RBA interest rates live updates: Reserve Bank decides to hold rates after inflation breaks out of comfort zone

As expected, the Reserve Bank has held the cash rate steady, spooked by last week’s quarterly inflation figure which busted out of the central bank’s comfort zone.

As expected, the Reserve Bank has held the cash rate steady, spooked by last week’s quarterly inflation figure which busted out of the central bank’s comfort zone.

In case you missed it, here’s your essential form guide to today’s race (and why the RBA is reluctant to offer any more rate relief, at least for now) ...

Rate Cut: Likely a late scratching. Had been looking the goods just last week until she stuck her head around the corner of Inflation’s stable on the way back from training. That clearly scared the bejesus out of her and she won’t trouble the bookies today. Sorry folks, this horse has bolted.

Unemployment: Resilience personified. Has been ticking along at a steady pace for much of the past year with only a few sign that he may just be starting to run a little hotter. The stewards will be keeping an eye out for any unexpected movements.

Inflation: Once thought tamed, last week showed you can never write her off. Was in fine form earlier this year when she was brought back to a trot. Tests last week revealed a spike in performance. All bets will be off if she and Unemployment are leading the pack at the final turn.

Rate Hike: A real outside punt. He hasn’t looked a chance since last 2023, but some bookies are starting to factor in a possible return to form, maybe next year?

Michele Bullock: AKA ‘The Governor’, she has looked good since taking the reins in September, 2023. Strong under pressure from the cameras, and you can guarantee she’ll be watching closely where Inflation and Unemployment sit in the field. If those two start to get any from her, she knows they’ll be hard to chase.

Homeowners: Don’t expect to hear much. The quiet achiever, he’s been rolling with the punches, just holding on for dear life since May, 2022. Absolutely no chance of a place and would just be happy to pass the post.

Stay with us and we’ll bring you all the action ahead of the race.

Key events

04 Nov 2025 - 01:05 PM

RBA minds the gap

04 Nov 2025 - 01:00 PM

Dollar drops on rates hold

04 Nov 2025 - 12:33 PM

Where the RBA thinks the economy is headed ...

04 Nov 2025 - 12:30 PM

Kochie’s advice to those with a mortgage

04 Nov 2025 - 11:49 AM

What Treasurer Jim Chalmers says ...

04 Nov 2025 - 11:44 AM

As always, it’s about the data

04 Nov 2025 - 11:40 AM

Rate cut part of ‘technical assumption’

04 Nov 2025 - 11:39 AM

What the board had to say ...

04 Nov 2025 - 11:30 AM

Sorry, not rate relief winners on Cup Day

04 Nov 2025 - 11:15 AM

Countdown to a cut?

04 Nov 2025 - 11:05 AM

Help kids buy a home without ruining your retirement

04 Nov 2025 - 10:49 AM

Pricing in a bit of pain

04 Nov 2025 - 10:41 AM

Brokers back extended pause

04 Nov 2025 - 10:20 AM

Don’t wait! What you can save on your loan right now

04 Nov 2025 - 10:02 AM

ASX falls ahead of rates call

04 Nov 2025 - 09:53 AM

What the experts say ...

04 Nov 2025 - 09:21 AM

How our spending habits have changed over the past month ...

04 Nov 2025 - 09:16 AM

Key factors to watch

04 Nov 2025 - 08:59 AM

Debate rages over RBA’s next move

04 Nov 2025 - 08:40 AM

Why we’re unlikely to see a rate cut today

Rate cut part of ‘technical assumption’

The central bank board members said that some of the increase in underlying inflation in the September quarter was due to temporary factors.

It said it central forecast in the November Statement on Monetary Policy, which is based on a technical assumption of one more rate cut in 2026, has underlying inflation rising above 3 per cent in coming quarters before settling at 2.6 per cent in 2027.

Help kids buy a home without ruining your retirement

Home ownership used to be a milestone. For many young Australians, it now feels like a miracle — and more parents are stepping in to help turn their dreams into a reality.

The so-called “Bank of Mum and Dad” has grown into a $35 billion force — large enough to rank among the nation’s top lenders if it were a bank.

More than six in 10 first-homebuyers receive parental help — often a gift or “informal loan” averaging more than $70,000.

Yet behind this generosity lies a growing financial strain: more than half of parents draw on savings, while others may dip into superannuation or even delay retirement to make it happen.

It’s natural to want the best for your children, but good intentions are no substitute for good planning.

With the right strategy, you can help your kids without putting your own retirement at risk.

Read the full story here

Pricing in a bit of pain

Consumer confidence polling by ANZ released this morning showed inflation expectations lifted 0.4 percentage points last week to be 5.2 per cent.

The index is a little volatile and has generally averaged between 4 and 6 per cent over many years.

But the increase suggests recent consumer price data has sparked worry among households.

The RBA has been extremely careful to make sure inflation expectations stay under control since 2022. That’s because it can becoming self-fulfilling — when workers, businesses and consumers expect prices to rise, that will push up prices.

Also in the ANZ survey, consumer confidence was down for the week.

Brokers back extended pause

Mortgage brokers have joined the growing chorus of expert voices tipping the Reserve Bank will not consider further rate cuts until next year

Finance Brokers Association of Australia MD Peter White said rates would stay on hold while there was rising inflation.

“This has been accompanied by a rise in unemployment – but perhaps not a big enough rise to make a dent in inflation. This is why we expect it won’t be until the new year before we see any potential for a rate reduction,” Mr White said.

“The best thing homeowners can do is check their current interest rate and talk to their bank about getting a lower rate.

“If this is not successful speak to your mortgage broker who can search the whole market to source the mortgage product which best suits you, including many products not available through banks or major lenders.”

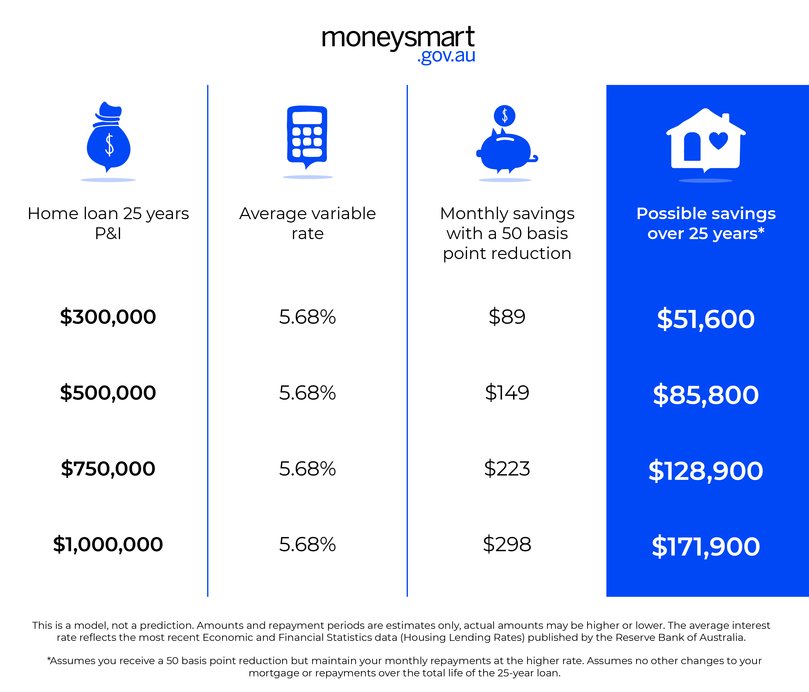

Don’t wait! What you can save on your loan right now

Moneysmart finance expert Justine Davies says homeowners don’t need to wait for an RBA rate cut to save money on their mortgage.

On a $500,000 home loan, there’s currently a more than 2 per cent difference in variable home loan rates on offer.

“It’s always worth doing some market research, then contact your lender to see if you can negotiate a lower interest rate,” Ms Davies said.

“The interest rate you’re being charged by your lender is partially based on the RBA’s cash rate, but it could also be based on your personal credit worthiness, your value as a customer and what the competition are offering, among other things.

“Reducing your mortgage interest rate by 50 basis points could reduce the monthly repayments on a $500,000, 25-year mortgage by almost $150 a month.

“Alternatively, reducing your mortgage rate by 50 basis points and keeping your repayments the same could cut more than two years off the life of that loan and save you around $86,000.”

ASX falls ahead of rates call

The local share market is on track for a fifth losing day in the past six sessions ahead of Reserve Bank commentary on the future direction of interest rates.

At midday AEDT, the S&P/ASX200 index had dropped 44 points, or 0.5 per cent, to 8850.8, while the all ordinaries had slid 43.7 points, or 0.52 per cent, to 9134.7.

The Reserve Bank was all but certain to leave interest rates on hold on with inflation lingering, Capital.com analyst Kyle Rodda said, but its commentary would be critical for the market trying to gauge the central bank’s assessment of the balance of risks.

“Will the RBA remain steadfast in its commitment to keep inflation around target, potentially at the expense of the labour market? Or will it blink at the prospect of a rising unemployment rate and keep cuts on the table,” he said.

At midday nine of the ASX’s 11 sectors were lower, with health care and technology higher.

The utilities sector was the biggest mover, falling 2.2 per cent as Origin Energy dropped 3.4 per cent.

All of the big four banks were lower, with CBA falling 1.3 per cent, ANZ and NAB both dropping 0.6 per cent and Westpac retreating 0.7 per cent.

What the experts say ...

Just like any wide-eyed (and possibily slightly tipsy) punter on race day, we never say never!

Almost no one is tipping a rate cut today, but would you bet on it?

The majority of experts - that’s 30 out of 35 - from comparison site Finder’s RBA cash rate survey believe the central bank will hold the cash rate, keeping it at 3.6 per cent.

It is a significant about-face from September when nearly seven in 10 were predicting a cash rate cut in November.

Graham Cooke, head of consumer research at Finder, said Melbourne Cup day isn’t shaping up to be a winning one for borrowers.

“This time last month there was plenty of optimism for a rate cut in November – that’s largely evaporated,” he said.

“The RBA wants to see inflation sit somewhere between 2 and 3 per cent, and it just edged above the top threshold.

“The RBA will want to see that number trending down again before relieving any more cash rate pressure.”

Jeffrey Sheen from Macquarie University is one of the few experts predicting a rate cut.

“Though the RBA board will be concerned about the mixed messages, I expect them to cut the cash rate in recognition that the downside macroeconomic risks dominate,” he said.

Micaela Fuchila from Jarden is also tipping a cut.

“At this point in the cycle focus is expected to shift to the labour market. Employment growth has slowed and the unemployment rate is on the rise while inflation pressures remain contained,” she said.

First-time homebuyer? Here’s how to get your loan approved

Navigating the money side of buying a home can be daunting — especially if it’s your first time. Unless you’ve recently come into a small fortune, you’ll need to have saved a deposit and take out a home loan.

That means engaging with the world of banks and mortgage brokers, and grappling with what might be intimidating-sounding jargon — terms like “pre-approval”, “offset accounts” and “serviceability buffers”.

Here’s a general guide to some of the essential steps: how to figure out what you can afford, how the loan process works, and some key things to watch out for before taking the plunge.

Read the full story here

How our spending habits have changed over the past month ...

The RBA is in a quandary.

Jobs remain reslient, with only a small uptick in unemployment (which means there’s no near-term reasn to offer a rate cut to stimulate the economy).

On the other hand, spending is creeping up, adding to price pressures.

New fugures from the Australian Bureau of Statistics out yesterday showed spending on essentials such as food, health and petrol drove the increase.

Yet discretionary items including clothing and restaurants both went backwards.

EY chief economist Cherelle Murphy said spending over the past 12 months had grown at the second-fastest rate since November 2023.

Key factors to watch

Commonwealth Bank has dropped predictions of any further rate cuts — with inflation on the rise and demand on an upswing.

Yet there are still a few tipping a move next year. Westpac and AMP are among them.

AMP’s My Bui yesterday was optimistic about the chances of further rate cuts, adding that spending was improving but “fragile”.

“Household spending is still better than where it was last year, but (Monday’s) data shows that the recovery in household sector remains very fragile, which is consistent with the recent stagnation in consumer confidence,” she said.

Ms Bui said the labour market was weakening — with a fall in job advertisements — even as inflation remained sticky.

“While it’s likely that the RBA will hold rates steady in the November meeting, given that inflation readings have been hotter than expected; the future direction for cash rates next year is a bit more uncertain.

“We continue to see household spending recovery momentum relatively modest, and coupled with a rising unemployment rate, it is hard to see any further spike in demand-led inflation.”

Debate rages over RBA’s next move

Borrowers will get a signal on whether Australia’s recent inflation bounce has blown up the chance of any further rate cuts when the Reserve Bank reveals its call this afternoon.

Financial markets remain optimistic — but not certain — of one more cut by the middle of 2026. Yet a handful of economists have warned the RBA’s next move may be upwards, though perhaps not for some months.

Governor Michele Bullock will need to give a steer on which direction she is leaning.

Judo Bank’s Warren Hogan on Monday warned inflation may worsen further.

“Economic data from the past three to six months indicates momentum could be building faster than previously expected,” he said.

“Factors include unexpected consumer spending growth in (the June quarter), improved business profitability and trading conditions, rising dwelling prices, and recent inflation increases, all suggesting a cyclical rebound may be underway.

“This could also imply an increased likelihood of rate hikes in the short term.”