Treasurer Jim Chalmers spruiks lower debt as cash rate decision looms

Treasurer Jim Chalmers claims Australia has shaved off $149.1 billion in debt since he took control of the books two years ago by showing ‘restraint’ and ‘responsible economic management’.

Treasurer Jim Chalmers claims Australia has shaved off $149.1 billion in debt since he took control of the books two years ago by showing “restraint” and “responsible economic management”.

New figures released as part of the final budget outcome on Monday revealed the country’s nominal gross debt had fallen from just over $1 trillion to $906.9 billion since 2022.

Meanwhile, gross debt as a percentage of gross domestic product had improved by 10.6 percentage points from 44.6 per cent two years ago, to 34 per cent.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The Treasury estimated the lower debt would save about $4 billion in interest in 2023-24.

“Lower debt saves taxpayers on interest costs, helps in the fight against inflation and makes more room in the Budget for what matters most like Medicare, aged care and defence,” he said.

“Our economic plan is all about easing pressure on people at the same time as we fight inflation and get the Budget in much better nick and this shows we’re making meaningful progress.”

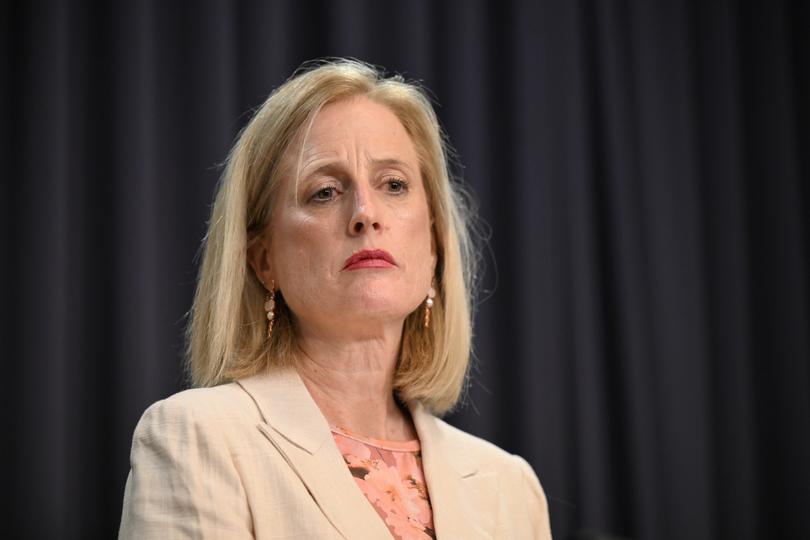

Finance Minister Katy Gallagher claimed the Labor government inherited $1 trillion in debt and had been “doing the hard work, finding responsible savings, and showing spending restraint” to bring the balance down.

“This has saved taxpayers billions of dollars in money that would have otherwise been spent on interest payments,” she said.

“Having a stronger Budget position means we can continue to deliver responsible cost of living relief while reducing inflationary pressures.”

It comes as Dr Chalmers faces accusations of being at odds with the Reserve Bank of Australia’s firm stance on interest rates after he claimed the monetary lever was “smashing the economy”.

Attempting to hose down purported tensions on Sunday in an interview with Sky News, Dr Chalmers said he and RBA Governor Michele Bullock had a “respectful working relationship”.

The Treasurer was also optimistic that monthly inflation numbers due to be released on Wednesday would drop substantially.

“Some of them, expected to be in the high twos but again you know whether it’s the high twos or the low threes, what we’ve seen over a period of time now is inflation has come off quite substantially,” he said.

That will be after the RBA is due to make its next decision on the cash rate on Tuesday.

It’s broadly expected the board will hold the cash rate steady at 4.35 per cent.

Australia’s banks and economists are divided as to when the RBA will decide to start cutting rates, despite pressure from some areas of the market that Australia should be following suit from the United States.

The US Federal Reserve cut rates for the first time in four years last week, by half a percentage point.

But some consider inflation is still too high.

July’s monthly update revealed the Consumer Price Index rose 3.5 per cent in the 12 months to July, dropping from the 3.8 per cent recorded in June.

Mr Chalmers also said the first visit by a federal treasurer to China in seven years would help to stabilise ties with Australia’s largest trading partner.

Dr Chalmers was speaking before the imbroglio over US president Joe Biden’s hot-mic comments became common knowledge.

He is due to meet major Chinese economic officials in Beijing on Thursday and Friday.

The meeting comes as diplomatic relations between the two countries have thawed and economic sanctions on several Australian goods such as wine and barley have eased.

The upcoming visit will be the first time an Australian treasurer has visited China since Scott Morrison in 2017.

Dr Chalmers said the trip would aim for a firmer relationship between the two countries.

“This is part of our effort to stabilise a really important economic relationship,” he told Sky News on Sunday.

“This is a relationship full of complexity but full of opportunity as well, and we believe that you get more out of this relationship when you engage as we have been.”

The treasurer will hold talks during the two-day visit with officials from China’s National Development and Reform Commission.

Australia’s strategic economic dialogue with China is expected to be the main focus of the discussions.

“I’ll be meeting with a number of my counterparts in order to compare notes on the economy, to work through any issues that we might have between our two economies,” Dr Chalmers said.

“A more stable relationship, and particularly a more stable economic relationship between Australia and China is a good thing for our workers and our businesses and our investors and for our country more broadly.”

The talks in Beijing come as Prime Minister Anthony Albanese held talks with world leaders in the US at the Quad leaders’ summit, where talks about China’s influence in the Indo-Pacific have been on the agenda.

But the treasurer said managing economic ties with China could come at the same time as other issues involving the Asian nation were discussed.

“Stabilising the relationship with China is a very key economic priority. We can do that while we manage the complexities in the region,” he said.

“We’ve shown an ability and a willingness to engage because we believe it’s good for our country when we engage.”

Mr Chalmers also took a shot at Coalition plans to build seven nuclear power plants, calling it “economic insanity”.

The federal opposition has outlined plans to build seven nuclear reactors across five states, should they win the next election, with the first to be built by 2035 to 2037 at the earliest.

The proposed reactors would be built in areas with existing coal-fired power stations, including the Hunter Valley and Lithgow in NSW, Victoria’s Latrobe Valley, Collie in Western Australia and Port Augusta in South Australia.

While Opposition Leader Peter Dutton is set to lay out more information about the proposal in a major speech to the Committee for Economic Development of Australia on Monday, Dr Chalmers said the plan would not solve energy issues.

Opposition environment spokesman Jonno Duniam said it was unlikely Mr Dutton would lay out the costs of the nuclear plan in the speech.