour of regional centres, the market is giving investors genuine choice.

As Mr Sloan puts it, investors should stop asking “capital or regional” and instead think “capital and regional.”

The balance between the two could be the key to building a resilient, scalable portfolio.

Originally published as Regional vs capital city: what is the best choice for an investment property right now?